In case you haven’t heard, investing in yourself is the new “it” thing. Self-care has shifted from being a luxury to a priority among the masses and it is vital for brands to navigate this shift. The growth of the beauty industry is and has been, rapid, dense, and a vast force to be reckoned with. The beauty category, which includes cosmetics, skincare, fragrance, and haircare, has seen an explosion of growth — with some of the main drivers being self-care-focused Millennials. With the ever-shifting political and economic climate of the world, Millenials are looking to invest in themselves and self-care as a coping mechanism, leading to a major prioritization of self-care products that have never been seen before in any other generation as these millennials are amplifying their buying power as many are entering their thirties and have the economic backing to do so.

The visual nature of social media, and the growth of social platforms themselves, have also propelled and intensified the growth of the beauty industry. Consumers can now candidly see the products brands are selling, as well as results that go beyond glossy magazine spreads and expertly curated displays at the store. TikTok and Instagram creators have contributed to the appreciation for authenticity by giving real-time tutorials and candid reviews — both paid and organic. UGC has been huge for the growth of the beauty industry and is essential for any brand’s growth strategy to enter the market.

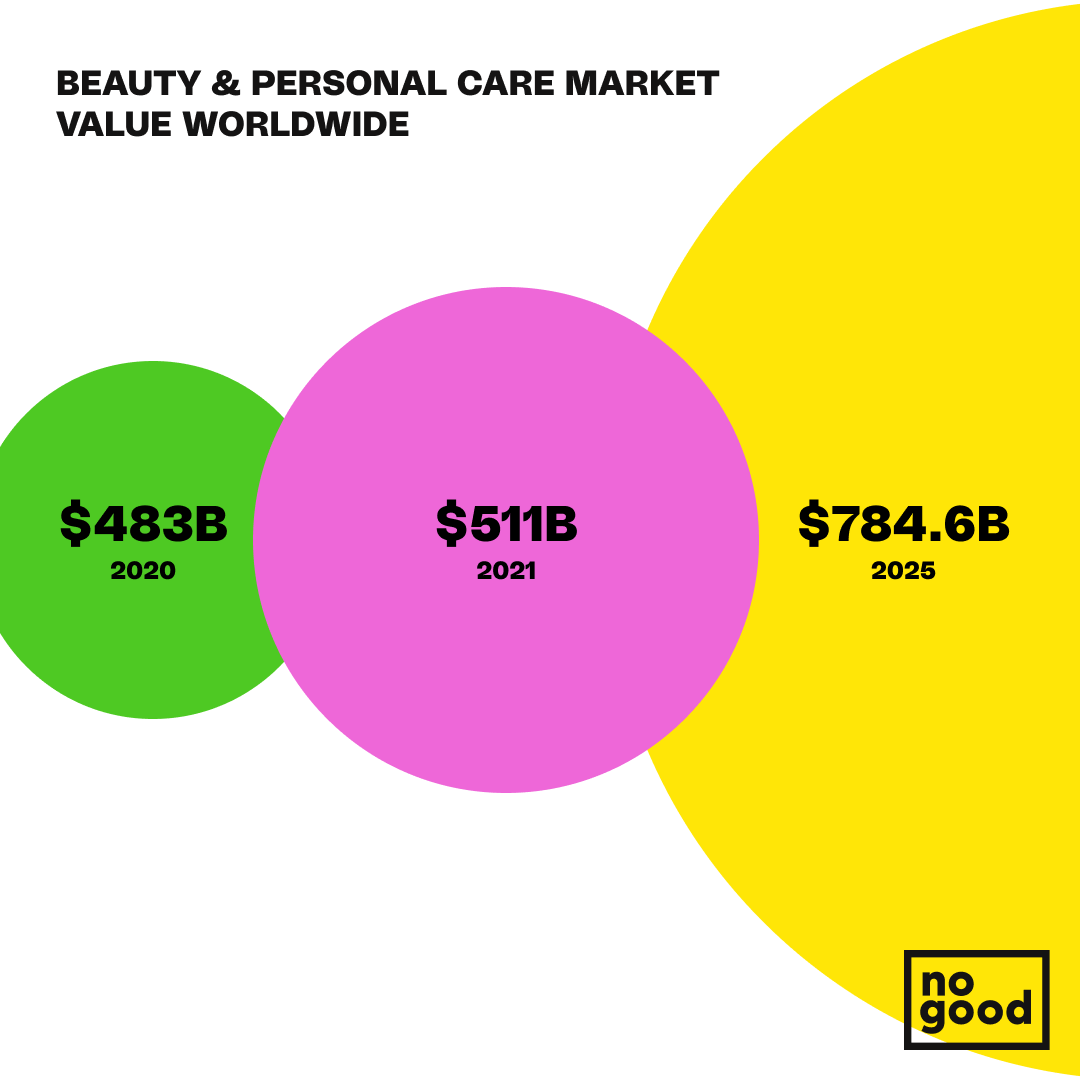

The beauty and personal care market grew from $483 billion in 2020 to $511 billion in 2021, an increase of almost 6%, and the industry is expected to exceed $716B by 2025. The growth of the category has led to an extremely saturated market, requiring brands to be more strategic than ever when entering the beauty space and standing out in the noise.

Growth in the Age of Social:

Community-led growth is the name, customer retention is the game. Social media platforms allow brands to generate a sense of community among consumers as well as increase brand trust and awareness. So, how exactly do you do this as a brand? Foster connection through interaction.

In today’s competitive beauty market, having a presence on the right channels is an undeniable requirement, but standing out is where it becomes difficult. Cultivating community through live streams, giveaways, comment interactions, and more is a great place to start. Essentially making the consumer feel like they are a part of something and therefore more willing to purchase again and again.

Building community is increasingly important, and in addition, being very distinct about who your consumer is. With the saturation in the industry, a brand will not, and should not, aim to appease everyone — as it is more successful for growth in a saturated industry to pick a niche, and target the specific demographic (or demographics) that aligns with said niche.

