Fintech startups are becoming increasingly popular, as they offer innovative solutions to the financial industry. According to an Adroit Market Research study, the size of the global fintech market is expected to increase at a CAGR of 20.5% to reach $699.50 billion by 2030. This is both an opportunity and an obstacle as with so many new companies entering the market spanning across the payments, investments, cryptocurrency space and in the presence of looming existing fintech giants, it can be difficult for a fintech startup to stand out from its competitors. Nonetheless, there are a few players who have managed to cut through the noise with innovative approaches to Fintech marketing that we will be analyzing.

In this article, we take a look at 5 of the most successful marketing tactics and strategies deployed in the Fintech space:

1) Leveraging Word-of-Mouth Referrals

Strategy: Compound community growth by engaging existing communities to encourage advocacy + adoption.

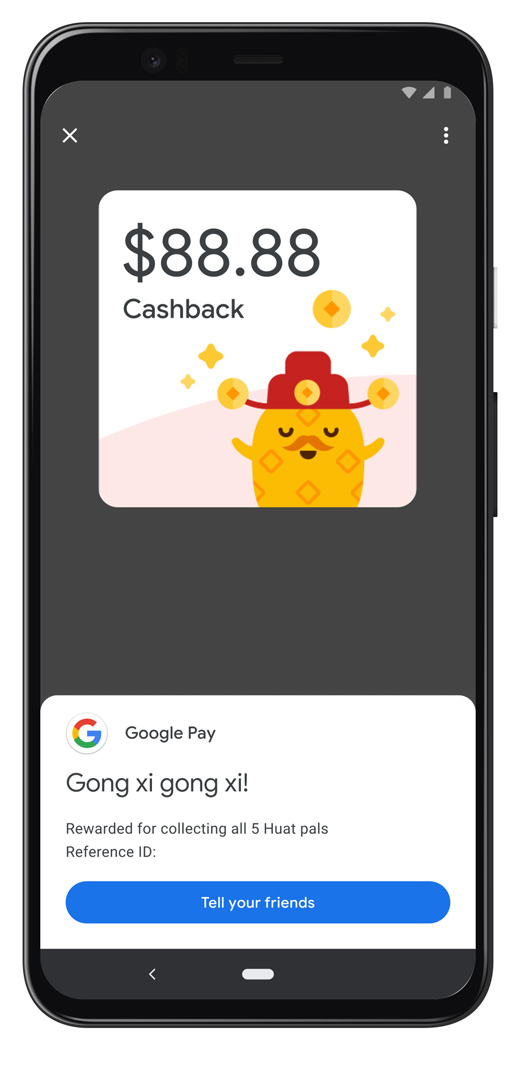

One of the most important parts of community-led growth is leveraging word-of-mouth referrals from existing users who enjoy using the product enough that they want others to try it out too. To make this happen more easily, companies typically offer incentives like referral discounts or rewards programs which encourage people to share about their positive experiences with their social circles of friends, family and colleagues. While it’s been popular in the investments and credit cards space to offer referral bonuses of up to $900, one of my favorite examples of a great referral marketing campaign was done with a promise of just up to $88.88. While not a start-up, this example comes from the launch of Google Pay in Southeast Asia in 2020.

