Dive into the battle of short-form video platforms. Learn which offers the best brand experience for marketers today.

It seems like every platform has a TikTok-like feature these days. Whether on TikTok, Instagram Reels, YouTube Shorts, or even Spotify’s recently introduced discovery feed, the consumption of short-form video has taken over and is here to stay.

Not only has short-form shaken up social sharing and consumption, but it has also extended to social shopping and advertising as more platforms discover the full-funnel potential of these channels. Marketers are not the only ones recognizing the benefits of building brand awareness and community via UGC (User-Generated Content) or CGE (Customer-Generated Content) sharing; brands are also getting more creative with lead generation and conversion campaigns.

So you may be asking yourself, which platform is the best for my brand? When comparing Reels, TikToks, and Shorts, they may seem similar (if not identical at times), but each platform offers its own particular sets of strengths and weaknesses depending on your audience and campaign goals.

This article will take you through the ins and outs of Instagram Reels, TikTok, and YouTube Shorts to help you understand which platform is best for your brand and ad budget.

TikTok

Let’s start with the ultimate trendsetter — TikTok. Founded in 2016, TikTok has taken the world of short-form video by storm. Even with its 1.925 billion active monthly users, TikTok doesn’t consider itself a social media platform. Rather, they’ve labeled themselves as an “entertainment platform,” not only competing with social platforms such as Instagram, Facebook, YouTube, and Snapchat but also coming for the likes of more traditional over-the-top (OTT) video streaming platforms such as Netflix and Hulu.TikTok’s ad revenue worldwide is projected to reach $33.1 billion in 2025, representing a 40.5% increase from 2024.

Valued at $50 billion, TikTok has set the standard for short-form video sharing and consumption. Driven by content creators and the support of Gen Z, TikTok is less about following friends and more about finding niche communities to connect with.

TikTok users aren’t concerned about how many followers one has or curating the perfect aesthetically pleasing feed; rather, it rewards content based on its entertainment and engagement value, based on interactions such as liking, commenting, or even co-creating through duets and stitches.

TikTok allows users to create videos up to 10 minutes long when recording in-app and supports uploading pre-recorded videos up to 60 minutes in length. Videos are displayed on user profile feeds and remain discoverable through the “For You Page” and hashtag searches, with the platform’s algorithm personalizing content for each user.

Beyond video content, TikTok also supports posting carousels, which allow users to share multiple images in a single post, and singular images, offering users more flexibility in how they express themselves. Despite the option for longer videos, shorter content between 15 to 120 seconds remains highly engaging, aligning with TikTok’s identity as a platform for quick, snappy content.

One of the biggest advantages of TikTok is its discoverability and top-of-funnel opportunities. Any user has the ability to go viral due to the algorithm’s focus on visual discovery, entertainment, and trending topics — whether in an organic or paid ad strategy. Branded accounts have the ability to stand out even more on TikTok due to fewer brands taking the leap from their Meta ad spend and using TikTok as a viable ads platform.

TikTok can be for both entertainment and conversion — that being said, TikTok requires a brand to break down its barriers and step out of its comfort zone. It involves having a strong pulse on culture but also gives the opportunity to humanize a brand and the individuals that make it up.

It’s a sound-on experience that can range from silly skits to educational bites, all with a pulse on trending topics and culture. Brands that take themselves too seriously or are not willing to create in the style of the platform may not find as much success. The best way to know if TikTok is right for you is to jump in with organic content and begin exploring all TikTok has to offer.

Instagram Reels

Meta launched Instagram’s short-form, swipeable video feature known as Reels in August 2020 as, let’s be honest, a response to TikTok’s growing success and popularity among Gen Z users. Though seemingly a TikTok copycat, the new feature was a hail mary touchdown for Instagram — with Zuckerberg himself admitting that Reels was the biggest contributor to growth on Instagram and the platform’s fastest-growing content form.

Though Instagram may seem like they’re going through an identity crisis (i.e. Adam Mosseri announcing it is not a photo-sharing platform that had social media managers shaken), Reels has been a hit with its users – first starting with 15-second videos, expanding to 60-second, and most recently 90-second videos.

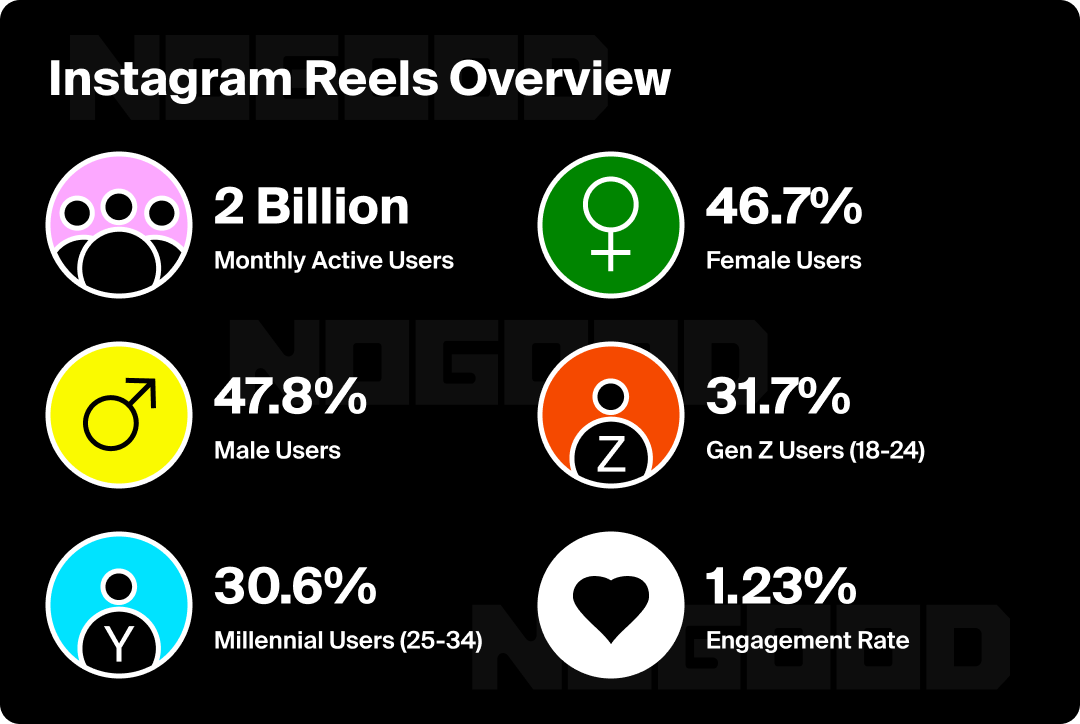

While Reels may be Instagram’s version of TikTok, the beauty of Reels is also its flexibility on the platform. These videos have the opportunity to reach 2.11 billion monthly active Instagram users through discovery, a user’s feed, or on the dedicated Reels tab.