Content creators and Influencers have quickly become drivers of brand identity and traction. It is essential for growth and visibility of a beauty brand to pick carefully curated personalities that align with your brand image and have audiences that align with your brand messaging and product.

These influencers even have contributed to the growth of the beauty industry by occasionally becoming entrepreneurs of their own — creating beauty brands where they have seen a hole in the market after candidly reviewing them for years. For example, skincare guru and TikTok creator Hyrum educated his audience on skincare must-haves as well as faux-pas for years before launching his own line of products.

He did so by building trust among a community and with that confidence built a brand. Trust is not an easy thing to gain with an audience, and will always take time, but contributes greatly to long-term sustainable growth by turning customers into advocates. Creators who nail down the ability to foster trust will in turn create a more tight-knit community as well as a greater ability to sell a product. This is being seen a lot with creators and influencers across all industries. For the sake of brand growth through influencer partnerships, it is important to note that organic social content holds great value, and the combination of the two is key. Creating buzz around your brand that naturally generates creators to talk about products is the sweet spot. There are countless brands that work with content creators to create Get Ready With Me’s, How-Tos, tutorials, unboxings, etc., but creating produced content that still feels native and organic is difficult to achieve — though nailing this is the key to success.

This all ties back to the idea of authenticity. Over-produced content loses relatability, and in order to connect and drive community among an audience, organic-feeling content is required. This is especially important in the beauty space as physically using the products and seeing the results is a main driver of sales.

Celebrity Driven Beauty Brands vs. Micro-Influencer Strategy

It feels as though with each new day, there is a new celebrity beauty brand. Rhode by Hailey Bieber, Haus Labs by Lady Gaga, Fenty Beauty by Rihanna, and Rare Beauty by Selena Gomez are just a few. Celebrity brands have the advantage of immediate mass exposure based on the influence of said celebrity. But, with this said, there is so much saturation in the beauty industry with these celebrity brands that they have to have more than just their name backing them. Furthermore, the concept of celebrity-backed products is now decades old and in many ways, it’s lost its charm. To be successful they must demonstrate authenticity, involvement, and longevity to see true success.

