Fintech is one of the fastest-growing tech sectors, with companies innovating in almost every area of finance, from payments and lending to credit scoring and stock trading. Despite the socio-economic challenges posed by the pandemic, investor confidence continues to rise. The global fintech market is expected to grow at a CAGR of 27% during the forecast period.

While developing a great product is the first step to disrupting this industry, in an increasingly saturated market, it’s often a challenge to use the right marketing techniques to make it big — especially when traditional banking companies are finally catching up with new technologies, world-class user experiences, and consumer needs and expectations.

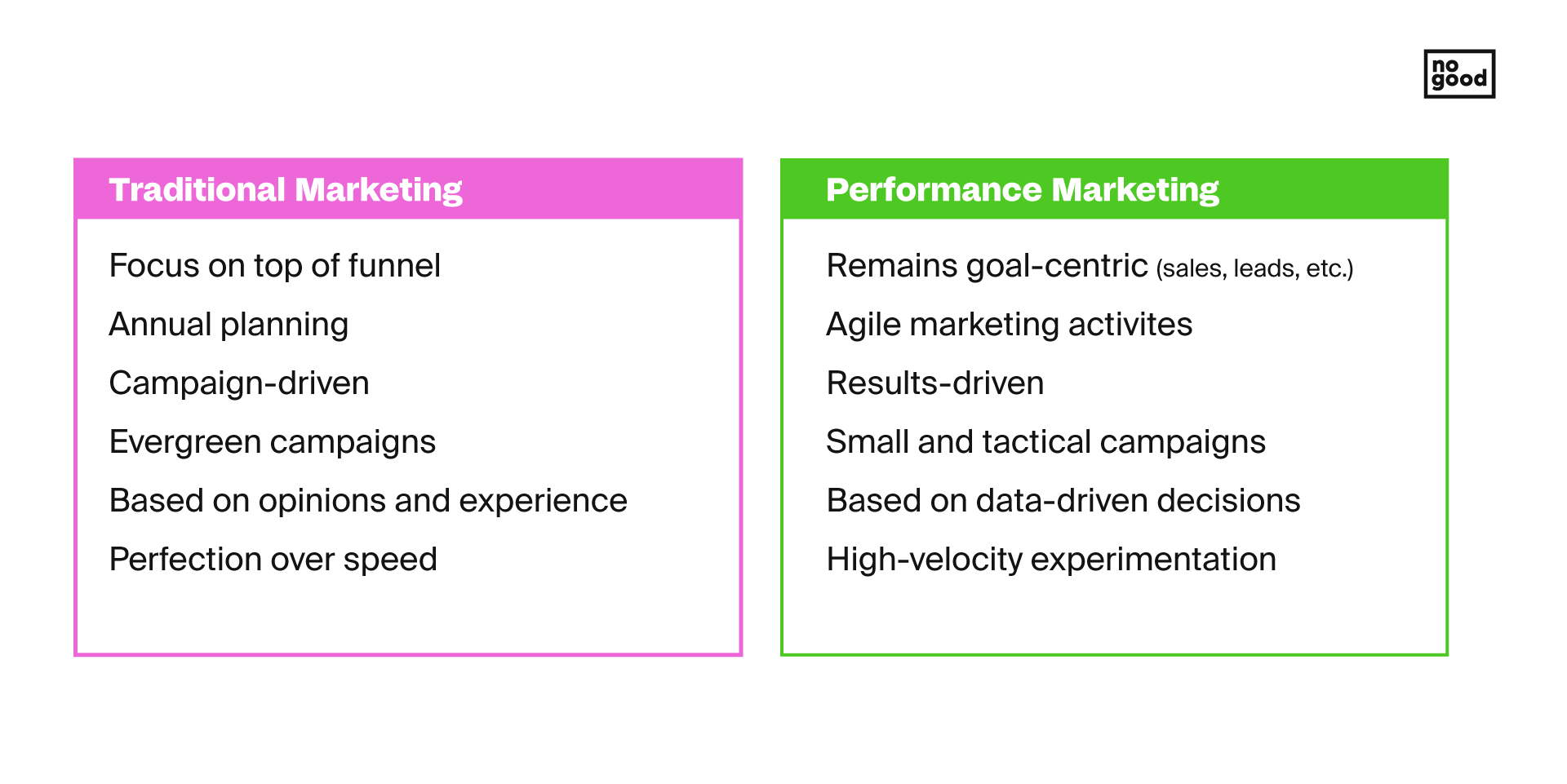

What Is Performance Marketing?