The algorithm favors Reels and is continually pushing them in front of audiences to enjoy and encouraging users to create their own. In fact, Instagram is offering top creators up to $50,000 per month to post on Reels, with some deals potentially worth even more.

The platform has a tiered bonus system, with payouts ranging from $5,000 to $50,000 per month based on a six-month contract. Additionally, Instagram provides a “Breakthrough Bonus” program offering up to $5,000 over three months to eligible creators who post content to Reels.

Instagram is already well established, joining the short-form video space with an audience already built-in through the years as a legacy platform — building a culture of subscribing to relevant accounts.

Instagram has historically established a steady cadence of rolling out new features that users are quick to adopt. For example, the Notes feature, released in December 2022, allows users to share short messages, up to 60 characters, which appear at the top of the inbox and above their profile picture.

While TikTok is an entirely different platform for brands to learn, Instagram has legacy loyalists and accounts that are already established. On TikTok, brands are left to build accounts from the ground up, discover their audience, and find their community. This can be intimidating for brands that are already familiar with Instagram’s features, have established audiences, and are familiar with Meta’s ad capabilities.

YouTube Shorts

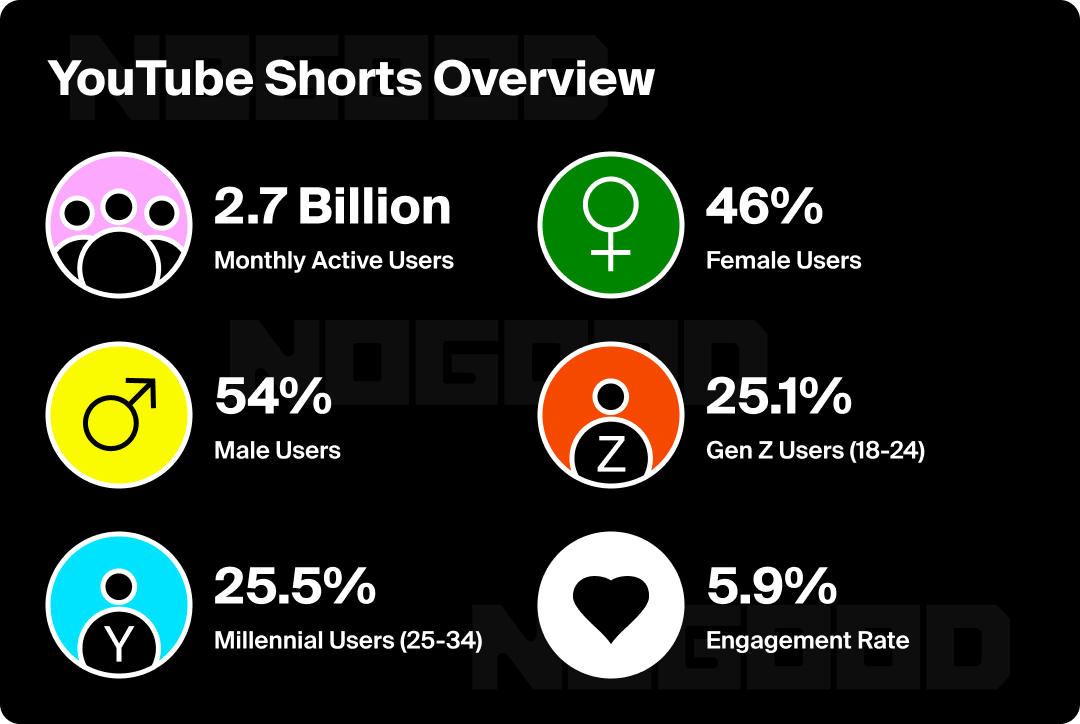

YouTube Shorts was first launched in India in 2020, and, to much acclaim, was officially rolled out to U.S. users in April 2021. As of today, more than 1/3 of the world’s population are YouTube users. The traditionally long-form video platform was sure to make a splash with its new TikTok-style feature.

Shorts are optimized for a mobile viewing experience, though they can be consumed via desktop as well. If eligible, Shorts creators can join the regular YPP and earn a 45% share of ad revenue on their videos. This new system allows creators to earn money directly from ads shown between Shorts in the Shorts feed, providing a more consistent and potentially more lucrative income stream compared to the previous Shorts Fund.

YouTube has 2.1 billion dedicated monthly active users who are already coming to the platform to consume video content. Though users may be looking for the traditional long-form and landscape style, creators can tease their longer content with up to 60-second long skits and sketches similar to the style of TikTok and Reels. Shorts has reached 90 billion daily global views – a number that cannot be ignored. This is a tremendous increase from previous years, with daily views growing from 70 billion in 2023 to 90 billion in 2024.

YouTube has many advantages over its short-form competitors, specifically with the YouTube audience accumulating a massive 77.9 billion monthly site visits. These dedicated users are sure to back any of YouTube’s new features, and Shorts has been no different. Video is already native to the app, which gives users and brands an additional avenue to practice the content format for further reach. As the potential TikTok ban looms, it’s a prominent opportunity for brands and creators alike to join and establish themselves on the platform and cast an even wider following and reach potential.

