Technology has made nearly all aspects of our lives easier. Easier to track, easier to understand, and easier to manage. It should come as no surprise then that fintech has become the $112.5B behemoth that it has in recent years.

However, with general sentiments leaning towards if not completely stepping over the line into distrust towards the financial sector, brands entering the space, and legacy brands looking to modernize require growth strategies that not only convert audiences into users but build trust and turn active users into advocates to keep the sign-ups coming.

It’s no wonder then that we see brands focused on managing crypto portfolios focusing on education rather than features, and investment platforms handing out free stocks rather than investment advice.

With the current focus on building community in all industries, it’s important that fintech companies align their goals with strategies that nurture not just conversions, but community. So while campaign goals of the past may have set KPIs built around lowering CAC or increasing CTRs, the most effective campaign goals of today are:

- Education

- Trust

- Loyalty

- Advocacy

While these may not seem like goals that can drive revenue and conversions, the companies that are changing the way we look at fintech are telling a different story and implementing different tactics than the centuries-old multinational investment firms with names comprised of the initials of the various phantoms of Wall Street.

The modern fintech company is helpful, approachable, and dare we even say…friendly? And thus so are the new fintech tactics for growth implementing such wild things as:

So if you’re in the business of building a fintech, welcome to the club — we’re here to help and so should you be too!

Tactic 01 – Freemiums – Robinhood

The tactic of giving away products for free to entice people to try them is nothing new from the perspective of marketing. Free sample kiosks have been ubiquitous to the shopping experience since the dawn of time — though less so since COVID in most grocery store food aisles.

For digital brands, particularly in the SAAS space, the freemium has taken on a bit of a different flavor. With the new model, brands will target users with an offer of a free month of their subscription; with a slight caveat. The caveat is, in this instance, that the user creates an account and provides payment information for when the service auto-renews at the end of the free period.

Ultimately, the goal is that the user tries the service, the trial period expires, and the user continues to subscribe. This is great because any subscription that goes beyond a single month is profitable, with even those that only extend a month past the trial period breaking even and at least capturing information that can be used for win-back campaigns.