Performance marketing is a broad term for the interplay between paid advertising and brand marketing, where advertisers pay only when a specific action occurs. It’s basically what it sounds like: marketing based on performance. These actions can be a generated lead, a sale, a click, and more. There are many ad platforms and performance agencies that support the larger paid media echo-system.

By paying the affiliate or publisher only when a specific action is taken, the brand can be sure that their money is well spent because they are already converting their audience before they pay for the transaction.

Performance Marketing Challenges For Fintech Startups

Challenge #1: Trust & Transparency

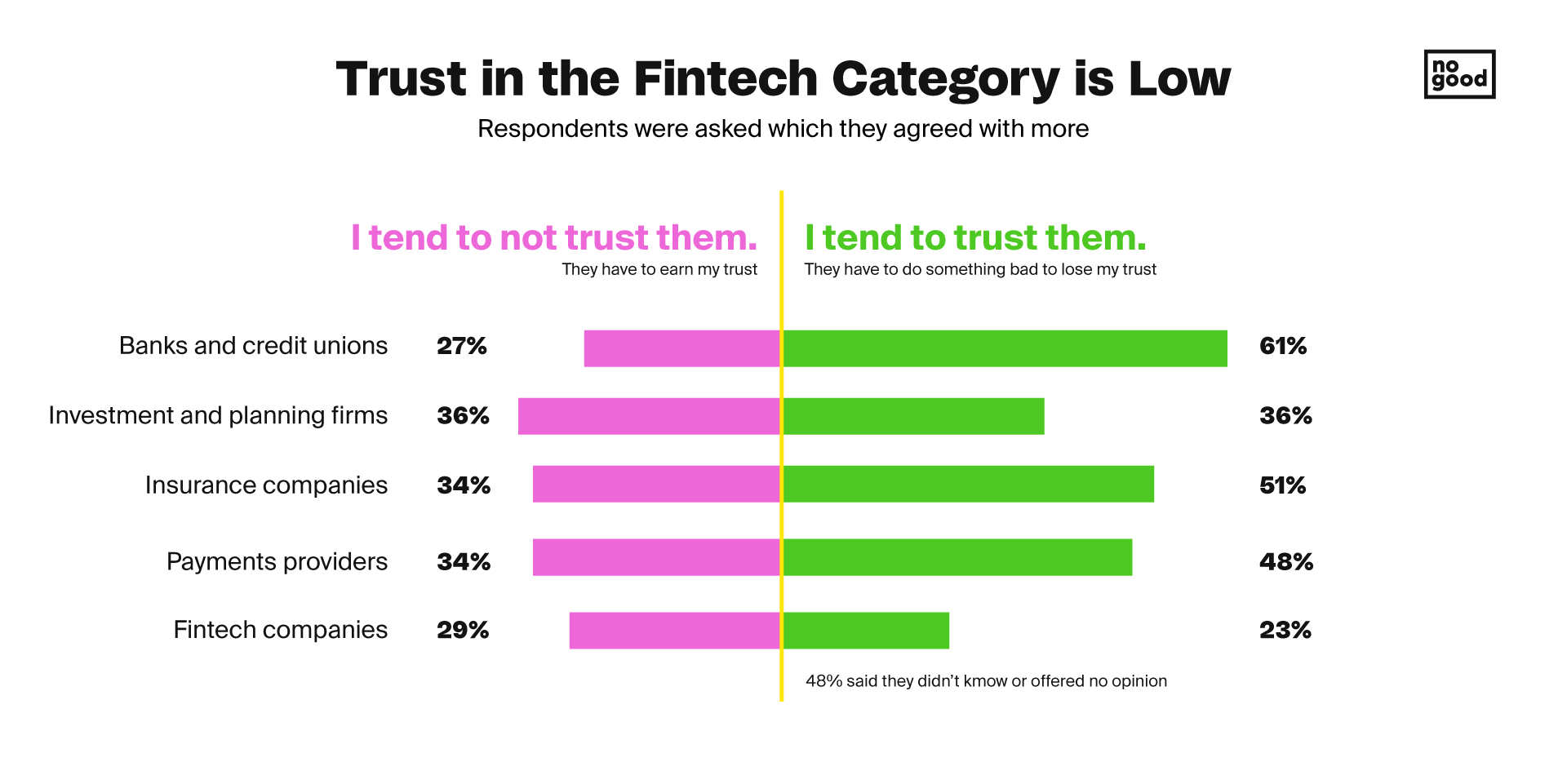

The origins of distrust of financial institutions date back to the Great Depression. The stock market crash became the catalyst for the inherent distrust associated with these institutions, forcing Americans to take out their money from banks they no longer trusted and changing the relationship between financial institutions and the public forever. Fast forward to modern-day in which fintechs are starting to take a stand beside traditional financial institutions, the past distrust in financial institutions, combined with the newness and lack of public knowledge of fintech services, has become a burden for the growth of the latter.