TikTok vs. Reels vs. Shorts By the Numbers

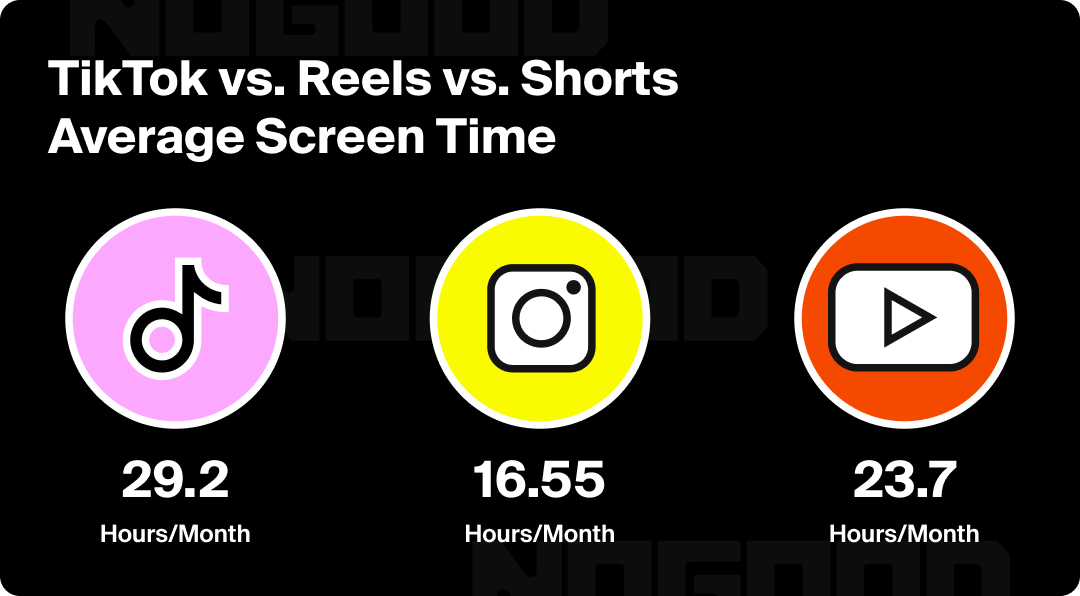

Screen Time

The average human spends 34% of their waking life online at roughly 5 hours and 30 minutes per day. Social media accounts for 46% of that total at 2 hours and 31 minutes per day. Users spend about 200 hours per month on screens connected to the internet, with video content being a major contributor to this figure. So how much time per day are users spending consuming content on these three short-form videos?

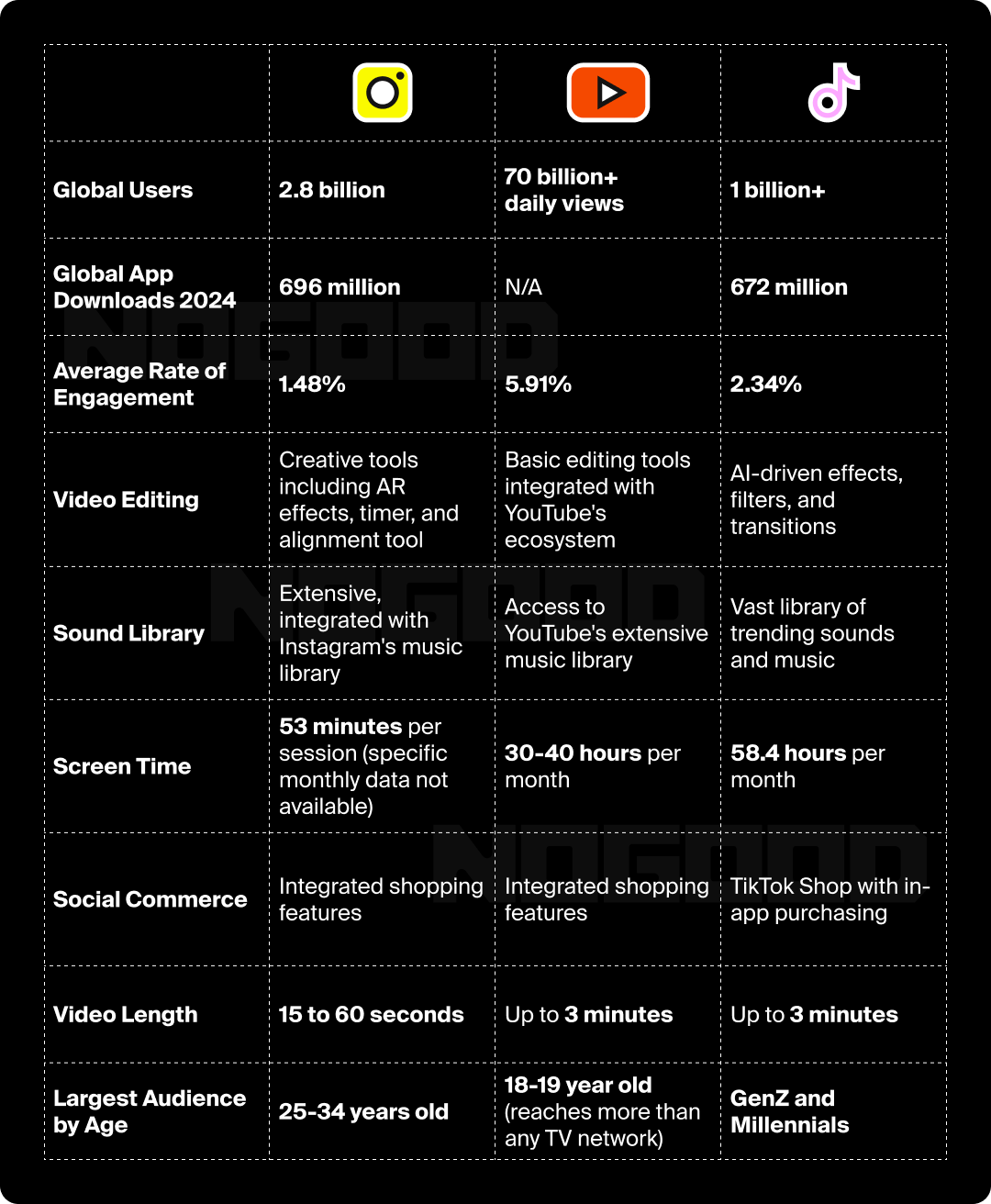

YouTube accounts for the most time spent at 23.7 hours per month, more than likely due to its legacy long-form content offerings and robust live streaming capabilities. TikTok comes in at 29.2 hours per month followed by Instagram at 16.55 hours per month. While specific data for YouTube Shorts is not available, YouTube as a whole contributes significantly to overall screen time. Users spend about 200 hours per month on screens connected to the internet, with video content being a major contributor to this figure.

It’s worth noting that these figures can vary based on factors such as age group and location. For instance, in the U.S., children spend an average of 56.5 hours per month on TikTok, which is higher than the global average.