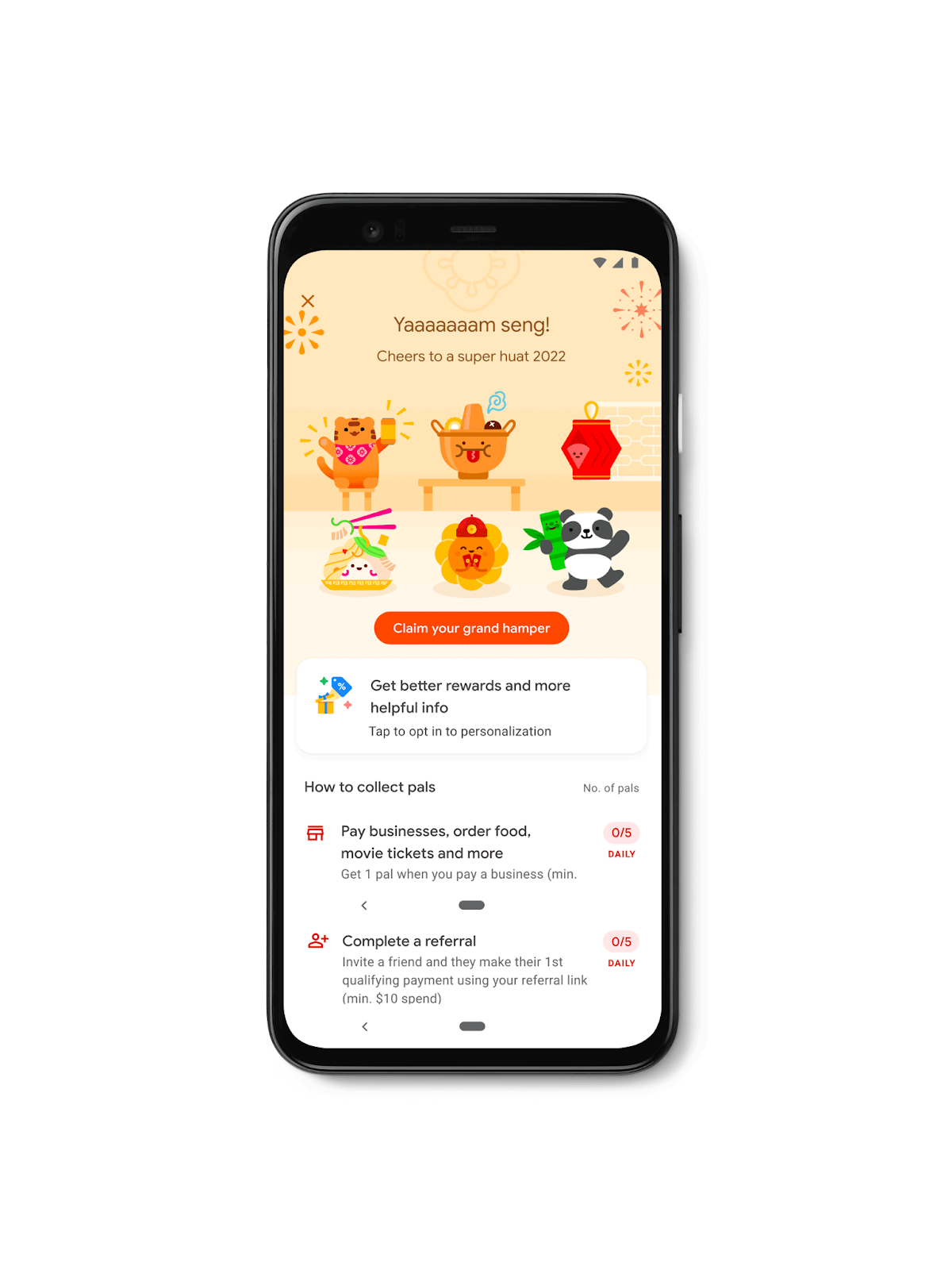

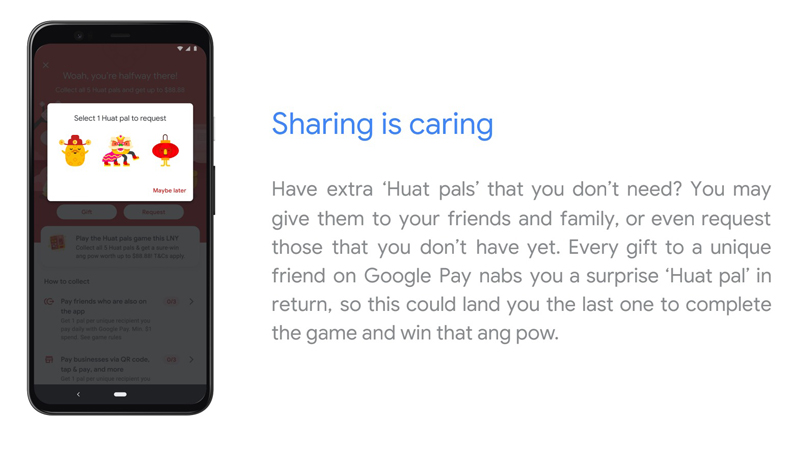

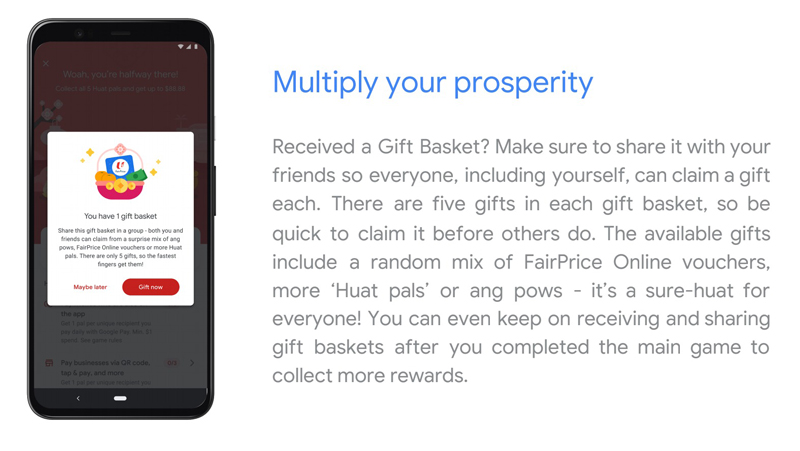

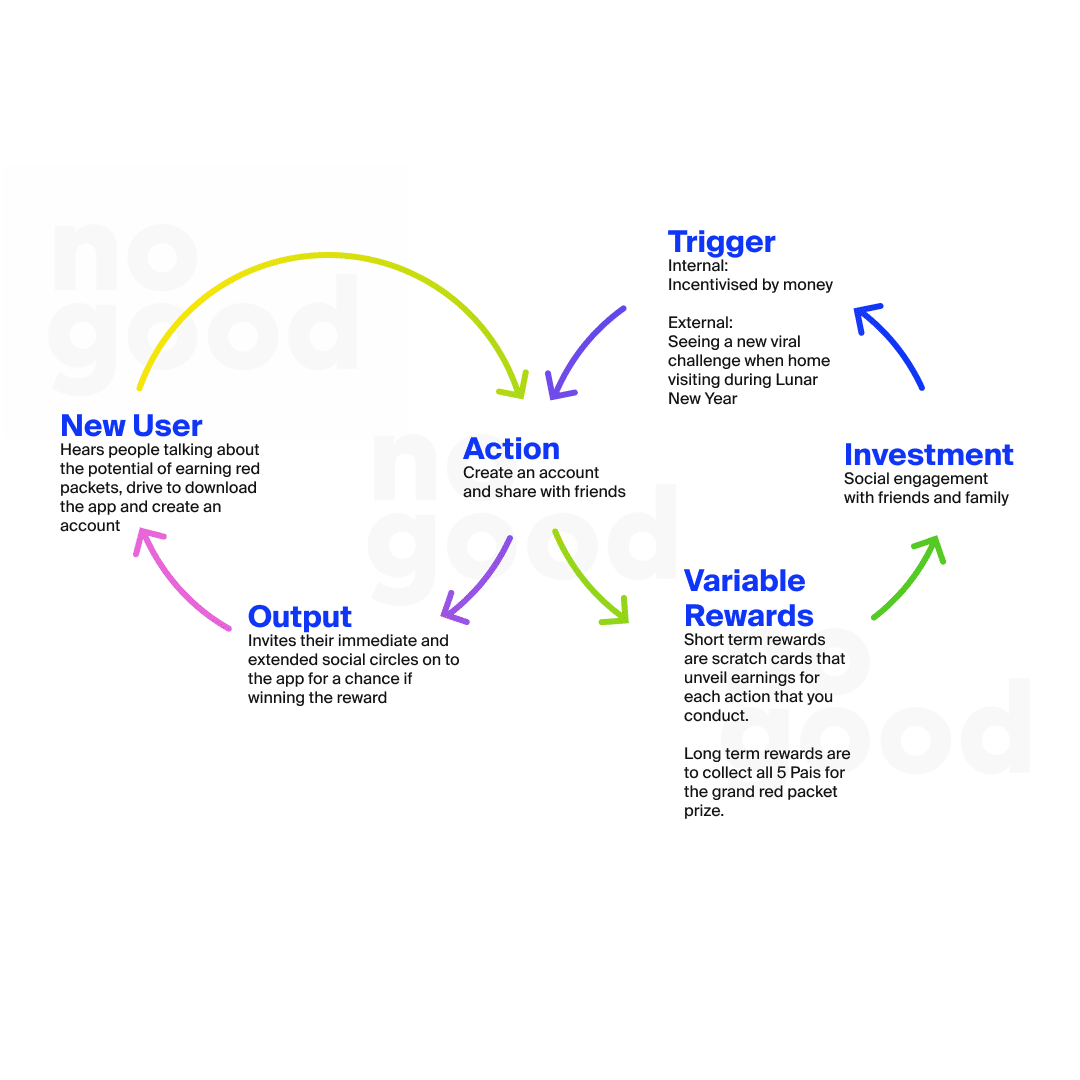

Google introduced ‘Huat Pals’ – a social game built into Google Pay launched during Lunar New Year in Singapore where you can win virtual red packets (angpows) ranging from S$8.88 to S$88.88. By launching their gamified payment campaign during Lunar New Year which is centered around social visiting, Google amped up the focus on the social aspect of the game, creating opportunities for users to reach out to their friends and family by allocating rewards based on the number of times a friend is referred or a transaction happens to/from friends. On top of that, Google not only incentivized working together with your social network as a collective towards the ultimate goal of the red packet prize but also created short-term rewards focused on sharing and multiplying rewards as a collective.

In its simplest form, word of mouth is probably the most simple acquisition loop. You create an amazing product, introduce it to your audience, they love it, and tell their friends about it. What Google did differently from the many other referral campaigns was two things:

- Timing matters – Google hyper-localized their launch campaigns to the local markets by ensuring that the holiday campaign aligned with one of the biggest local holidays in Southeast Asia, where majority of users are typically house hopping, visiting friends and family and gathering over a meal. This supercharged the social aspect of the campaign and gave it the increased potential of going viral as there was an increased frequency and probability of people sharing about the campaign during the holiday period.