In addition, fostering a community and tapping into the fan base that the celebrity has already established, and aligning their brand with that is very important. Let’s look at Lady Gaga’s brand Haus Labs in comparison to Kim Kardashian’s new skincare line SKKN as an example. Lady Gaga has committed not only her beauty line but her career to inclusivity and expression. Back in 2009, she stated in an interview that her goal was to “inject gay culture into the mainstream”, and has been supporting and resonating with key demographics within the LGBTQ+ communities every since. Her brand Haus Labs has been embracing inclusivity in its marketing as well as pledging a percentage of every purchase made to go towards her Born This Way foundation – supporting the mental health of young people. Overall, she has a strong community with aligned individuals who value her dedication to inclusivity and will always be her “little monsters”, and this is strongly reflected in the way she built this beauty brand. When comparing this to SKKN by Kim, it is important to note the definite distinction between how the two brands were built. Haus Labs through existing community values and inclusion, and SKKN through the reliance on celebrity prowess and a broad fan base. SKKN is a luxury skincare line that was expertly crafted with quality ingredients all while boasting sustainable packaging, but there isn’t a community being built around the brand in a direct way.

Celebrity brands have the advantage of focusing less on growth and more on launch strategy, essentially proving the product goes beyond a celebrity name and provides true quality and differentiation. This fad of celebrity beauty brands makes it difficult for new, emerging brands with no credibility in the eye of the consumer without a big name behind them to grow and launch — or does it?

Beauty brands entering the market and looking to grow need to tap into a niche and harness that in order to see successful growth. There is little room for, or a need for, appeasing everyone — especially in such a saturated market. Well-established legacy brands such as P&G dominate the self-care “staples” we all know and use, and have been for decades, which makes it all the more important for specialization and differentiation in new, emerging brands. Tapping into a niche starts with leveraging the power of the micro-influencer. While their followings are smaller, their engagement rates are higher, which speaks to the truthfulness of their audience as well as their community strength: a cult-like loyalty if you will. Christina Garcia of impact.com says that a micro-influencer’s value to brands “is through authentic and original content… which can be measured through performance-based models like CPA”. Micro-influencers also generate a highly desirable ROI with their low-cost marketing solutions by leveraging their strong influence — despite lower follower counts.

Innovation and Standing out in the Crowd

Hyper-Personalization:

Differentiation is key for growth in the beauty industry right now due to its saturated nature. A major trend being seen in the beauty industry right now is the utmost personalization for the consumer. It’s no longer about expressiveness – think eyeshadow pallets with every color on the rainbow – it’s about hyper-personalization and catering to the extremely niche and exact needs of each customer. This is tricky, because as we all know beauty is in the eye of the beholder. For a brand to successfully personalize a consumer experience and increase their engagement in doing so, they need to understand where the consumer is in their buying journey and cater to that.