App Downloads

TikTok continues to dominate app downloads in 2025. It was downloaded 773 million times in 2024, maintaining its position as the most downloaded app worldwide. TikTok’s growth has been consistent, with cumulative downloads reaching over 4.92 billion since its launch.Though we can’t be sure if a user was downloading Instagram or YouTube for short-form video content in “Reels” or “Shorts” feeds, it is likely they used the feature at some point.

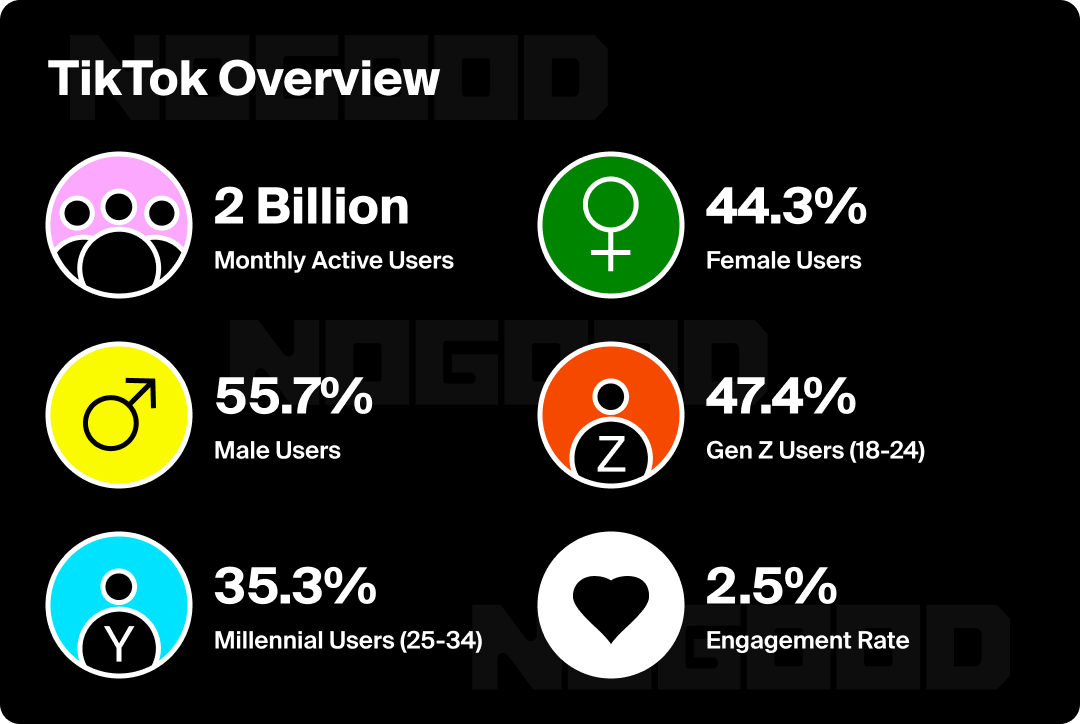

Active Monthly Users

In our research, this was the hardest statistic to nail down. Many companies hold these stats close to their chests. Though Facebook is still the world’s most-used social media platform with 3.065 billion monthly active users, YouTube has narrowed the gap, boasting 2.70 billion monthly active users. Instagram has seen substantial growth, now ranking third globally with 2.11 billion monthly active users. TikTok has also experienced significant expansion, reaching 1.925 billion users globally.

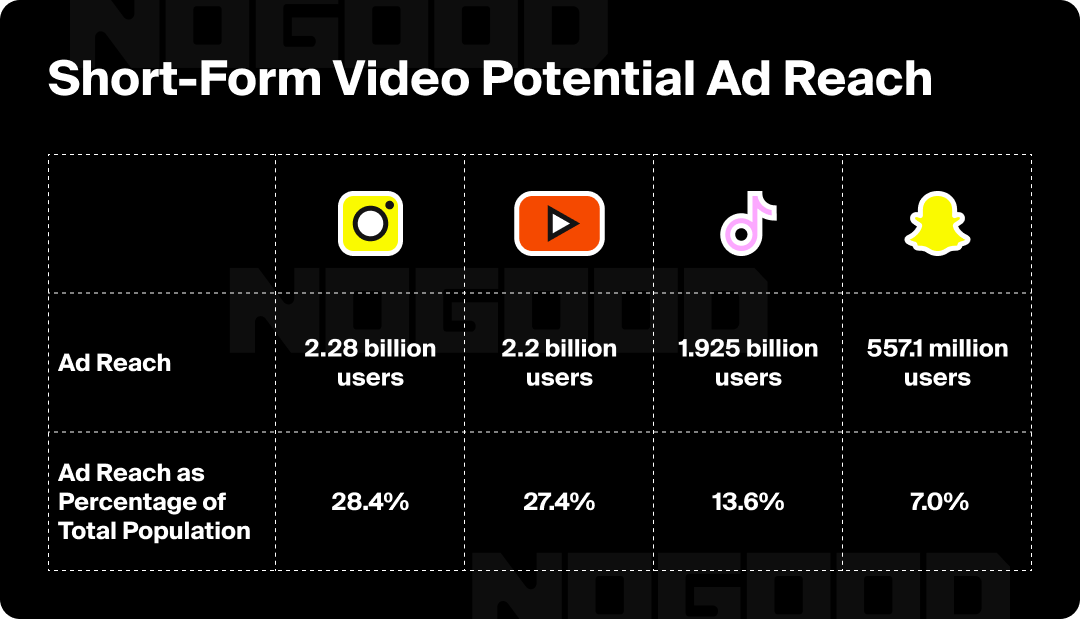

Advertising

While Meta’s Ads Manager Platform may be more tested and established, TikTok’s Ads Manager continues to impress as they roll out and optimize their features and campaign types that we haven’t seen on other ad platforms. TikTok now leads in engagement rates with 2.50%, outperforming Instagram (0.50%) and Facebook (0.15%). Additionally, TikTok shows the highest median monthly follower growth at 21% for small and medium-sized brands, compared to Instagram’s 6%.