Although creating a unique product that stands out within the industry is the first step towards success, it is often a challenge for brands to market their financial technology due to the lack of trust and transparency that accompanies the financial world. According to the 2021 Edelman Trust Barometer, financial services has been the least trusted industry over the past decade among global consumers. Users generally don’t trust financial institutions as a whole, and they consider fintech companies to be in the same boat.

Given fintechs are new in the financial game and most of them lack a well-known and trusted brand, consumers have been very skeptical about becoming users of these new technologies. According to a PwC 2019 study, “most consumers place strength of brand and reputation high on the list of criteria they use to select a business that will support and protect their financial well-being,” indicating that new entrants of the financial services industry are being refrained from growing market share due to the lack of potential customers willing to test their technology.

Consumers also feel fintechs are not being completely transparent about how they use their data. A survey conducted by The Clearing House in 2021 revealed that 76% of respondents were unaware of fintechs’ ability to sell personal data to other parties for marketing, research, and other purposes, showcasing a growing discomfort expressed by consumers when it comes to fintech data practices. Consumers feel they are left in the dark about how their data is being used, so fintech companies must improve their control over their customer’s financial data and be more candid about it.

Challenge #2: Competition

In recent years, there has been significant growth in the fintech sector with many new startups and companies seeking to become a major presence in the lives of consumers when it comes to handling their finances. This means the fintech sector has become highly competitive, and new fintechs face the challenge of competing against the brands that have had to build their brand’s reputation over the years in an ever-growing market.

For potential customers, it is good to have options to choose from when selecting a fintech brand; however, for fintechs, the rising competition decreases their individual market share and could potentially decrease their customer base if newly emerging competitors position themselves better in the market and in the minds of consumers. In any industry, competition is indeed one of the greatest challenges, but for an industry like fintech that is new in the financial services world, it is even harder to gain the trust of consumers when there are so many different fintechs that can deliver a similar value to their customers.

Moreover, due to the emergence of new fintechs, costs across all performance marketing strategies increase as a direct consequence. This leads to inherently higher CPCs, CPMs, and CPLs, forcing fintech brands to adhere to increases in budget and the growing demand for the cost-effective and easy-to-use financial services that fintechs seek to offer. Fintechs must keep an eye on their competitors, and learn from them, to see how they can improve their services to stand out from the competition.

Challenge #3: Product Adoption & Scale

Although the fintech industry seems to have a promising future, it also poses the challenge of increased exposure to numerous rules and regulations that may hinder the growth of fintech brands. Since the 2008 financial crisis, there has been a drastic increase in regulatory fees regarding earnings and credit losses, making regulatory compliance a major setback for fintech companies trying to compete in this relatively new market. Although they are not subject to a fintech-specific regulatory framework, fintechs may be subject to licensing and registration requirements with federal and state regulators.

Unlike for traditional software companies, these regulatory requirements cause even more financial strains for fintech startups. When it comes to compliance, staffing implications will always be present and they’re a huge resource sink for financial institutions. With that being said, given startups have legal compliance issues to worry about, they will need to hire additional people that will help their business to oversee these regulations, forcing them to account for new labor and spend even more on these new hires.

Mass adoption has become difficult for new entrants in the fintech industry with these imposed regulatory requirements that fintechs may face. According to Reena Agrawal Sahni from Shearman & Sterling, fintechs may be required to get licenses including consumer lending and virtual currency licenses at a state level as well as to follow the Consumer Financial Protection Bureau’s wide range of consumer protection laws that apply to all financial institutions at a federal level. This is why compliance has become a burden for the growth of fintech startups in the country.

Not only is regulation a challenge to fintech product adoption and scale but the fact that these services and platforms are still in their infancy is. Society is still getting used to the new available technologies that allow them to make use of their money through technology that seeks to enhance and automate their current financial processes. With the emergence of the internet and the use of mobile devices, consumers have slowly began to shift their financial habits to the digital world; however, due to fintech services being a relatively new phenomenon, as well as the lack of trust for these platforms that accompanies such, it may be difficult to reach mass adoption from the very beginning, so fintech must develop marketing strategies that raise awareness of their products and services to build their brand equity and reputation in the industry.