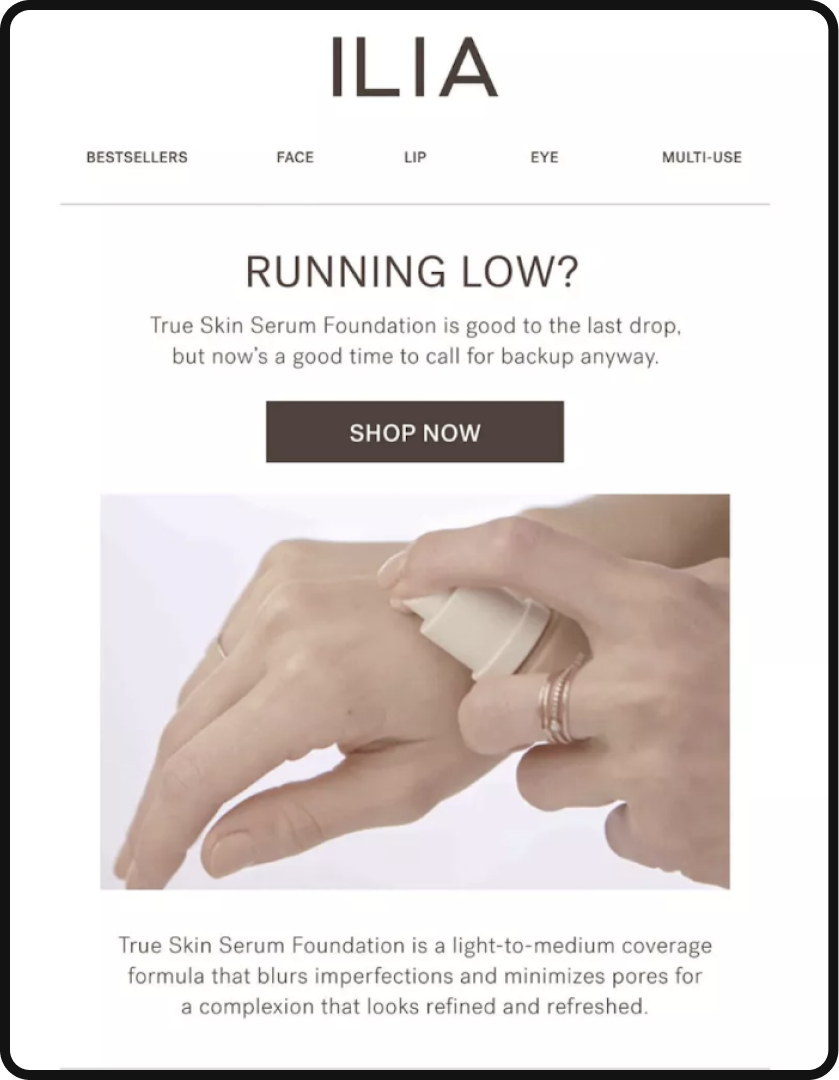

Beauty brand ILIA sends out personalized emails letting customers know when it’s time to reorder a product, based on when they purchased it and how long the product lasts on average. According to Omisend, these automated email messages had almost double the open rate – 34.26% open rate in Q1 2020 compared to just 18.86% in 2019 before they personalized them.