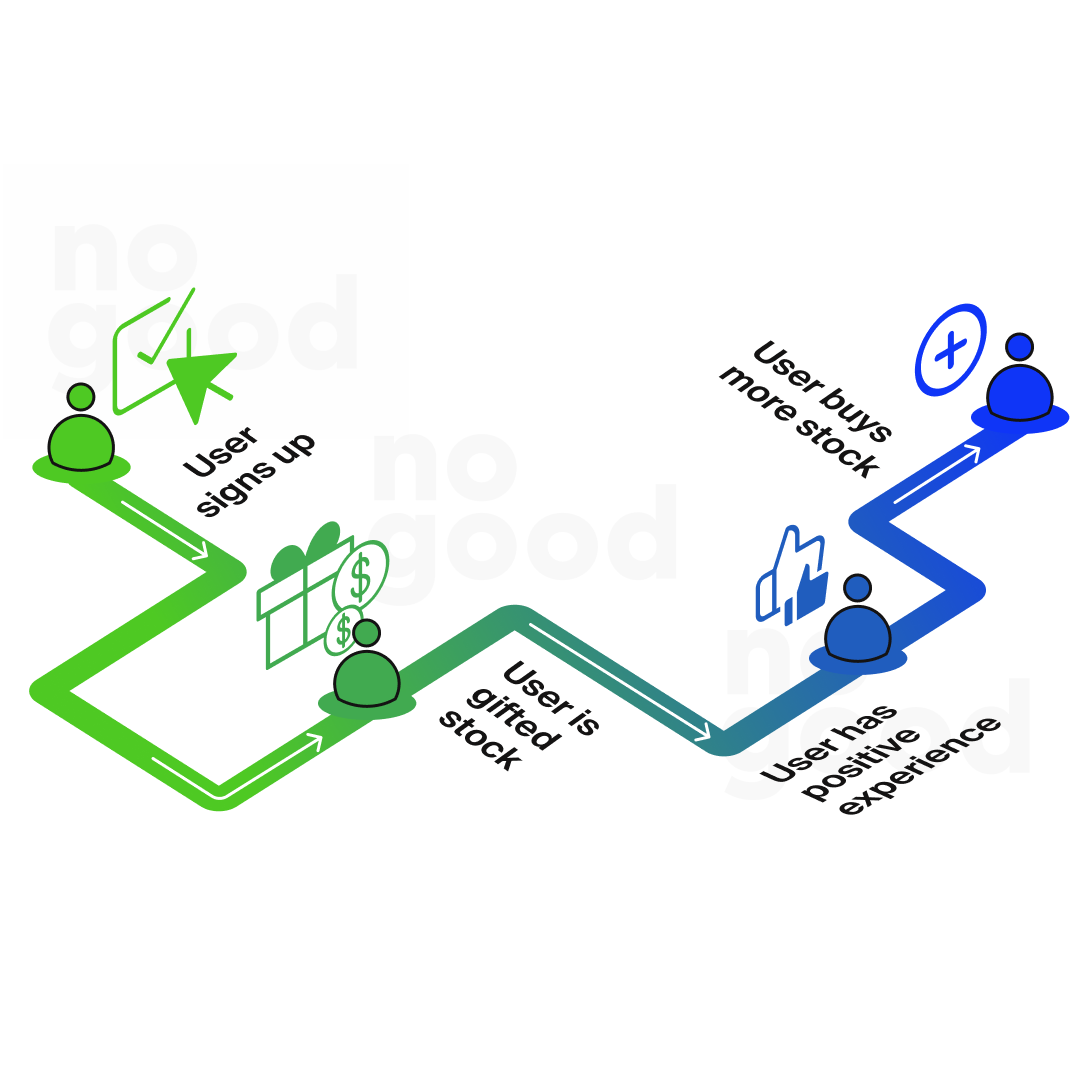

But Robinhood isn’t a subscription service, they’re a stock trading platform. They couldn’t possibly give away stock, right? Wrong. It may seem like a crazy idea, but Robinhood implemented the same tactic for growth as they saw being used in SAAS companies and with similar motivations in mind.

Robinhood had two simple approaches:

- You sign up

- You get a stock

And

- You refer a friend

- You both get a stock

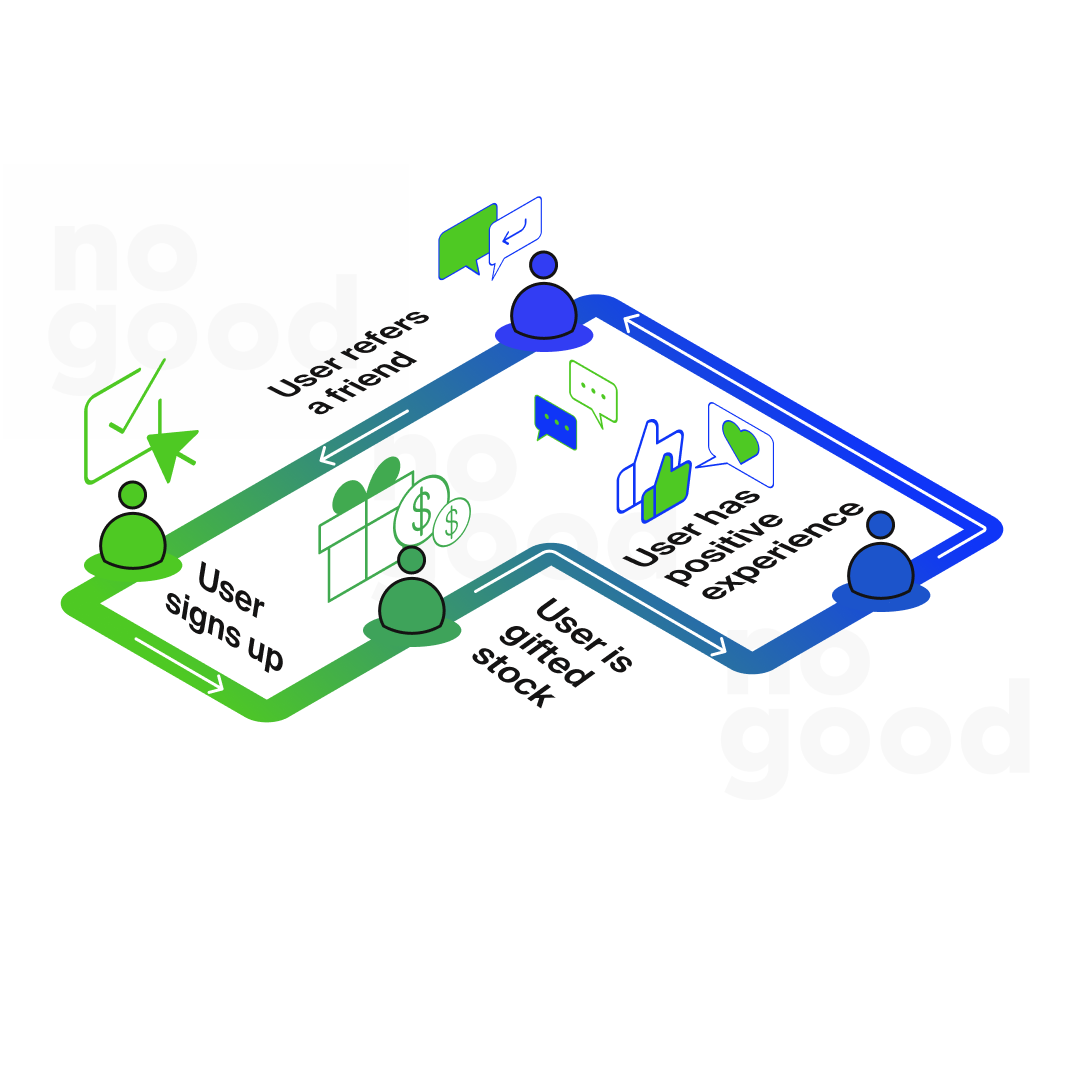

While this may seem like a crazy thing to do, just giving away stocks to anyone who signs up for your service, it does accomplish two of the main goals that modern fintech aims to accomplish — advocacy and trust.

As Robinhood set out to overcome the skepticism that many face with the stock market, with the average consumer being hesitant to contribute their money to a system that they don’t understand or believe in, they provided a solution by allowing users a pathway to try it without risk. This, of course, was done with the hopes and intentions that they find some success or alleviation of their skepticism as they monitor their newly acquired stock and see, firsthand, that it’s not so scary.

Taking things a step forward and baking advocacy into this process, Robinhood also allowed users to encourage other users to sign-up and reward them for doing so. And while there was a slight risk that users received a stock, it immediately tanked, and they were forever scarred by the experience and never bought stock of their own or referred a friend — there was also a pretty decent chance that this would never be the case.

For one, the stock market does fluctuate from minute to minute and day to day as prices go up, then down, then up, then down, then back up again. But looking at the trend of the stock market as a whole, the overall trend has historically only been up — with a few brief but catastrophic downs.

Robinhood knew that, while not a sure thing, their product was something that users would enjoy and have faith in and trust once they finally tried it.

By providing access to a new financial mechanism without risk, Robinhood understood that they would be able to provide positive experiences to a new audience and create advocates to help churn new users and generate a growth loop of new users for relatively little cost — outside of the occasional golden Apple stock that got given away (which we might mention later *foreshadowing*).

Tactic 02 – Coinbase – Positive Feedback Loops

In the same way that crypto is looking to fiat currency systems to build better financial systems for the future, Coinbase likely saw the growth model Robinhood was implementing and immediately thought to themselves, “Hold my bitcoin.”

While it may not seem like it today, there was a time when cryptocurrency wasn’t a household name, and it was possible to make it through a meal without someone trying to give you advice on what to invest in — if you’re getting stock flashbacks, that’s not a coincidence.

And while there’s still a decent portion of the population who is still crypto-illiterate, the massive jump in knowledge within the space is largely due in part to Coinbase. In the same way that Robinhood users had a fear of the unknown often preventing them from investing, Coinbase understood that the skepticism, lack of truck, and general lack of understanding of the crypto-market was their most formidable obstacle to achieving success.