That being said, Meta’s Ads platform is much more robust, but TikTok has significantly closed the gap in advertising capabilities. TikTok’s Creator Marketplace has evolved into a powerful tool, now available to all Ads Accounts and Creators with 10K+ followers. This marketplace facilitates seamless brand-creator collaborations, from sourcing to campaign execution, analytics, and payments. TikTok’s API integration provides unprecedented transparency into creators’ content and audience analytics. The platform’s “Brand Chem” approach, introduced in 2025, emphasizes collaborative content creation between brands, creators, and communities, reshaping traditional marketing strategies. As a response to TikTok’s Creator Marketplace, Instagram launched its own platform, and we continue to see others such as YouTube and Pinterest playing catch up to facilitating creator partnerships as well.

Advertising on YouTube remains highly effective, with 75% of consumers open to learning about products through YouTube video ads. YouTube has fully integrated its advertising capabilities into Shorts, offering tools like BrandConnect, Super Chat, and advanced shopping features. This integration allows for efficient reach options specifically for Shorts ads, enabling advertisers to target this growing format more effectively. YouTube Shopping has expanded, allowing creators to tag up to 30 products in their videos and Shorts, provided they meet specific channel requirements.

The evolution of YouTube’s advertising ecosystem is marked by the introduction of Demand Gen Campaigns in 2025, which replace Video Action Campaigns and offer new ad placements across YouTube, including Shorts. This shift reflects YouTube’s commitment to adapting its advertising approach to meet the needs of both advertisers and consumers in the short-form video era.

As all channels continue to evolve, it ideally shouldn’t be a singular choice for a brand in regards to where to invest ad dollars — a healthy marketing mix includes a variety of diverse channels that account for the entire user journey from awareness to conversion. With this in mind, certain advertising channels are better for certain objectives — and this is widely dependent on the brand industry, vertical, and maturity.

Social Shopping

Social Commerce or Social Shopping is the union of social media and eCommerce. In the United States, approximately 69.4 million people are expected to shop on Facebook alone this year, representing about 20% of the country’s population. The global social commerce market is projected to exceed $1 trillion by 2028, up from over $570 billion in 2023.

Social media platforms are also gaining significant traction in the U.S. market. This growth is driven by changing consumer behaviors, with 82% of consumers now using social media platforms for product discovery and research. The trend is particularly strong among younger demographics, with 73% of consumers aged 18 to 34 reporting that they’ve made purchases through social media channels. TikTok and Reels both already have extensive shopping capabilities with YouTube trailing right behind them with the release of “YouTube Shopping.” YouTube has Live Shopping and shoppable ads on Shorts as well, enabling creators to tag products in their short-form content, allowing viewers to purchase products directly from the video.

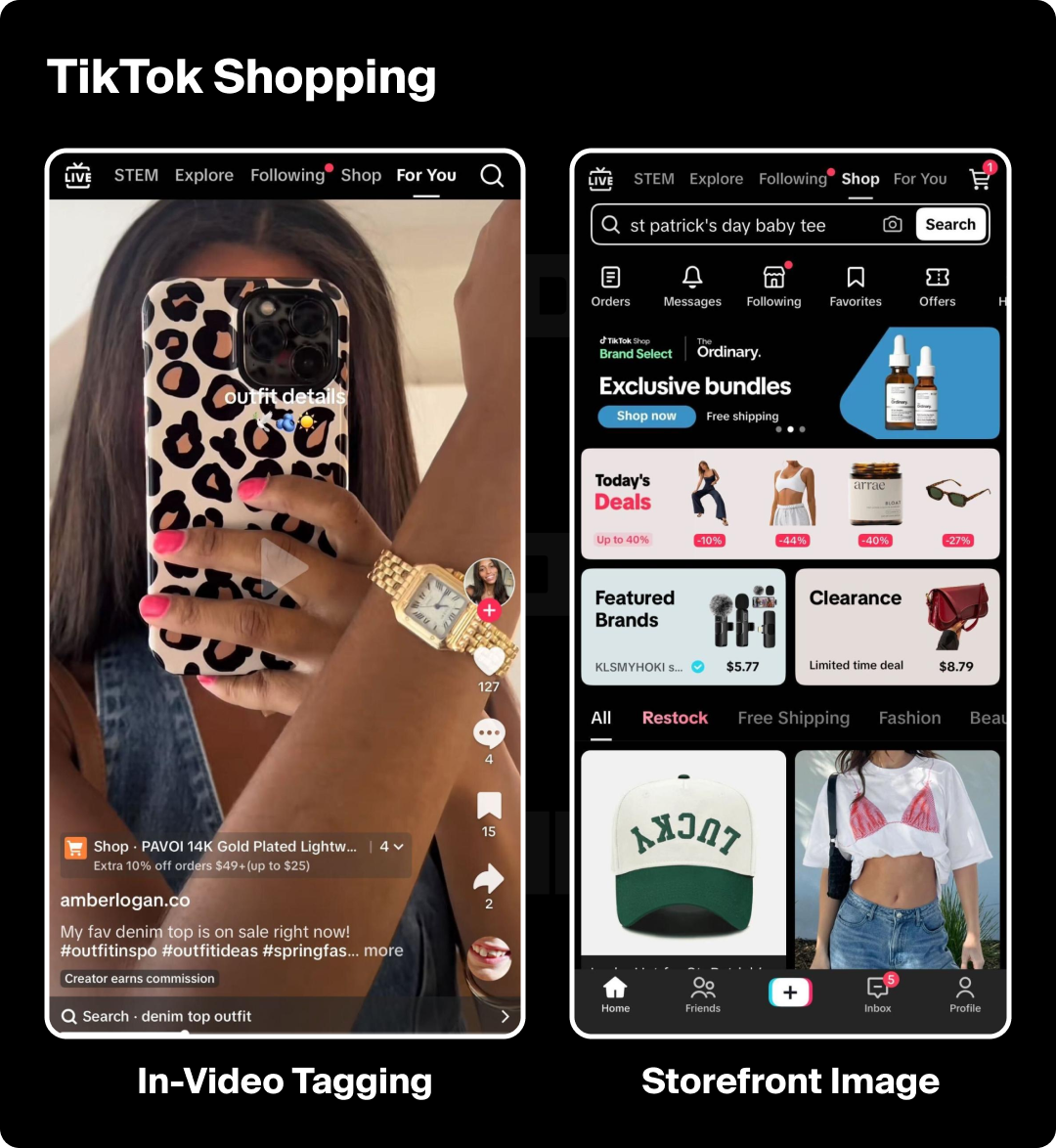

Instagram and TikTok’s shopping capabilities have proven to be quite successful. Similar to a feed post, Instagram accounts can tag products in their videos with shopping tags. Users can select the “view products” button to save, buy, or learn more about the featured product. Accounts with Instagram Checkout can even collect payment through the app so users don’t even have to leave the app.