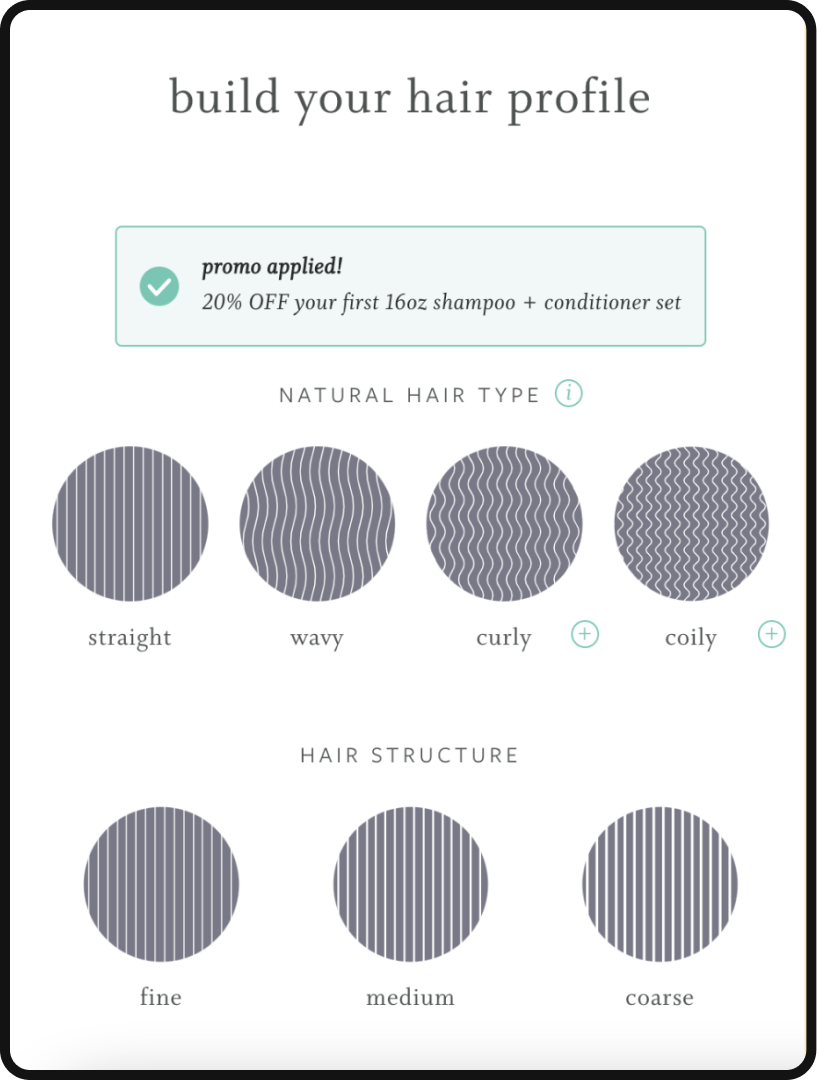

Function of Beauty is a “100% custom hair, skin, and body care” brand that is also embracing the power of personalization. This brand utilizes quiz pop-ups to diagnose each customer’s specific needs and desires for a product – essentially allowing the consumer to feel as though they are building their own product. Function of Beauty goes a step further by putting the customer’s name on their bottles, adding to that personalized touch.

Even something as simple as engraving on a perfume bottle or lipstick is an aspect that can assist any brand in reaching their consumers in a more personal way. Everyone wants to feel special and as if something was made specifically for them — custom if you will. YSL for example offers engraving on their lipsticks which is the perfect blend of accessibility for a luxury product and the personalization everyone craves (I may or may not have an engraved YSL lipstick – I can attest to drinking the personalization Kool-Aid)

AR/ VR Experiences:

Major players in personalization right now are AI and VR try-on tools, specifically in e-commerce platforms. As DTC formats in this industry become more mainstream, these brands need to make up for the lack of personal interaction and presence they would otherwise attract in a brick-and-mortar format. In Sephora for example, customers can physically put on any beauty product they want to see on their skin, so in order to make up for this experience online comes the reliance on virtual try-on tools.

The technology of today allows brands to expand their offerings online to mimic in-person experiences in a variety of ways. Especially during COVID, brands were prompted to think outside of the box when it came to personal interaction and online shopping. Beauty brands especially had to replicate an in-store experience that often involved physically applying, smelling, and feeling the products on. AR/VR tools have become the answer in recent years. For example, beauty brand NYX, owned by L’Oreal, launched its virtual try-on feature for a variety of products. Even being able to see a lipstick color on your own skincare makes all the difference in an online experience. But it doesn’t stop there. Brands have even been implementing virtual retail spaces on their e-commerce sites where users can “walk around” their store, look at products, and essentially simulate the brick and mortar experience, even providing VR consultations.

Growth Loops:

Growth loops have shifted the way marketers approach acquisition and retention. A growth loop is a self-sustaining, compoundable growth tool where the action taken by one consumer creates an output that further drives demand. With the saturated nature of the beauty industry, the implementation of growth loops is vastly important for customer retention and loyalty- and AR/VR experiences are the perfect mechanism to implement growth loops.

