Netflix, the renowned streaming service, is taking a significant step in its business strategy by introducing ad-supported subscription options. This change is designed to offer more flexibility in subscription choices, expand the audience base, and diversify revenue streams. Let’s explore the implications of these new ad-supported tiers and how they fit into Netflix’s broader market strategy.

Here’s what we’ll cover:

- Understanding Netflix’s Strategic Shift

- Key Drivers Behind the Introduction of Ad-Supported Plans

- Netflix’s Market Positioning

- Can We Still Watch Ad-Free?

- Future Directions for Netflix

- Embracing Strategic Evolution

Understanding Netflix’s Strategic Shift

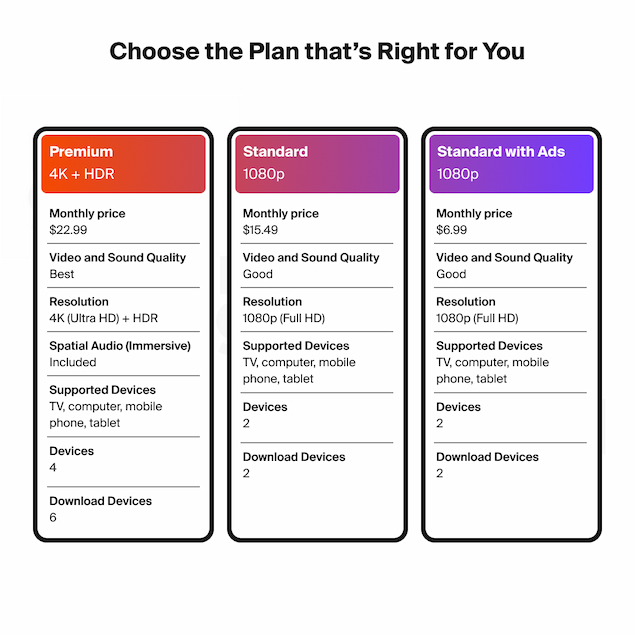

Netflix has introduced a new $6.99-per-month ad-supported plan, providing an affordable entry point alongside its traditional ad-free episodes. This move is part of a broader strategy to accommodate the diverse preferences of its active users and compete with other ad-supported streaming platforms like ad-supported Hulu.

Key Drivers Behind the Introduction of Ad-Supported Plans

Market Differentiation: By launching an ad-supported Netflix plan, the company differentiates itself in a crowded market, appealing to price-sensitive consumers.

Revenue Diversification: Facing the need to diversify revenue beyond its traditional subscription models, this shift allows Netflix to tap into advertising dollars, supported by third-party billing partners and advertising tiers.

Market Expansion: The ad-supported tier aims to capture a larger share of the market, particularly targeting mobile devices, which are used for media consumption.

Enhanced Data Insights: Partnering with firms like Integral Ad Science, Netflix can leverage behavioral advertising to gain deeper insights into viewer preferences, enhancing content personalization and advertising effectiveness.

Analyzing the Pros and Cons

Pros:

Increased Accessibility: The cheaper ad-supported plans make Netflix accessible to a broader audience, potentially increasing ad-supported memberships.

Financial Flexibility: This model opens up new streams of income from both subscription fees and advertising, providing financial content that is robust against market shifts.

Richer Data for Targeting: Collecting data on ad-supported subscribers helps Netflix refine its content offerings and advertising strategies, fostering a more personalized user experience.

Cons:

Potential User Disruption: Ads could disrupt the viewing experience, especially for those accustomed to an uninterrupted service, leading to frustration and dissatisfaction among subscribers.

Price Perception Issues: The introduction of a cheaper ad-supported plan option may lead existing subscribers to question the value of higher-priced ad-free tiers, potentially resulting in churn or revenue loss.

Brand Image Concerns: As Netflix deviates from its traditional all ad-free model, there is a risk that its brand perception as a premium provider could be diluted, impacting its long-term competitiveness in the market.

Netflix’s Market Positioning

With these new plans, Netflix addresses market competition and internal growth metrics. As Greg Peters, a key executive at Netflix, and experts like Ross Benes from Insider Intelligence suggest, the strategy responds to direct competition. It aligns with evolving consumer behavior trends toward more personalized and affordable viewing options.

Netflix’s Market Positioning and Competition

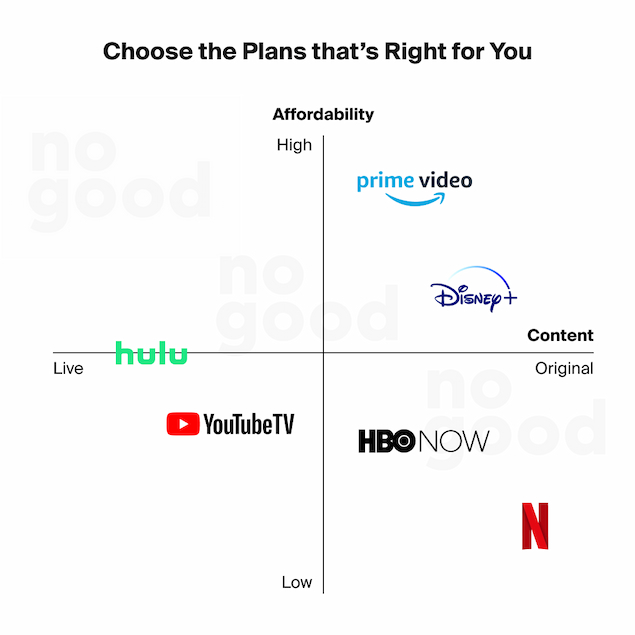

In the streaming industry, Netflix is a titan, but it’s not immune to competition’s pressures. As it ventures into ad-supported subscription options, it becomes crucial to understand its positioning relative to key competitors like Hulu, Disney+, HBO Max, and Amazon Prime Video.