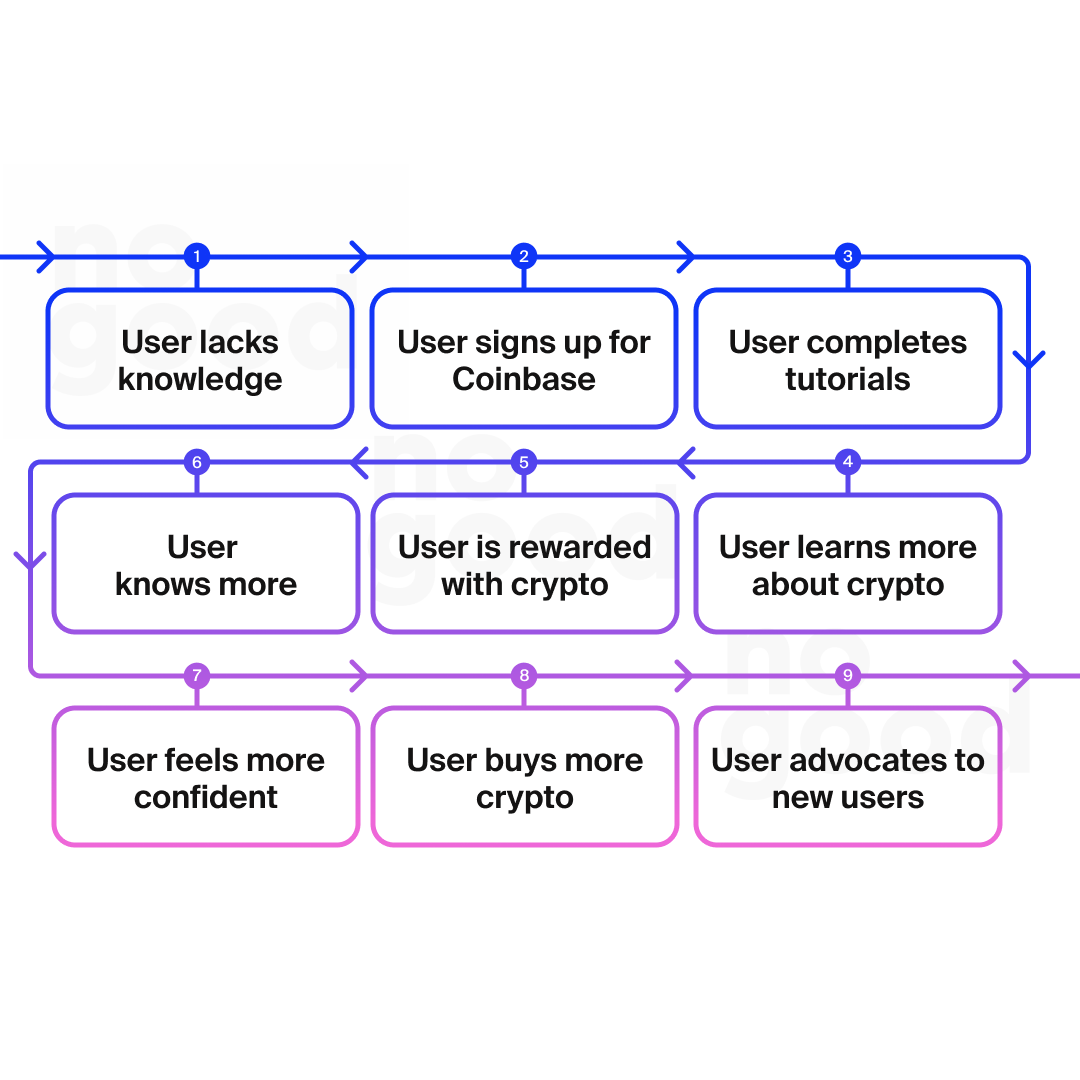

Coinbase took a page from Warren Buffet, who famously said, “The more you learn, the more you’ll earn.” playbook in their approach to building their platform by rewarding users with crypto for learning how it worked.

Their system was simple and created a positive feedback loop to empower users while rewarding them for learning.

The Coinbase model may be complex and requires an (arguably) substantial upfront investment in crypto to give away resources for building the tutorials, however, sustainable ltv is not built overnight and, as we’ve mentioned, trust is paramount.