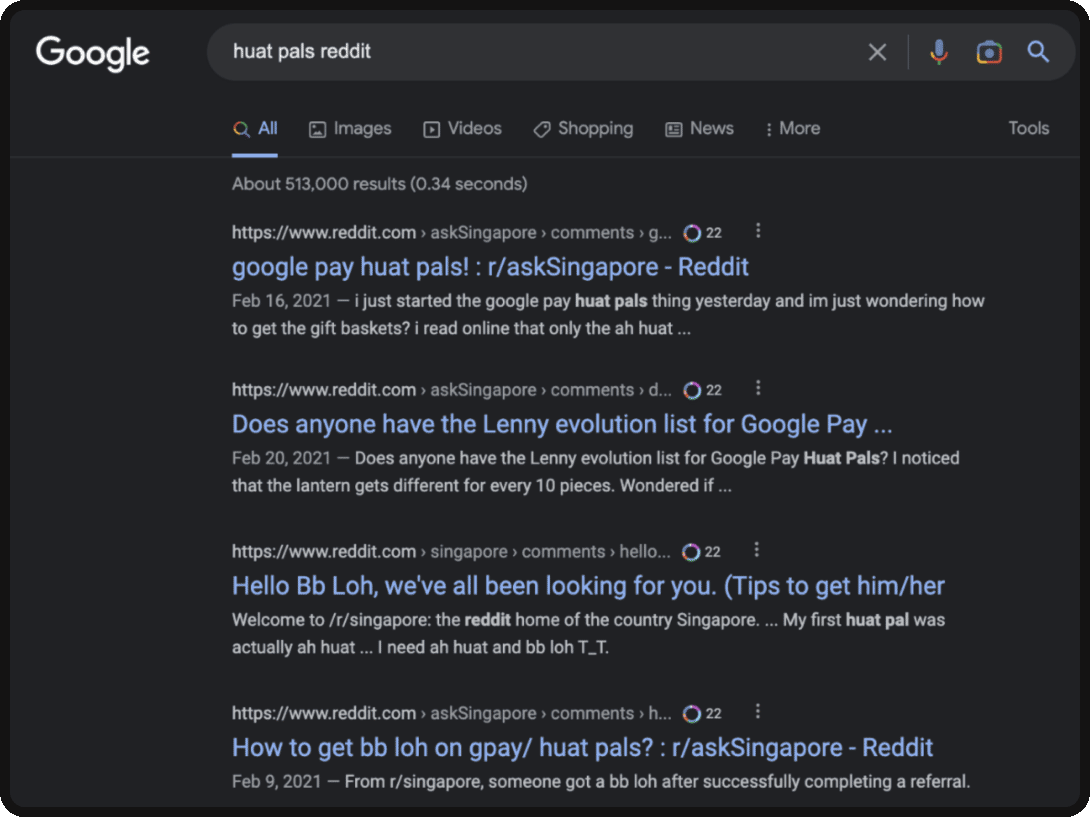

- Gamification of referrals – As Google Pay gained increased market traction in the Southeast Asian markets they were entering, the difficulty of hitting these actions increased with the added requirement of transferring to “unique” friends. This forced users to push beyond the daily comfort of exchanging Huat Pals with their immediate network, only acknowledging transfers to unique friends as eligible to earn one Huat Pal. By taking things a step further and baking advocacy into this process, Google Pay allowed users to encourage other users to sign-up and rewarded them for doing so. Huat Pals became such a huge trend that communities started Reddit threads, scrolled through their list of contacts and even created telegram groups just to reach out to more people in their extended network to onboard them onto the platform.

At its core, Google understood that they would be able to provide positive experiences to a new audience and create advocates to help generate a growth loop of new users for relatively little cost, thus turning current customers into brand advocates. It compounded community growth by launching the campaign at an opportune timing and amassed widespread engagement by giving their users something valuable enough to share. From a growth perspective, this is an incredibly powerful strategy to establish trust with your audience base which in turn builds the habit of use and retention of the app.

2) Influencer Marketing

Strategy: Extend your reach and relevance within your target audience personas by leading with authenticity when choosing the right influencers to partner with.

Influencers have evolved from a good-to-have, experimental part of brand marketing to a ubiquitous force dominating social media marketing with a dedicated budget in most companies’ marketing strategies. The influencer marketing industry grew from $1.7 billion in 2016 to a whopping $16.4B in 2022, with 68% of brands expected to increase their influencer marketing budgets in the next year. This comes with no surprise as financial service providers are switching from a product-centric focus to a more human-centric perspective that offers personalized solutions to a widespread base of consumers. Influencers bring authenticity and trustworthiness to the table which is crucial when it comes to key financial products that users are willing to adopt in their lives.

A prominent trend with influencer marketing is the growing popularity of micro and nano influencers, who have significantly fewer followers than mega or celebrity influencers but have higher engagement rates — meaning a stronger connection and engagement with followers to benefit a brand. In particular, Instagram and TikTok have respectively given rise to an economy of finance micro and nano influencers, often called “finfluencers”, who are key sources for financial education that provide advice and tips on financial literacy or break down significant economic trends. Finance TikTok, also called #Fintok are videos on how to manage money, save, buy crypto and even invest in the latest stocks.