Take the NYX virtual try-on tool for example. If a user is impressed by the experience, they may share it on their personal social channels, which in turn builds additional brand awareness. Once buying the product from this experience, the user is prompted to share their experience with the product, and after being socially validated, sharing this will attract new consumers who then try the virtual tool for themselves. Voila! A growth loop. Not only does this scenario result in a consumer likely to make a repeat purchase, but also attracts new customers in the process.

Ingredient Focused:

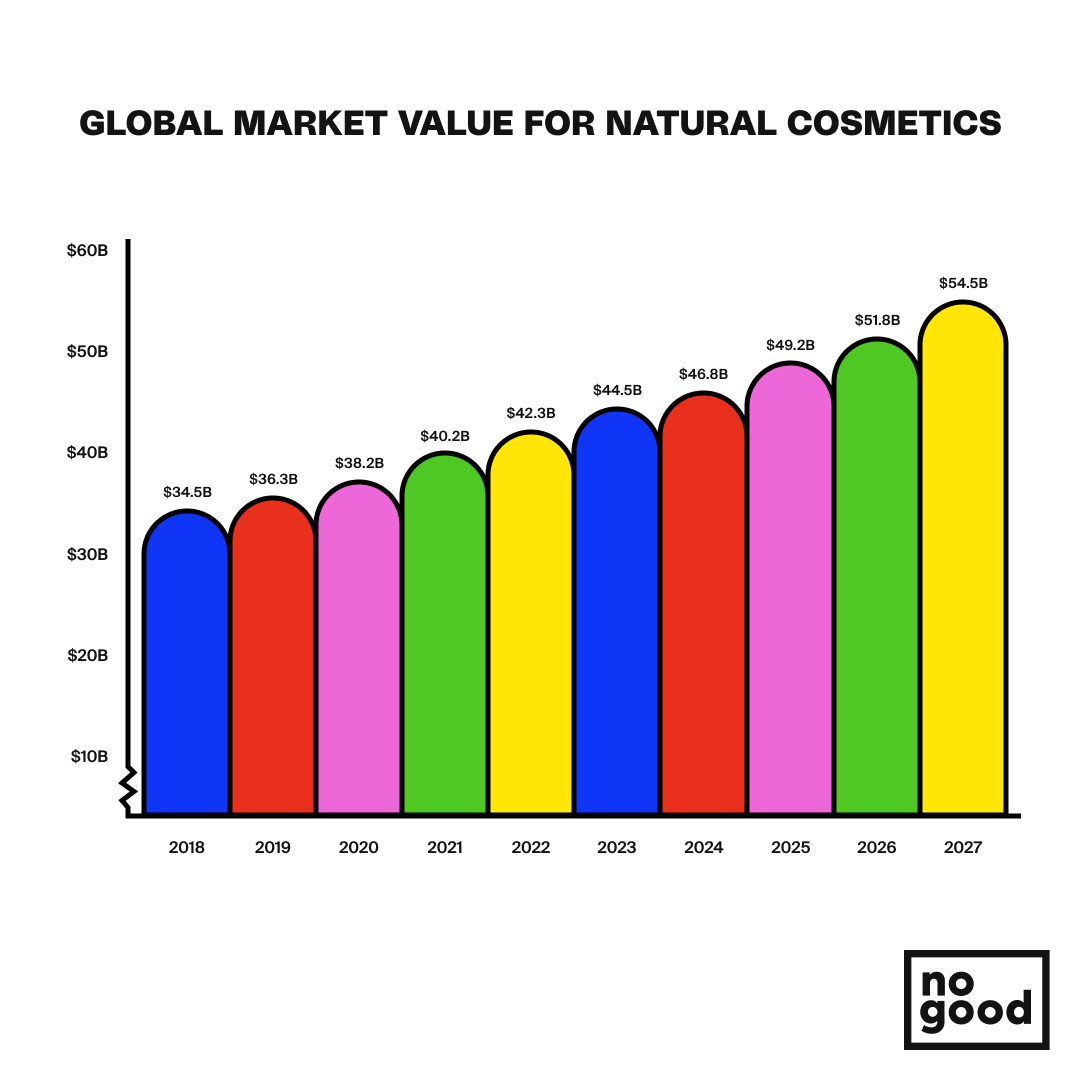

Customers are now hyper-informed, thanks to platforms such as TikTok, about skincare and makeup ingredients — what to look for and what to avoid. Not only this, but Millennials and Gen Z especially look for products that are organic and free of animal testing. TikTok and Instagram creators alike have built followings and harbored trust through informing their viewers on ingredient lists as well as what exactly to look for depending on your wants and needs. Because of this, consumers are more informed, and therefore more picky in the realm of ingredient lists