Launched in 2021, TikTok’s shopping experience came in like a wrecking ball as users spent $2.3 billion dollars on the app, a 77% increase YoY. TikTok Shop, officially launched in September 2023, has revolutionized social commerce. By 2025, it has become a dominant force in eCommerce, with users expected to spend over $20 billion on the platform.

The shopping experience has evolved beyond a simple storefront, integrating seamlessly with TikTok’s content-driven ecosystem. Users can now purchase products directly within the app through in-feed videos, live shopping events, and a dedicated Shop tab. The platform’s success is evident in its rapid growth, with TikTok Shop spend overtaking Shein’s in Q4 2024.

The average order value on TikTok Shop is $35, with users making an average of 5.3 transactions each year. Notably, 90% of TikTok Shop customers plan to make future purchases, and more than half admit to making impulse buys, 10% more than on Facebook. This highlights TikTok’s unique ability to convert its highly engaged audience into paying customers through its AI-driven recommendations and immersive shopping features.

Engagement

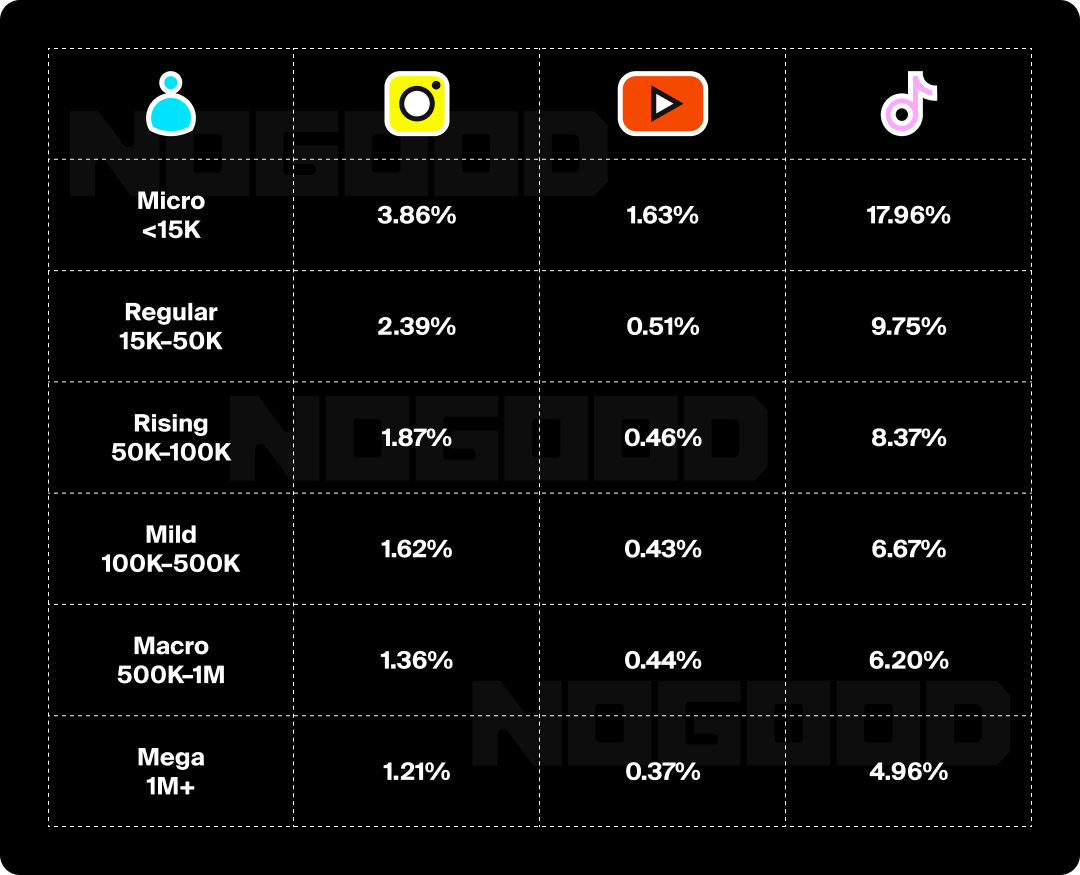

Having a large following is good and well, but it doesn’t actually make a difference if your users aren’t engaging with your content – engaged followers mean higher intent, higher ROAS, and lower CPAs. The engagement rate is calculated by the number of engagements divided by the number of followers x 100. Engagement includes interactions such as likes, comments, saves, and sends.

Based on data from Upfluence, TikTok, and micro-influencers specifically, has the highest engagement rate across the three platforms. Designed for discoverability, the algorithm assists quality content in receiving maximum visibility and rewards videos with higher engagement to continue being pushed out to users.