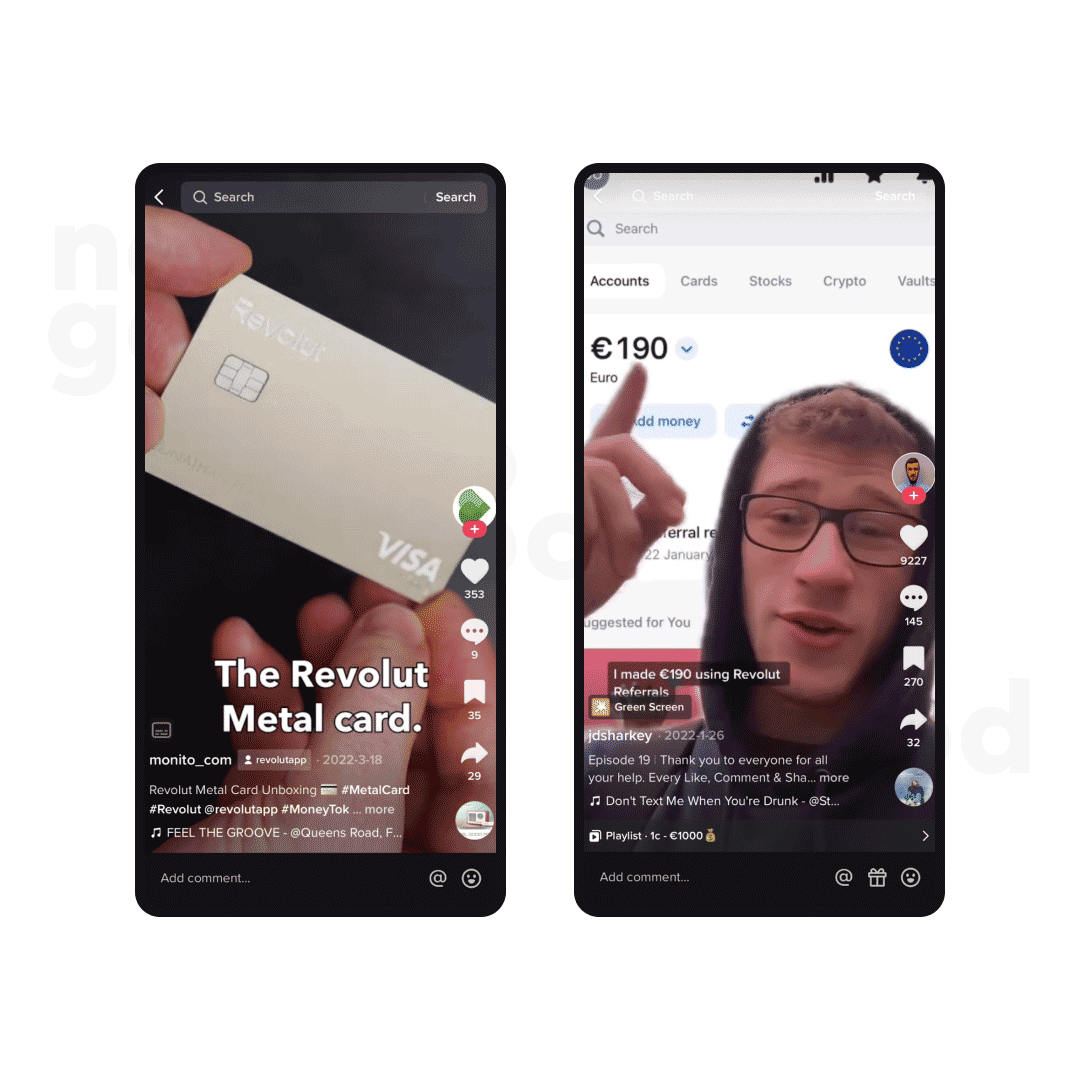

According to a PwC 2019 study, “most consumers place the strength of brand and reputation high on the list of criteria they use to select a business that will support and protect their financial well-being,” indicating that Fintech startups need to focus on building trust and transparency with their global consumers in order to growth their market share. By partnering with the right finfluencers who provide content that is in line with their brand, Fintech startups are able to stretch and effectively leverage their influencer marketing budgets while still working with influencers that are deeply connected to their audiences. A good example is Revolut, a UK-based fintech company that acts as a digital alternative to traditional banking offering a range of digital banking services including worldwide spend and transfer capabilities in real time. Influencers and collaborations are one of the driving elements behind the company’s marketing tactics to add a touch of humanity to their service in order to win the trust of users.

Creative: add phone border

Partnering with micro and nano finfluencers like @jdsharkey and @monito_com helped Revolut access an audience that was already invested in financial topics and naturally thought about saving more money. The format of #Fintok also perfectly fits Revolut’s target audience on TikTok, with a Gen Z-loving participation-based marketing. Considering the alignment in brand, message and by targeting the right audience on the right platform, Revolut’s authentic influencer marketing saw a surge in growth in the 25-34 age demographic and an increased sense of interest and engagement among fans of these influencers.

3) Building Strategic Partnerships

Strategy: Supercharge entry into low-hanging prospective audiences by partnering with the right brands to champion your product.

Collaborating with other businesses or brands related to your niche is another excellent way of getting your message across without having too many overhead costs associated with traditional advertising methods such as TV commercials or print ads. By forming strategic partnerships, Fintech brands benefit from increased credibility amongst potential customers who have a trusted relationship with these partner brands.