and the organic nature of a product. Clean is king in beauty right now- and brands that aren’t adhering to this will lose traction and stunt growth. “Clean beauty” and “organic makeup” are more than just buzzwords with the global natural cosmetics industry expecting to reach $54.5 billion by 2027.

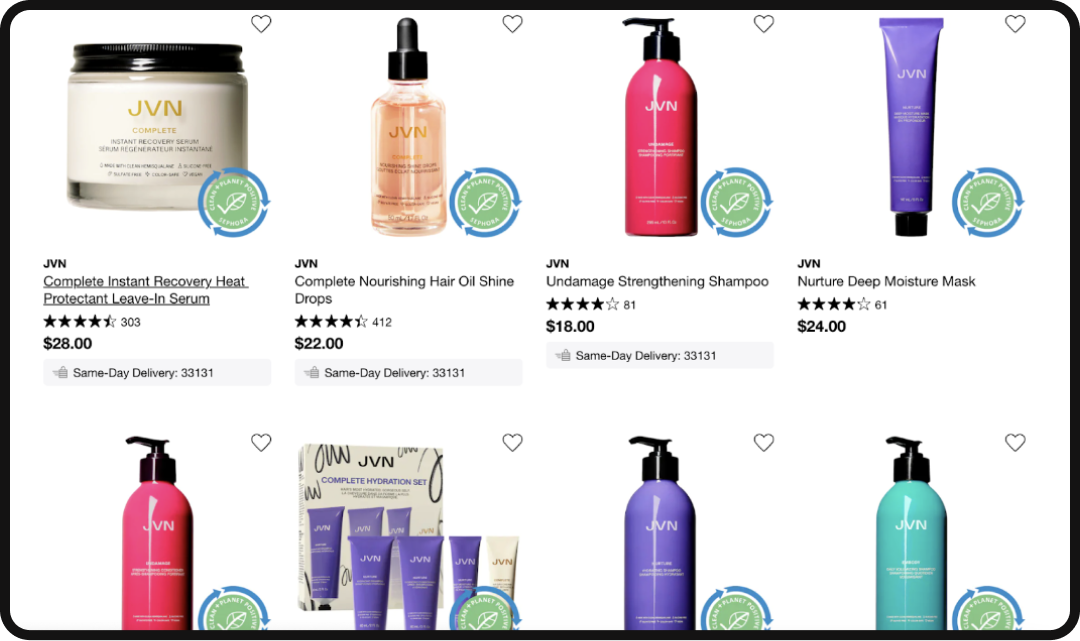

JVN is a fast-growing hair care brand that embodies the importance of sustainability in self-care products. Their products are sold at retail giant Sephora, which in recent years has assigned special badges to products that meet their clean beauty standards. Consumers have become reliant on seeing a green badge or a blatant mark of sustainability and cleanness in order to make a purchase, and this is important for brands to note and adapt to. The green badge with blue arrows on Sephora’s website indicates that this is a brand that is focused on, “…climate commitments, sustainable sourcing, responsible packaging, and environmental giving.” This clean status at Sephora is not only favorable for the consumer’s visibility, but also for the brand, and by reaching this status they are rewarded with greater exposure and special perks awarded by the retailer.