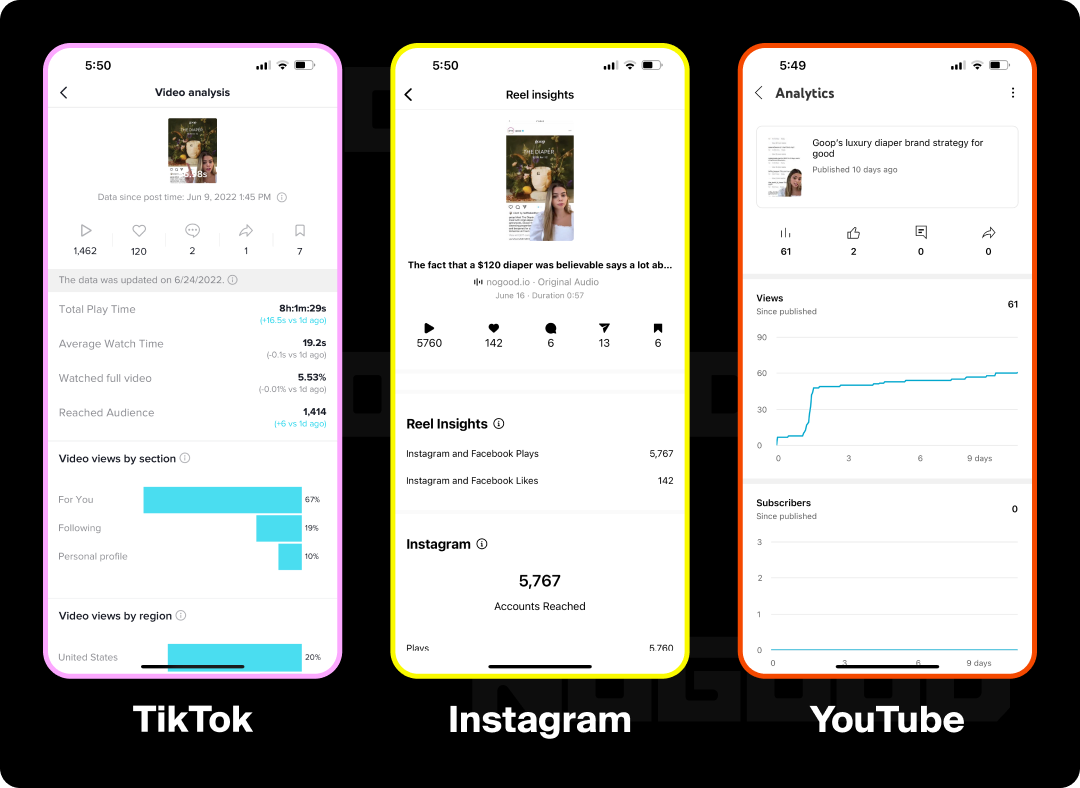

Though engagement is highest on TikTok, it does not diminish the fact that engagement for growth is massive on Reels. We’ve seen first hand that the number of views can vary greatly from Instagram to TikTok to Shorts. As an example, we posted the same video across all three platforms.

On Reels, our goop breakdown video received 5,767 views. It had 167 interactions resulting in an engagement rate of 2.89%.

On TikTok, the same video received 1,462 views, 130 interactions, and an engagement rate of 8.89%.

On YouTube Shorts, the video received 61 views and 2 interactions with an engagement rate of 3.27%.

Taking these analytics into consideration, engagement was highest on TikTok while views were much higher on Instagram. Depending on your KPI growth goals, different content will perform differently across all three platforms, therefore it’s important to experiment with all three to know what combination will work best for your brand.

Reels vs. TikTok vs. Shorts: Final Comparison

Choosing the right short-form video platform for your ad spend and resources is crucial in a rapidly evolving digital landscape. TikTok, YouTube Shorts, and Instagram Reels have emerged as the dominant players, each with unique strengths and audience demographics.

When deciding where to run your video campaigns in 2025, consider key factors such as engagement rates, audience reach, content discoverability, creator monetization, industry dominance, and video length across TikTok, Instagram Reels, and YouTube Shorts. Each platform offers unique strengths. Consider these factors alongside each platform’s unique features, such as sound libraries, editing capabilities, and core audience demographics, to determine the best fit for your campaign objectives and target audience in 2025.

Content Aesthetic

When it comes to video quality, legacy Instagram users are used to a more curated look and aesthetic which can put pressure on creators with the quality of their Reels. On the other hand, TikTok videos are perceived as more authentic due to their lower visual quality with a homemade feel in comparison to Instagram’s high-quality and perfect-looking feed. This makes for an interesting dichotomy when TikTok is viewed as more genuine while Instagram has more sophisticated targeting (and retargeting) options.

TikTok remains the leader in short-form video editing capabilities, offering a comprehensive suite of tools including AR effects, green screen options, and a vast library of filters and transitions. Instagram Reels has significantly improved its editing features since its release, now providing AR effects, timers, alignment tools, and stickers. That being said, the common sentiment from creators is that the function is less extensive than TikTok’s offerings.

YouTube Shorts, while initially lagging behind, has made strides in its editing capabilities, introducing basic tools like multi-segment camera options, speed controls, and timers. However, Shorts still lacks the advanced AR and green screen features found on TikTok and Reels. TikTok’s edge in editing tools, combined with its powerful algorithm and trend-driven content creation, continues to make it the platform of choice for creators seeking to produce highly engaging and polished short-form videos quickly and easily.

The value placed on Instagram vs. TikTok quality is also reflected in the users consuming the video. Gen Z, who largely gravitates towards TikTok, places a large importance on authenticity, social proof, and values-based marketing. This is reflected in the quality of TikTok videos and UGC marketing. Whereas on Instagram, Millennials are the largest portion of its audience and value connecting (and showing off) to their peers through perfect filters and feeds. 73% of millennials (ages 25-34) use social media to connect with family and friends, while 84% of Gen Z (ages 18-24) use it primarily to pass the time and consume entertaining content.This is the only generation that ranks killing time on social media above connection.

Social Search

TikTok’s other strength to consider is its rise as a social search engine that’s directly competing with Google. As a key discovery channel, TikTok is increasingly becoming the ultimate destination for Gen Z and beyond in finding answers to their questions, learning new facts, and discovering products and activities.

In fact, a key part of any content strategy on TikTok needs to include TikTok SEO, introducing a new alley for brands to meet user search intent and rank for key terms that desired audiences search for. The superiority that TikTok search results hold in contrast to Google and other platforms goes back to the initial argument about the raw and unpolished, community-validated nature of the videos on this platform, which automatically earns any brand points in the eyes of the consumer and inspires more trust than traditional Google search results cluttered with ads and SEO hacks.

Content Strategy Advantages

When it comes to introducing audiences to new features and brands to new platforms, Instagram and YouTube have the advantage of legacy users and advertising capabilities. However, TikTok was the first to roll out their full-screen, swipeable short-form video experience, therefore Reels and Shorts not only seem like a copycat but come in at second and third best as their features are not as innovative or quick to roll out as their competitor.

Similarly, as TikTok is an entirely new platform with a singular focus, Reels and Shorts complement (and sometimes compete with) additional in-app features and creative formats including Carousels, Stories, Lives, Feed, YouTube Premium, Subscriptions, and more. On one hand, content is created specifically for each of these features on the same account, which spreads creators and resources thin as assets have to be created for each content type.