In the example of Klarna, a Swedish fintech company that allows customers to pay for many goods in four interest-free installments, building strategic partnerships is one of the driving elements behind the company’s marketing tactics.

Klarna’s list of partners has grown exponentially and already involves over 250,000 merchants worldwide including H&M, IKEA, Samsung, ASOS, Peloton, Nike and AliExpress.The key to Klarna’s success lies in its ability to select strategic partnerships that share similar ideologies as the company when it comes to inspiring customers, prioritizing their needs, and having a loyal following and a wide reach.

In 2021, Klarna struck a partnership with Stripe to fuel growth for retailers worldwide. The partnership redefined the e-commerce experience for Stripe’s global retailers, enabling their online businesses to attract more customers and increase their basket sizes with a seamless shopping experience, while Klarna gained access to Stripe’s extensive global merchant and loyal customer base. “Over the past years, Klarna and Stripe redefined the e-commerce experience for millions of consumers and global retailers,” said Koen Köppen, Chief Technology Officer at Klarna. “Together with Stripe, we will be a true growth partner for our retailers of all sizes, allowing them to maximize their entrepreneurial success through our joint services. By offering convenience, flexibility, and control to even more shoppers, we create a win-win situation for both retailers and consumers alike.” Klarna’s partnership with Stripe as a prominent payments platform was a natural fit for their expansion strategy, allowing them to profit by collaborating with partners who provide access to leading brands and consumers across the globe.

The key takeaway is that with strategic partnerships, there is a huge opportunity for Fintech brands to supercharge growth and reach a new audience by understanding where their target communities interact and engage.

4) Content is King

This is especially true with Fintech since product education is needed to turn a complex and dull concept into something relatable and easily digestible.

Strategy: Generate advocates and drive engagement with content through education.

Content is increasingly having its value recognized – leveraging it at every stage of the marketing lifecycle helps brands create and optimize value-driven, audience-relevant content to attract, retain, and convert target customers for each stage of the growth loop.

Take Robinhood for example. Robinhood is a popular investment platform that allows users to trade stocks, ETFs, and crypto. The aim of Robinhood as a company is to lower the barrier of entry, democratize information and achieve financial empowerment. In line with that, Robinhood launched Robinhood Snacks – a 3-minute digestible newsletter that gives their subscribers a daily dose of Financial news. In this instance, the goal of Robinhood Snacks’ content marketing is to foster loyalty and retention. The bite-sized content format of Snacks that is sent straight to a user’s inbox empowers them to keep up to date on the latest business easily, enabling them to make financial decisions all within one app.

But valuable content is more than just education. It’s also for building trust and driving retention, before users even open your app. Not only does this continued engagement create a long-term relationship between Robinhood and their users, it also helps to position their brand as a knowledgeable industry expert. In 2021, Robinhood even entered into a content partnership with Snap Inc. to bring its Robinhood Snacks to Snapchatters. Episodes averaging three minutes in length and featuring the top financial news stories were made available via Snapchat’s Discover platform, effectively turning their content into an awareness driver as well.

Content marketing is an effective strategy but it is a marathon, not a sprint. It is important to understand the specific goals of your content marketing funnel as well as what formats and channels make the most sense when achieving your goals. Coupled with content strategy and analytics, content marketing enables Fintech brands to meet consumers exactly where they are in their consumer journey, by providing value to address the exact pain points that they may have. If done correctly, brands can even harness education through content marketing, to create informed consumers who then became advocates for the brand

5) Cost-Effective Performance Marketing Tactics in Times of An Economic Downturn

Considering the competitive Fintech landscape and in the wake of emerging new Fintechs, overhead costs from marketing are bound to increase, forcing Fintech brands to look towards cost-effective performance marketing tactics in order to stand out from their competitors.

Strategy: Performance marketing helps increase reach, engagement and conversion of new customers in new markets at a lower cost, lower risk and much higher ROI than any other marketing technique.

Performance marketing is the intersection of paid advertising and brand marketing, wherein advertisers only pay when a specific action is completed, such as a completed lead, sale, booking or download. Performance marketing campaigns are goal-centric and high-velocity experimentation is needed to ensure data-driven decisions are being made to improve marketing performance.