How can performance marketing support fintech startups

Organic growth and development is the key to the future success of fintechs. Through original creative innovations, the development of a targeted audience, and the appreciation and use of multiple communication channels, fintechs can scale quickly and find dominance within the industry. With that in mind, to solve the challenges mentioned in the previous section, it is imperative to incorporate a performance marketing strategy that focuses on the following areas to boost your startup organically:

Creativity

One of the most important aspects of your performance marketing strategy is the creativity that is set forth. Creativity in marketing is what makes you stand out from the competition and can elevate your business and services through innate originality. Authenticity through your content, copywriting, and campaign structures will attract your audience both visually and emotionally. Present yourself and your fintech brand to your audience in a unique way and be honest and transparent about what you have to offer. Don’t overpromise and underdeliver.

Audience Development

When it comes to selecting your target audience, you must make sure you understand the ideal personas, audience groups, and markets your service or product aims to support. By focusing on marketing a product that talks to a specific niche, your messages will be made loud and clear to the right audience, one that could potentially lead to conversions and user acquisition. Developing your audience should be more than just targeting your marketing efforts to specific people, it should aim to build a community around your brand and its services to further grow your reputation and trust more effectively.

Channel Diversity

Don’t put all your eggs in one basket. Performance marketing comprises multiple channels, and all of them should be leveraged. When choosing what channels to use to promote your services, you must always have your target audience in mind to see where they are and how they can be reached. Take for example TikTok; on this platform, you’ll probably want to direct your messages to Gen Z and young Millennials given they have the biggest presence. Every channel will have a different expectation, a different audience to be met, so focus on taking advantage of each of the platforms you deem to be the most effective and make sure you’re leveraging them to reach the specific audience you want to target.

Performance Marketing Channels & Strategies

Social Media Marketing

Fintechs are using social media to tell their stories, connect with customers and leverage their influence. Long-established brands like TD Bank, American Express, and Visa, as well as newcomers like Merlin Investor and Public App, are using creative social media strategies. As economies evolve into cashless societies and banking transactions go mobile, there is no better way to market the experience than through social media.

Depending on your audience and the channels your brand uses, you can have a lot of fun with social media in finance. Some social media channels to consider (if you haven’t done yet) are the following:

It is an incredibly popular social network for financial services. Through this channel, you can reach key decision-makers, including high-level influencers, small business owners, wealthy masses, financial opinion leaders, and affluent Millennials.

However, it is important to note that being attractive to your audience on LinkedIn requires you to show your expertise and authoritativeness in your particular niche to establish yourself as a trustworthy and credible company to them. On your profile, you must create content that would appeal to venture capitalists, founders, and prominent figures in the fintech space through comments, likes, and potentially reposts of content you deem pertinent to what your audience is looking for.

By setting your LinkedIn profile as the engaging, educational, and relevant source for your fintech brand, you’ll never have to worry about building a community of professionals who trusts the content you put out and your expertise in your particular fintech sector. Having a strong presence on LinkedIn will set you apart from the competition, allowing you to market yourself as the expert through a diverse selection of content and hence giving recognition and dominance to your fintech startup that will scale your business and potentially lead to the mass adoption of your service.

TikTok

It is a channel for bite-sized learning and life skills acquisition. As the older half of Generation Z grows up and enters the workforce, they become interested in personal finance, bank loans, and even investments. The amount of financial content on TikTok has skyrocketed, and fintech brands are also getting in on the action. There are also more and more “financial influencers,” those who focus on personal finance, money management, or investment topics.

TikTok can be used for your business in many ways, especially when trying to target a specific niche and to stand out among your competitors. The platform recently created TikTok for Business, an all-in-one tool for marketers to advertise their products and services on TikTok by creating ads, setting budgets, and most importantly, finding a diverse and targeted audience for a reasonable price. TikTok is the fastest growing social media channel, so you will indeed get an unprecedented amount of eyeballs if you create campaigns on this platform.

What marketers need to understand the most is that TikTok is the place to be your authentic self, not just the expert in your particular field nor the advertiser wanting to promote their product. People use this platform because its users are organic and natural, which consequently builds trust between users and creators through the content they create. With this said, leverage TikTok to build a community of trusted users and create content that they find not only educational and informative but also entertaining.

According to statistics from Sprout Social, 71% of US companies use this channel. For fintech brands, it’s a handy tool to show how personable they are and offers much more flexibility and storytelling opportunities. Instagram is more than just a photo and video sharing platform; it is a place where you can engage with your audience on a personal level and even promote signups and capture emails for organic outreach.