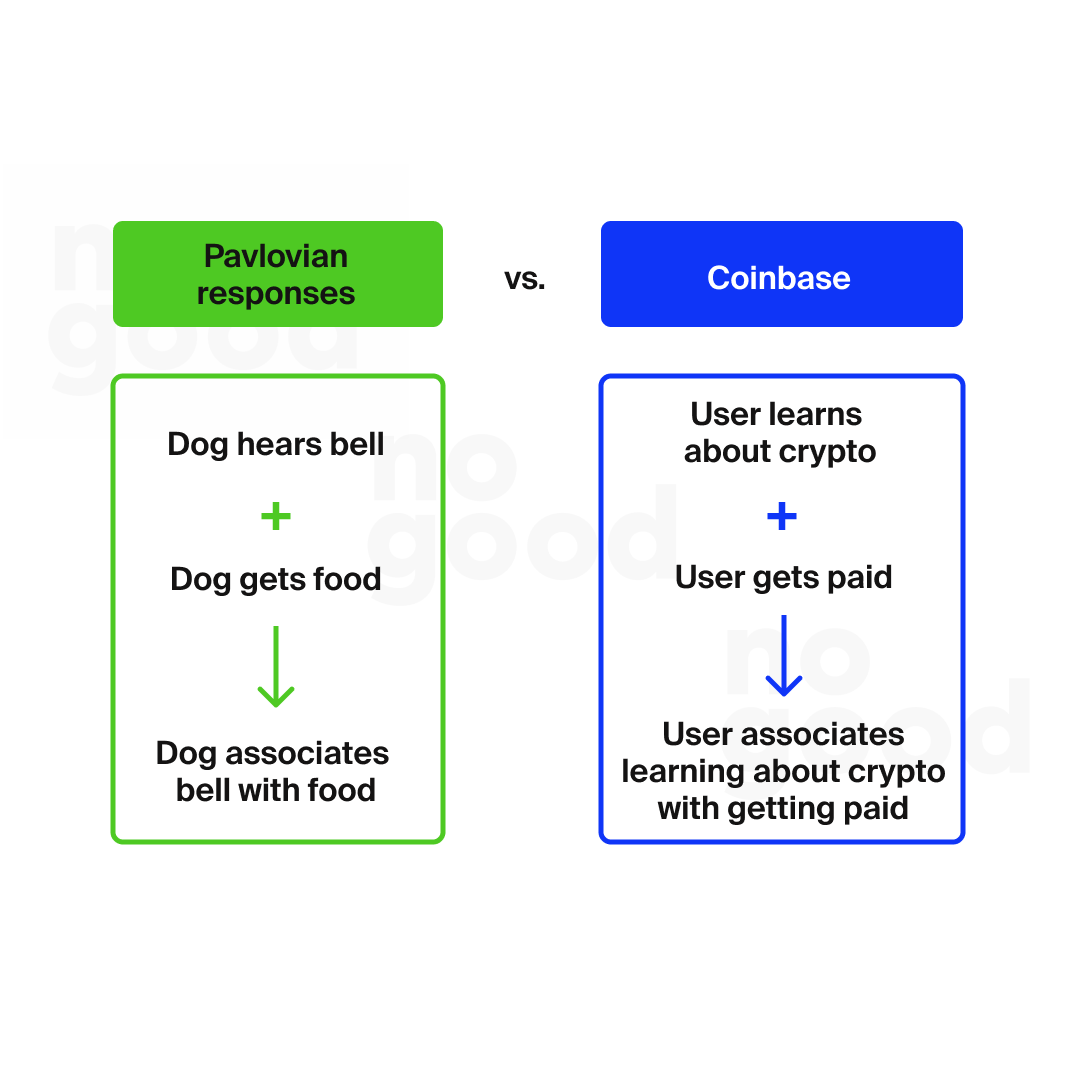

At its most basic, Coinbase conditioned their users with a Pavlovian Response by creating positive feedback loops with their brand experience.

The two key components to Coinbase’s success and its ability to build trust with users were trust and positive reinforcement. While not necessarily a tactic that is universally translatable to all fintech companies, the reality stands that many financial mechanisms and services aim to provide access to complex services to the masses, and education and positivity is the path of least resistance to accomplishing just that.

Tactic 03 – Klarna – IRL Experiences

Once again the newcomer to a legacy space, Klarna used real-life experiences to add a touch of humanity to their service in order to win the trust of users who were otherwise skeptical of the concept of “buy now, pay later”.

You may be asking yourself, “Isn’t that essentially just credit?” And the answer is, yes, it is. But Klarna is credit with a twist, offering users the opportunity to essentially take out micro-loans to pay for single items in installments. Don’t have $100 for a new set of bike tires? No big deal, just pay $20 for the next 5 months and all will be well in the world.

The obstacle Klarna was facing, and their largest barrier to growth, was that people are, as they should be, skeptical of pretty much everything on the internet. Users are buying things on their favorite ecomm sites for years and then suddenly, one day, without warning there’s a new name next to your payment options saying you can buy in installments — sus.