Performance marketing comprises multiple channels, and all of them should be leveraged. When choosing what channels to use to promote your services, you must always have your target audience in mind to see where they are and how they can be reached. Take for example TikTok; on this platform, you’ll probably want to direct your messages to Gen Z and young Millennials given they have the biggest presence. Every channel will have a different expectation, a different audience to be met, so focus on taking advantage of each of the platforms you deem to be the most effective and make sure you’re leveraging them to reach the specific audience you want to target.

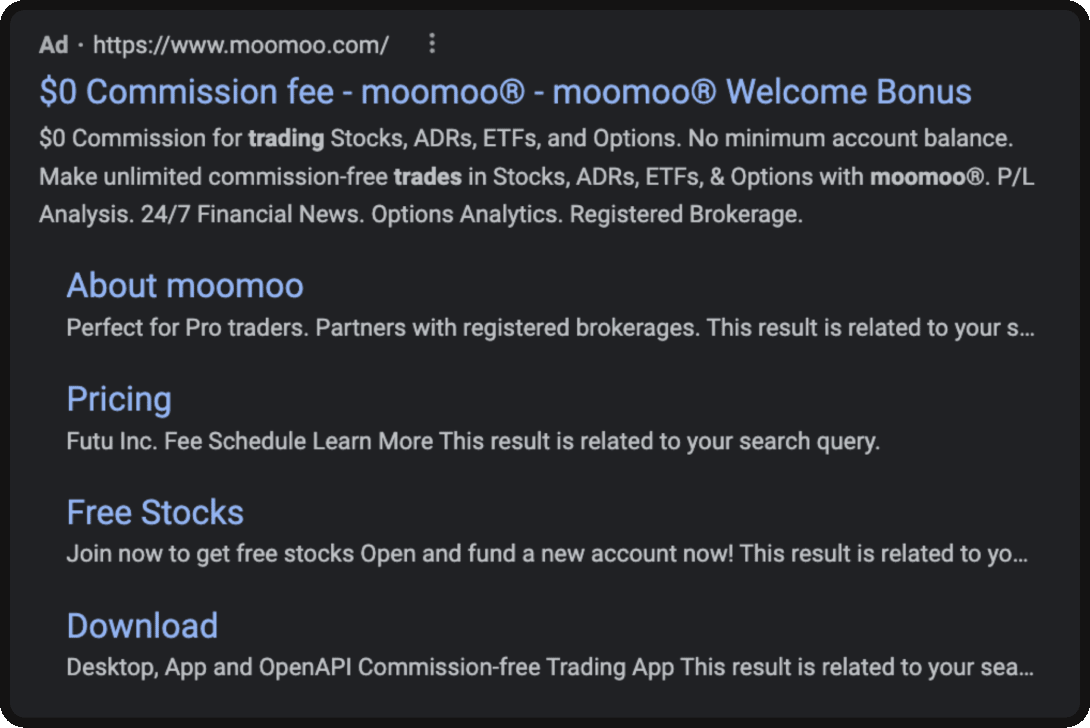

A fintech brand that is doing it right is Moomoo. Moomoo is an online stock broker that has a robust mobile and desktop trading platform offering zero-commission trading for stocks, ETFs, and options.

They’ve invested heavily in search performance ads which appear on the search engine results pages, just above the organic results. Search ads are tailored to the keywords used by searchers, but apart from being labeled as ads, they look very similar to organic search results. Moomoo made sure to utilize search ad extensions with specific eye-catching call-to-actions to not only increase their CTR but also to increase their real estate on the top-fold of the search engine results page.

As we enter 2023, Fintech startup marketing leaders need to be at the forefront of growth marketing as they overcome challenges around branding, trust and education that simply don’t affect marketing leaders in other industries the same way. While these tactics will provide a good foundation to your growth, the other main component is a growth partner that can help scale your Fintech marketing strategies as your company evolves. A growth-focused Fintech start-up should constantly look for new ways to reach their target market as there are an unlimited number of opportunities to increase customer acquisition pace, and validate product and value propositions. These tactics are sure to get you far, though if you ever find you need some help, you know where to find us!