Netflix vs. Hulu:

Hulu, a long-standing competitor, has offered ad-supported plans for years, positioning itself as a more affordable alternative to cable TV. With its extensive library of current TV shows and exclusive partnerships, Hulu has carved out a niche among viewers who value timely access to network content and a mix of on-demand and live programming. While Netflix has traditionally focused on original content, Hulu’s strategic partnerships with major networks like ABC, NBC, and FOX give it a unique edge in providing a comprehensive streaming experience. However, Netflix’s vast library of original content and global reach still make it a formidable competitor, especially as it now enters the ad-supported market.

Netflix vs. Disney+:

Disney+, launched in late 2019, quickly emerged as a major player in the streaming industry, leveraging its unparalleled catalog of beloved franchises like Marvel, Star Wars, Pixar, and Disney classics. Despite initially focusing on ad-free streaming, Disney recently introduced an ad-supported tier for its Hulu platform, aiming to capture a broader audience segment. While Disney+ remains ad-free for now, its competitive pricing and compelling content library pose a significant threat to Netflix, particularly in the family entertainment space.

Netflix vs. HBO Max:

HBO Max, launched by WarnerMedia, combines the vast HBO library with exclusive original content and a broad range of Warner Bros. films and TV shows. While HBO Max has yet to introduce ad-supported options, its premium content offerings and high-quality productions appeal to a different segment of viewers seeking premium, ad-free experiences. However, with the recent merger between WarnerMedia and Discovery, there may be strategic shifts in the future, potentially impacting HBO Max’s competitive positioning vis-à-vis Netflix.

Netflix vs. Amazon Prime Video:

Amazon Prime Video, bundled with Amazon Prime’s subscription service, boasts a diverse library of movies, TV shows, and original content. While Amazon Prime Video does offer ad-supported channels through Prime Video Channels, its core streaming service remains ad-free. However, Amazon’s vast ecosystem, including Prime delivery benefits and other Prime-exclusive perks, presents a unique value proposition that competes with Netflix on multiple fronts, particularly regarding customer retention and engagement.

Netflix’s Competitive Edge:

Despite facing formidable competition, Netflix maintains several key advantages. Its extensive library of original content, global brand recognition, and robust recommendation algorithms continue to drive subscriber growth and engagement. Additionally, Netflix’s proactive approach to innovation, as evidenced by its foray into ad-supported subscriptions, demonstrates its willingness to adapt to changing market dynamics and consumer preferences.

As Netflix navigates the increasingly crowded streaming landscape, its ability to differentiate itself through compelling content, innovative business models, and strategic partnerships will determine its long-term success in an ever-evolving industry.

Can We Still Watch Ad-Free?

For those who prioritize an ad-free experience, Netflix’s ad-free subscription plans remain the go-to option. While the newly introduced ad-supported plans offer affordability, they come with the trade-off of occasional ad interruptions. However, if you’re willing to pay a premium for seamless viewing, the Standard and Premium plans ensure an uninterrupted entertainment experience.

Introducing ad-supported subscription plans represents a significant shift in Netflix’s pricing strategy. While the newly introduced ad-supported plans offer a more affordable entry point for budget-conscious consumers, it’s important to note that the ad-free Standard and Premium plans are still available.

Moreover, the impact of ad interruptions on user experience cannot be overlooked. While ad-supported plans may attract new subscribers with their lower price point, the trade-off of ad interruptions may diminish overall satisfaction among users accustomed to the seamless ad-free experience. This could tarnish Netflix’s reputation as a premium streaming service and erode consumer trust and loyalty.

Future Directions for Netflix

As Netflix moves forward with its ad-supported offerings, the company faces both opportunities and challenges:

Balancing Ad Load and Viewer Satisfaction: Finding the optimal balance between ad frequency and viewer engagement will be key. Too many ads could alienate viewers, while too few might not generate sufficient revenue.

Ad Targeting and Privacy Concerns: With increased capabilities for data collection, Netflix must navigate the complex terrain of consumer privacy expectations and regulatory requirements, ensuring that data usage complies with global standards.

Global Market Variability: Different markets may respond differently to ad-supported models. Tailoring strategies to fit regional preferences and economic conditions will be crucial for global growth.

Netflix will need to innovate continuously, not only in content creation but also in its advertising approach, to ensure that both subscribers and advertisers see value in the platform.

Embracing Strategic Evolution

Netflix’s shift towards an ad-supported model signifies a major evolution in its business approach, reflecting broader industry trends towards mixed revenue streams. This transition is not just about adapting to competition or market pressures; it’s about seizing new opportunities to deliver value.

Key aspects of this strategic evolution include:

Innovative Advertising Solutions: Developing non-intrusive and engaging advertising formats that enhance, rather than detract from, the viewer experience.

Strategic Partnerships: Aligning with technology partners and advertisers who can bring additional value to Netflix’s offerings, such as through exclusive content or targeted advertising.

Sustainability and Growth: Ensuring that the ad-supported model contributes to long-term sustainability and growth, helping Netflix to fund more original content and expand into new markets.

Netflix’s proactive approach in adjusting its business model to the changing media landscape demonstrates a commitment to innovation and customer satisfaction. As the company continues to explore this new terrain, it will be imperative to maintain the quality and integrity of the viewing experience, ensuring that Netflix remains a top choice for consumers worldwide.