With that said, modern consumers are very cognisant of the charade many brands put on when it comes to being “natural”. Greenwashing is very real in the beauty space: many products and lines will incorporate natural imagery, or even the word “natural” in their name and descriptions while not necessarily being certifiably organic, sustainable, or non-toxic. Tying back to authenticity and community with your consumer, brands need to understand the difference between real authenticity and preformative branding. Consumers are smart, and they will see through performative tactics that come off as ingenuine and cutting corners. In addition to consumers, retailers are also very selective when awarding labels such as “green approved” or “clean status”, so it is in the best interest not only for authenticity but for exposure to be real relating to ingredients, and green in a genuine way.

In any case, it is still important for growth for a brand to stay true to who they are, and not try to check off every single box. There is a fine line between having a niche, sticking to that niche, understanding and acting on innovation, as well as not being too gimmicky. Applying and implementing innovation to your brand shouldn’t feel like a stretch, it should be a natural fit and ever-evolving.

Precisely Priced:

As a brand, it is vital to establish pricing with great meaning and intention, as there is a consistent push and pull between luxury and mass marketing pricing. It seems to be a theme in the past few years that more and more consumers are moving away from only trusting a luxury price point to boast the utmost quality, and are shifting to more ingredient-focused, and accessible brands. Take The Ordinary for example, a skincare brand that boasts minimal packaging, and the utmost simple ingredients, with a staggeringly low price point. Their goal? To show consumers that quality is not defined by price point, and they did just that. More and more brands are emerging with this premise. Sold at Sephora, The Ordinary can be considered a brand of “low-end luxury”. Over are the days that low price point self-care products are exclusively found at drugstores. There are products that have that lower price point yet maintain a prestige element, and therefore consumers are seeing more and more affordable options at retailers such as Sephora. With that said there is still space and great appreciation for luxury products in the beauty market. Take the lipstick effect as an example.

The Lipstick Effect:

The lipstick effect is the idea that consumers still tend to buy small, luxury items during a time of economic downturn or personal financial crisis, such as luxury lipstick. The lipstick effect, not so ironically, applied to much of the self-care and beauty industry — as there is an increased emphasis on the importance of self-care as well as the fact it is the small luxuries consumers want to spend their money on to forget their financial problems. This theory was stated originally by economic professor Juliet Schor who said women “are looking for affordable luxury, the thrill of buying in an expensive department store, indulging in a fantasy of beauty and sexiness, buying ‘hope in a bottle.’ Cosmetics are an escape from an otherwise drab everyday existence.” And this remains true to this day, whether it’s a time of economic downturn or not – hence why the luxury beauty industry is alive and well today – not to say they don’t have some adapting to do in the current climate.

Luxury consumers are still buying beyond those just splurging on the occasional lipstick or perfume, but they are also becoming much more discerning with how they make those purchases. Thanks to brands like The Ordinary and beauty TikTok creators who have educated consumers on ingredients and their true costs. This is causing luxury brands to think outside of the box, just as new and emerging brands would with innovation and micro-influencer strategies. Luxury brands need to leverage the idea that consumers are becoming comfortable with mixing luxury with mass market, and that quality does not have to come in the form of a three-digit price tag. Luxury brands are also exploring ways to enter the beauty space and draw in a new demographic of consumers, harnessing the lipstick effect, such as Hermes making a nail polish in their signature orange.

The beauty industry is one of vast resilience. Taking the lipstick effect into account, even in a time of economic downturn, the beauty industry seems to prevail more than others, and in this post-pandemic world- beauty continues to grow as generational priorities shift and people are spending more and more on the bliss of being seen out of the house and the ability to spend.

Adding a Bow:

A brand must understand the importance of differentiation in the rise of the beauty industry, as well as tapping into a niche and sticking with it. Standing out in the noise becomes more difficult for emerging and legacy brands each quarter, especially with the industry expected to exceed $716B by 2025. Leveraging community, as well as personalization and innovation, has become the expectation and a necessity for growth.