However, once these initial crises are reconciled, the diversity of formats in creative, in fact, introduces new opportunities for brands to create robust content strategies. For example, the static carousel format (still very much alive) on Instagram complements Reels in a strategic way: brands can plan short-form video to reel in new audiences and expand reach, while more specific value-driven carousels can engage the existing community and address more niche needs and questions that the brand’s followers have. With this dual approach, brands can maintain high community engagement while growing their overall audience with two distinct yet complimentary post types.

The same goes for YouTube Shorts. While at a first glance, it might seem like Shorts compete with the native long-form video format YouTube is known for, it’s important to think of the two video formats as part of a singular content ecosystem. YouTube Shorts are a powerful tool for experimentation and quick results to refine content pillars, and video delivery, and take various ideas on a test run. With this experimentation and validation of ideas at hand, brands can be more strategic with what longer-form videos they choose to invest in and produce, resulting in a better-informed and more efficient content production system internally.

TikTok, in its turn, is not stopping at short-form video and continues to introduce new formats for creators and brands alike to engage with a variety of audiences. Reviving image carousels and stories and borrowing a page from Instagram’s book and bringing longer-form video formats similar to YouTube, TikTok is evolving its content offerings as well — which is a further confirmation that brands need to take advantage of the variety of post types that each platform offers.

Advertising Capabilities

As of now, TikTok is a strong driver for awareness and consideration, with the natural UGC and value-forward content immediately earning user buy-in without alienating audiences with promotional content. Depending on the industry, it may or may not be a strong fit for conversions — as it stands, it’s best to be a primary channel for eCommerce and consumer app brands and an experimental awareness channel for the rest.

With Meta, considerations are different, largely due to how the ad platform has held a monopoly over being the top advertising destination for most brands. Despite the recent privacy roadblocks and app tracking complications, Meta remains a go-to choice as a starting point for experimentation and is typically a successful investment on a full-funnel basis.

Where the major Meta advantage comes in is that with the addition of Reels, the platforms have diversified the types of creative that brands can leverage in order to reach their desired audience. Whether it’s UGC for building trust or GIFs to incite action, brands have a strong arsenal of medium types to experiment with different creative choices, visuals, copy, and messaging across all funnel stages.

When it comes to YouTube, the offering is in full growth mode — with YouTube pouring investment in short-form video, it remains to be seen how the ad offering for this will continue to evolve. With that said, our prediction is that YouTube’s offering will very likely become extremely competitive to Meta’s due to the original user base YouTube already boasts, the lengths the platform goes to reward creators, and its historic success in full-funnel results.

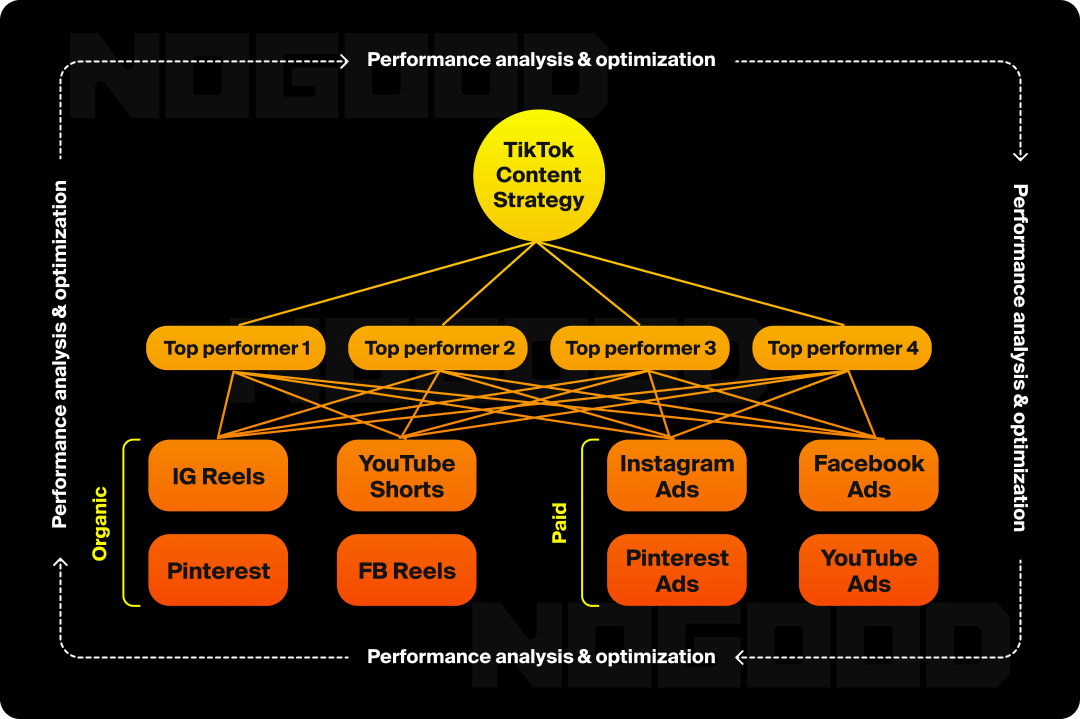

Content Repurposing Flywheel

Last but not least, short-form video’s strongest advantage is in how easy it is to repurpose cross-platform, whether it’s for paid or organic efforts. As a rule of thumb, the leader in the short-form video strategy for repurposing is TikTok — due to a few reasons:

- TikTok allows a faster pace for learning and experimentation.

- TikTok’s innate discoverability, paired with SEO tactics, makes it a priority to prioritize posting on this channel first.

- If a piece of content works on TikTok, it will work anywhere — due to the fact that UGC is TikTok’s inherent, native content type.

With this in mind, by kicking off content creation (organically), brands can effectively build a multi-channel content repository that provides winning short-form video assets tested and proven to resonate with desired audiences.

This allows for a higher threshold for experimentation across other paid and organic initiatives and can happen in parallel with other efforts across channels.

Short-form video has taken marketing by storm and as more platforms roll out their own version of the full-screen video experience, marketers and brands are having to learn the skills to keep up with the content form and fast-paced trends, preferences and developments of social selling and advertising.

Reels, TikTok, and Shorts each have their own pros and cons and these platforms continually are updating their features and introducing new campaigns and ad types for marketers to test. Our rule of thumb is experiment, experiment, experiment until you have enough data to decide where to spend your ad dollars and content creation efforts. Your organic audience engagement and interaction will help lead these decisions and be further supported by your paid targeting strategy.