Their solution? Take a step back.

While their intention was to build a digital brand (hello, Fintech) allowing users to experience the brand with real-life shopping experiences and broadcasting these experiences through content creators and their own social channels. And while, yes, there was a certain level of gimmick in creating an instagrammable moment through their “pup-up”, a pop-up dog-driven shoppable experience complete with dog grooming services and pup-friendly products, the true accomplishment of these experiences was the trust being built by pulling back the curtain and adding faces and places to a brand that seemingly appeared overnight in a space riddled with distrust.

Tactic 04 – Mint – Gamification

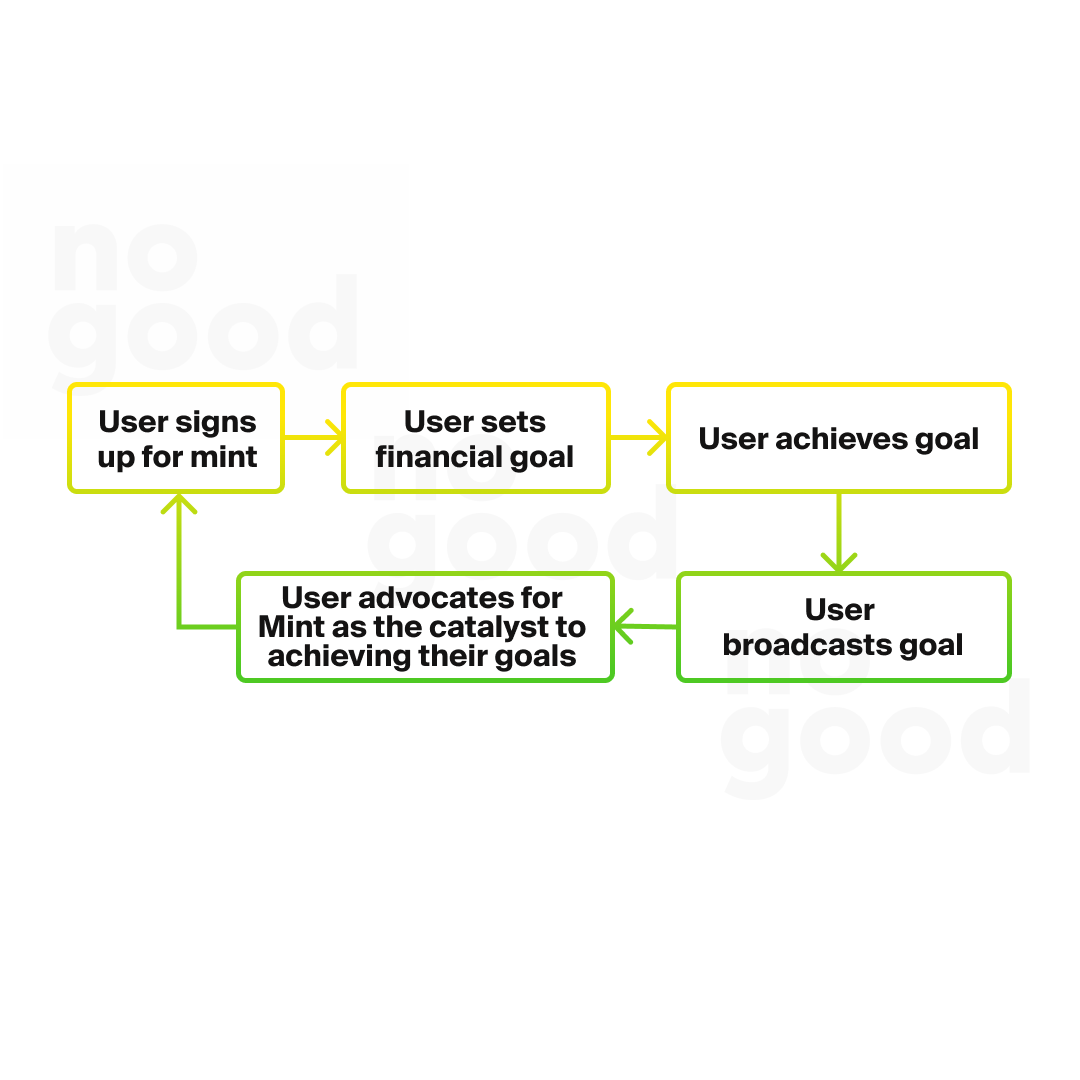

Remember those positive feedback loops from earlier? What would you say if I told you you could accomplish the same outcomes without giving away stock and crypto? Introducing, gamification.