Having one of the highest average engagement rates compared to all the main social media platforms, Instagram is the place to engage with your community; users are even more open to seeing branded content on this platform than on any other. With creative content that teaches your specific audience about your expertise, the services you offer, and engaging through real ー not automated ー comments and direct messages with your audience, you’ll start building the trust fintech consumers seem to lack for the industry.

By promoting your brand through visually appealing content in the form of photos, videos, or Instagram Reels, you’ll start raising awareness about your brand in the fintech sphere and will hence begin to differentiate yourself from your competitors through your unique branding and marketing efforts. Take the example of Coinbase who not only seeks to promote their services online but encourages its audiences to learn more about cryptocurrencies and educate themselves on this topic. Its content is both aesthetically pleasing and educational, appealing to their audiences in a way that incentivizes them to continue consuming its content.

Instagram gives fintechs the opportunity to position themselves in the minds of consumers exactly as they want to, all through the creation of content that not only visually represents the brand itself and attracts its audience, but one through which they can encourage the use of their product or service to achieve mass adoption and acquisition.

Reddit is basically the comment section for anything you can possibly talk about; it is where users share their thoughts and opinions on any topic they desire. Reddit is especially popular with Generation Z and Millenials, which fits well with emerging traders and investors in the fintech space.

Getting more than 500 million visitors per month, Reddit is not the typical platform to advertise on; however, it is where the majority of people tend to look for answers and join conversations on what they’re interested in. So, if you want to integrate Reddit into your strategy, although it might seem contradictory to say this, don’t sell on Reddit immediately. Contribute to your particular niche first and interact with others in conversations specific to such to build trust around the people you engage with.

When you are more comfortable with the platform and realize you have garnered a strong presence within your community, you can start your own subreddit and use the space to educate users about your product or create opportunities for organic feedback and customer service.Having this trust and visibility will allow you to promote your brand in a way that feels native to the platform, rather than looking like a fake “Redditor”, as users call themselves, when doing so. Being part of the conversation will allow you to learn more about your niche and further position yourself exactly as you should for your audience to stand out among the competition. This will ultimately build confidence within your audience to use your services and scale your business in no time.

Given the changing landscape of services and regulations that govern the fintech industry, Twitter plays a critical role in how companies inform the press, consumers, and investors about changes they are implementing on their platforms. Twitter is an ideal channel for keeping up with (and leading) developments in the industry, and it’s essential to a solid communications strategy.

On Twitter, users follow brands that they can identify with and relate to, which is why this platform is an effective one for fintech brands to establish a relationship with and build trust among their current and potential consumers easily. By tweeting about your company’s expertise, knowledge, and experiences, you’re building a profile that showcases your brand as the go-to source for information related to your niche. Fintech brands can leverage this platform to be perceived as trustworthy experts who not only stand out from their competitors, but are constantly engaging with their customers by tweeting, replying to tweets, and reposting relevant, informative content.

One thing to keep in mind while using Twitter is that you must define your brand voice and personality with your tweets to establish credibility and a major presence in the platform. This will allow you to differentiate yourself from competitors and can be done in a creative manner that will make your audience want to learn more about your brand and what you’ve got to say. Building trust and rising among the competition may be challenging on Twitter if you don’t establish a brand voice that speaks to your brand identity and expertise, so take advantage of this platform and define how you want your fintech brand to be recognized by your followers.

Advantages of Social Media Marketing:

- Humanize your brand

- Increase trust and brand recognition

- Boost levels of customer service and satisfaction

- Improve brand loyalty

Influencer Marketing (including Affiliate Marketing & Sponsored Content)

Influencer marketing is growing fast and furiously among fintech brands. From sponsored Instagram ads to blog posts to YouTube videos and everything in between, influencers are dramatically affecting buying behavior. A large number of videos on social media sites are created by influencers. An impressive 56% of all Internet users watch videos on social media sites.

What makes influencer marketing so valuable is that it allows brands to connect even more with their audiences by exposing them to niche-relevant personas. Influencers have built their own social media presence by posting content that relates to their audiences and builds community around them. This type of community and relationship between influencers and their audiences develops trust between them, and if fintech brands collaborate with reputable influencers in the industry, this trust can pass along to the brand itself.

Having influencers as part of your strategy could potentially help your fintech stand out among your competitors as well as audiences tend to associate influencers’ personalities with the brands they partner with. Influencer marketing doesn’t necessarily have to consist of partnering with an influencer, but it could also be in the form of affiliate marketing and sponsorships. The positive associations that influencers and established publishers and brands can in turn lead to even higher recognition for the brand and more trust and transparency between the brand and its customers given they are partnering with trusted entities.

Influencer marketing can be significant in the performance marketing strategy of your brand, so take advantage of the trust your consumers have for these personalities and leverage them to earn the trust of your audience when it comes to deciding whether to use your fintech service or not.

Affiliate Marketing

When choosing to affiliate with established and reputable publishers, you’re setting your fintech brand for success as the trust that consumers have for the latter tends to be inherited by its affiliating company. However, it is important to make sure that the affiliated brand has a history of trustworthiness and authority in your specific industry so that consumers looking for brands like yours can easily identify your product and associate it with the trusted affiliate.

Not only will this lead to bigger trust in your fintech brand but it will also make you more visible among your competitors. Forming an alliance with a well respected publisher or any other source will further increase your chances of standing out to your audience. Before doing so, look at the potential affiliate’s traffic, mentions, popularity on social media, and whether or not they’ve established a loyal audience to make sure this partnership will prove beneficial for your fintech. This will ultimately lead your fintech brand to scale and be recognized, and hence will lead to the mass adoption of your product if done right.

Sponsored Content

This type of performance marketing is mostly used by influencers and content websites and involves a special post or article that promotes a brand and/or product in exchange for some compensation. Sponsored content is a type of promotional media that is paid for by an advertiser but created and distributed by another brand, influencer, or publisher. Sometimes the compensation is in the form of a free product or experience; in other cases, it is CPA-, CPM – or CPC-based. A study by Time Inc. found that 2 in 3 Generation Z, Millennials and Generation X consumers consider sponsored content to be more sincere than traditional advertising, so fintech brands must leverage this type of marketing to build trust with their audiences and hence reach mass adoption of their products and services.

By creating content that is relevant for consumers and focusing on delivering value and not promotion only, fintech brands can build brand trust among their consumers. Sponsored content doesn’t necessarily have to be in-the-face advertising where the advertisers just plug in the brand into their content, but rather could be content that feels natural and conveys the value and benefits your product has to offer to your audiences seamlessly.

Having your brand be sponsored by well-known brands and influencers will allow you to reach new audiences and establish rapport between your brand and your current customers. The reputation these sponsors have can boost your brand’s resonance and reputation, so using sponsored content can lead to higher trust and engagement and even wider product adoption.

Advantages of Influencer Marketing:

- Boost awareness, credibility and higher engagement

- Reach Millenials and GenZs

- Support community and charitable causes

- Pay for performance

- Hyper-growth

- Recognition of thought leaders

- Sponsored content leads to sales

- Consumers trust sponsored content more than traditional ads

Native Advertising

Native advertising is the process of creating ads that match the surrounding content in form and function. Promoted social media posts, for example, are native ads, as is sponsored recommended content at the end of articles or blogs. Native advertising can result in 9% higher CTR and 18% higher purchase intent than traditional display ads.

This type of advertising allows you to promote your services in a way that doesn’t feel invasive for your audience. Placing sponsored content as a native ad under Instagram, TikTok or even an article, for example, will not only expose your audience to your services in a subtle manner, but it shows your consumers that you are prioritizing their online experience, which could ultimately lead to the cultivation of a relationship. Building relationships is key to building trust, so listen to your audiences and create native content, such as in the form of user-generated content, that they actually want to see and avoid any level of deceit.

According to Diana Adjadj from The Next Ad, “honesty and transparency will take you far in native advertising,” so take advantage of this type of content and remember that your fintech product or service shouldn’t always be the main focus. Make sure the content of your ads is relevant to your niche and delivers on the promises it makes, and this will help your brand grow through attaining credibility and trust.

Advantages of Native Advertising:

- Grab the attention of your audience

- Optimize targeting opportunities

- Increase the performance of your campaign

- Build trust with your target audience

Fintech Brands That Are Doing It Right

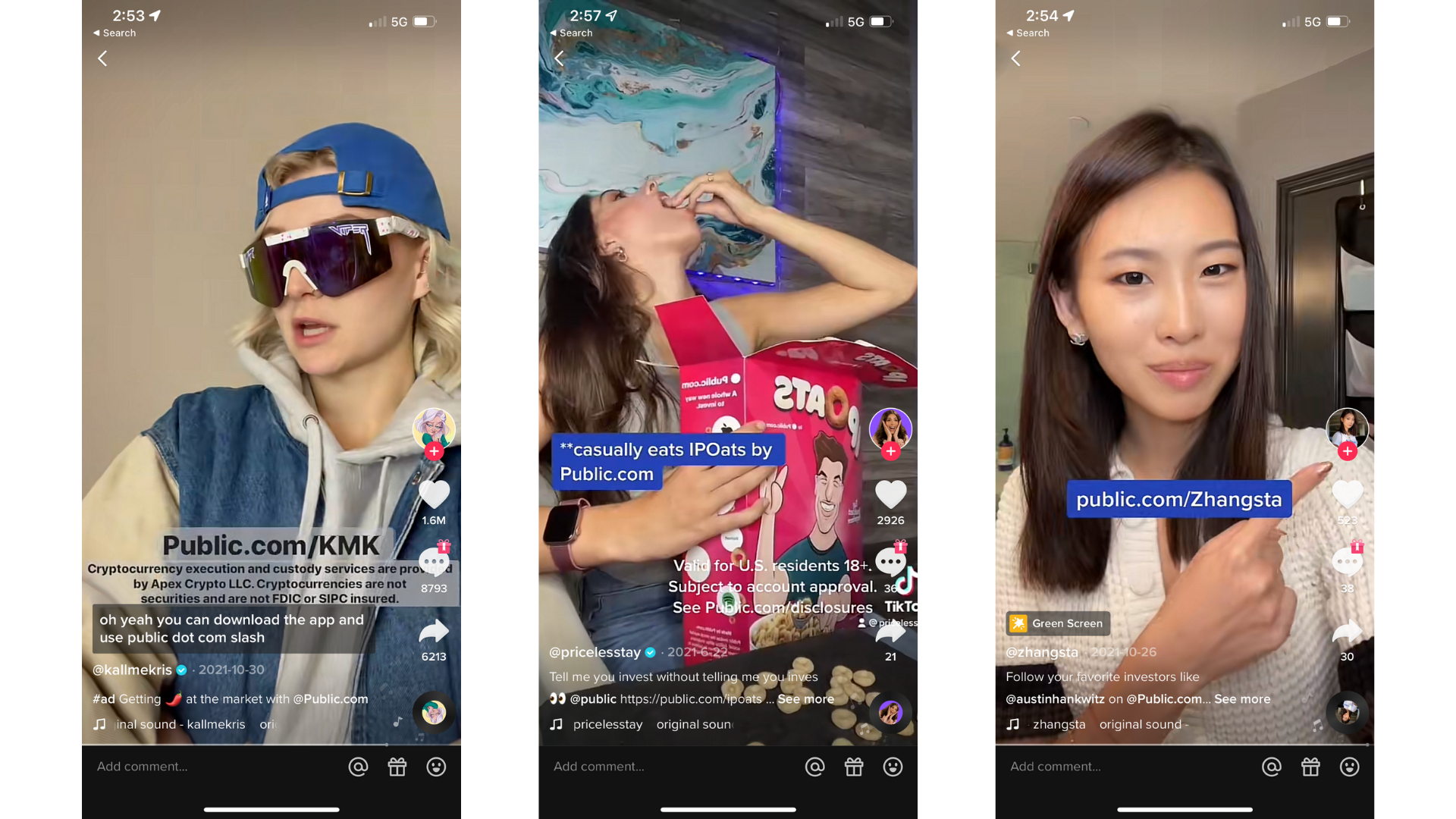

1. Public.com

Public makes the stock market social. With the ability to invest in “equity slices,” people of all ages (adults 18 and older) and backgrounds have easier access to investing, can own a portion of the companies they believe in, and learn from their peers through social shares and messaging.

Public uses performance marketing in the form of sponsored content. This channel mainly uses influencers. In the example above, influencers have published sponsored TikTok content that Public promotes in exchange for (probably) payment. Payment can be in the form of free products, services, experiences, cost-per-click, and more.