Is it a coincidence that a generation that grew up alongside video games is easily motivated by achievements and filling status bars? Maybe. Does that change the fact that it’s an incredibly effective way to grow a service? Absolutely not — and Mint knows this.

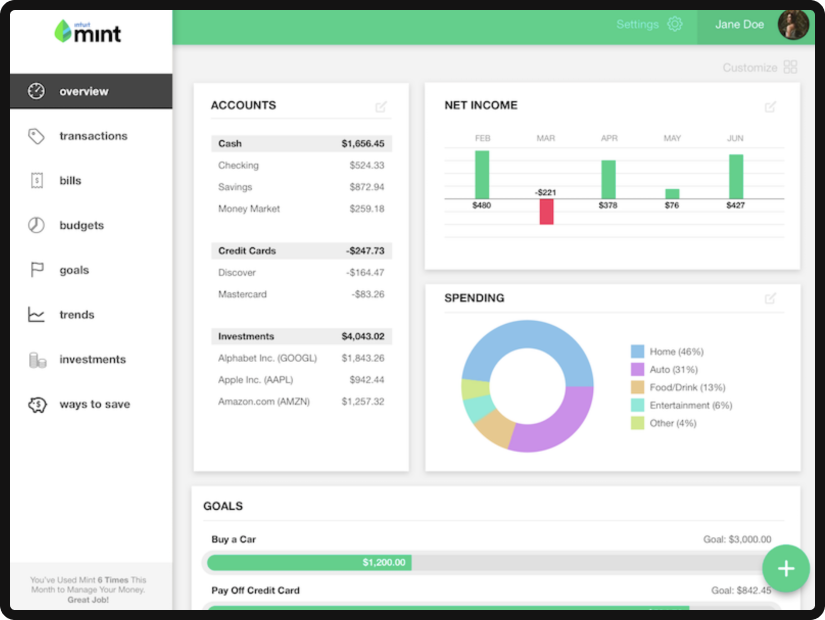

The intuit backed company is reapproaching financial goals by empowering users to be able to easily set goals and effectively track their spending to achieve those goals — it’s that simple.

While legacy financial systems tend to provide limited reporting and tracking metrics for their users that will show, at best, average spending from month to month with few meaningful insights beyond that, Mint gives users all of the tools they need to take control of their finances.

By making finances a game, with clear goals that can be visualized, users were not only motivated to achieve their financial goals, but also to be able to have a clear vantage point of their finances and were quickly moved to advocacy by way of their financial achievements.

Ultimately, the mechanism at play here is the visualization of progress and the use of tracking to encourage delayed gratification by giving a clear indication of when a reward will be received.

Those of us who live in metropolitan areas that have subway or public transportation systems are likely familiar with the displays that inform users of the next arrival time for the particular mode of transportation that they are waiting for. This was a change that was implemented by way of a consultancy that was tasked to optimize the train system to decrease wait times for users. And while the solution they provided had no impact on the actual efficiency of the rail system that they were meant to improve, the addition of the arrival timer increased customer satisfaction multiple times over.

Why is this relevant to Mint? Because it’s the same psychological mechanism in play to gamify the financial planning process and train users to delay gratification by creating clear pathways.

If we were to observe two users trying to save for a car downpayment with a goal of saving $5k, one with Mint and one without. What might those pathways look like?

User 1 is able to see where their weekly expenses go, make adjustments to their spending habits, create budgets for their different expenses, and visually track their progress towards their goal.

User 2 has a general idea of where their money goes, but doesn’t really see any meaningful progress towards their goals and is easy to be swayed towards impulse purchases because there’s no clear impact on goal despite there being a cumulative impact against them getting that new car they so desperately want.

So while it may just be a bar on a screen, the implementation of gamification is incredibly powerful in not only gaining the trust of users but encouraging them to advocate through their successes.

Fin…Tech

Trust in fintech is one of the most significant obstacles that brands in the space need to overcome. Thankfully there are some tried and tested strategies that some of the biggest names in fintech have proven for those to come after them.

While these tactics are a single component of growth, the other main component is a fantastic growth partner. These tactics are sure to get you far, though if you ever find you need some help, you know where to find us.