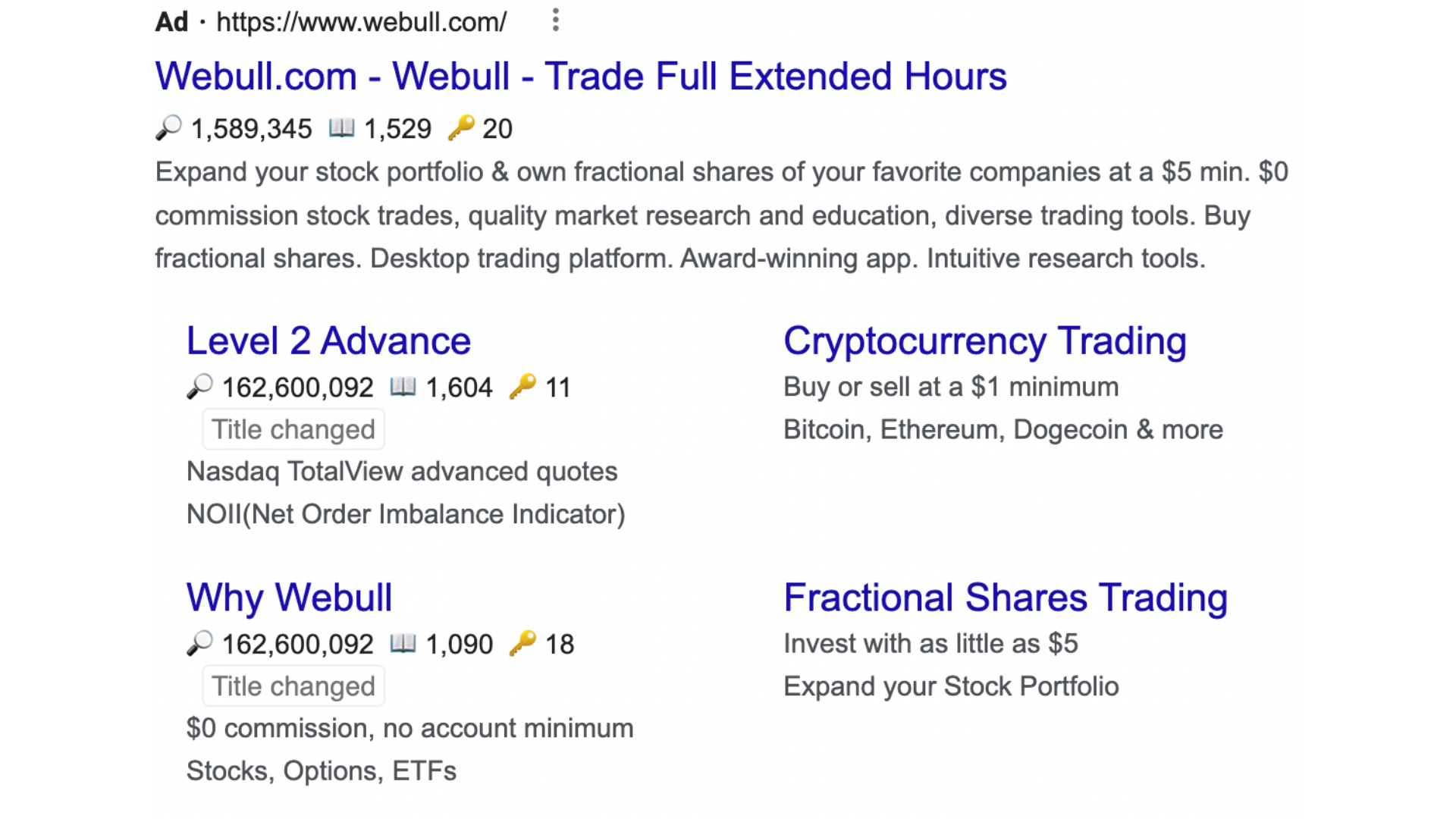

2. Webull

Webull is a mobile-first brokerage platform that offers a unique, community-focused experience. The business makes money by lending investors’ shares to short sellers, who then sell those borrowed shares to third-party investors in hopes of buying them back later at a lower price.

Performance ads also appear on the search engine results pages, just above the organic results. They are tailored to the keywords used by searchers, and apart from being labeled as ads, they look very similar to the organic search results.

3. Robinhood

Robinhood is a financial services company whose mission is to “democratise finance for all” by offering commission-free trading in individual companies, options and ETFs. The company also offers cash management accounts and cryptocurrency trading.

In a survey conducted by Hootsuite, 73% of all marketers cited “increased acquisition of new customers” as their top outcome for social media. Robinhood does this well by posting and advertising engaging content on social media. In this case, performance marketing is used to drive conversions and leads through actionable features.

4. Merlin Investor

Merlin Investor is an investment strategy platform that is changing the way retail investors trade. With the ability to create customised investment strategies, import 360° of their assets, and create custom dashboards, users can track their assets in real time and take a more informed approach to investing.

Here’s a screenshot of a native ad on the Twitter news feed. Chances are you would click through without thinking of it as an ad because of how it blends in with the rest of the page content.

In conclusion, performance marketing is a growing marketing strategy for fintech brands. Performance marketing requires marketers to track and measure hundreds or thousands of data points, if not millions and billions of data points. AI reduces the complexity of these data points and helps seamlessly scale efficient optimization through machine learning. Trends show continued investment in the channel, from new players entering the space to new technologies being invested to optimize outcomes better, faster, and cheaper.