Meta’s recent changes to Facebook and Instagram mark the end of the “social network“ era as we know it.

Consumption > Connection

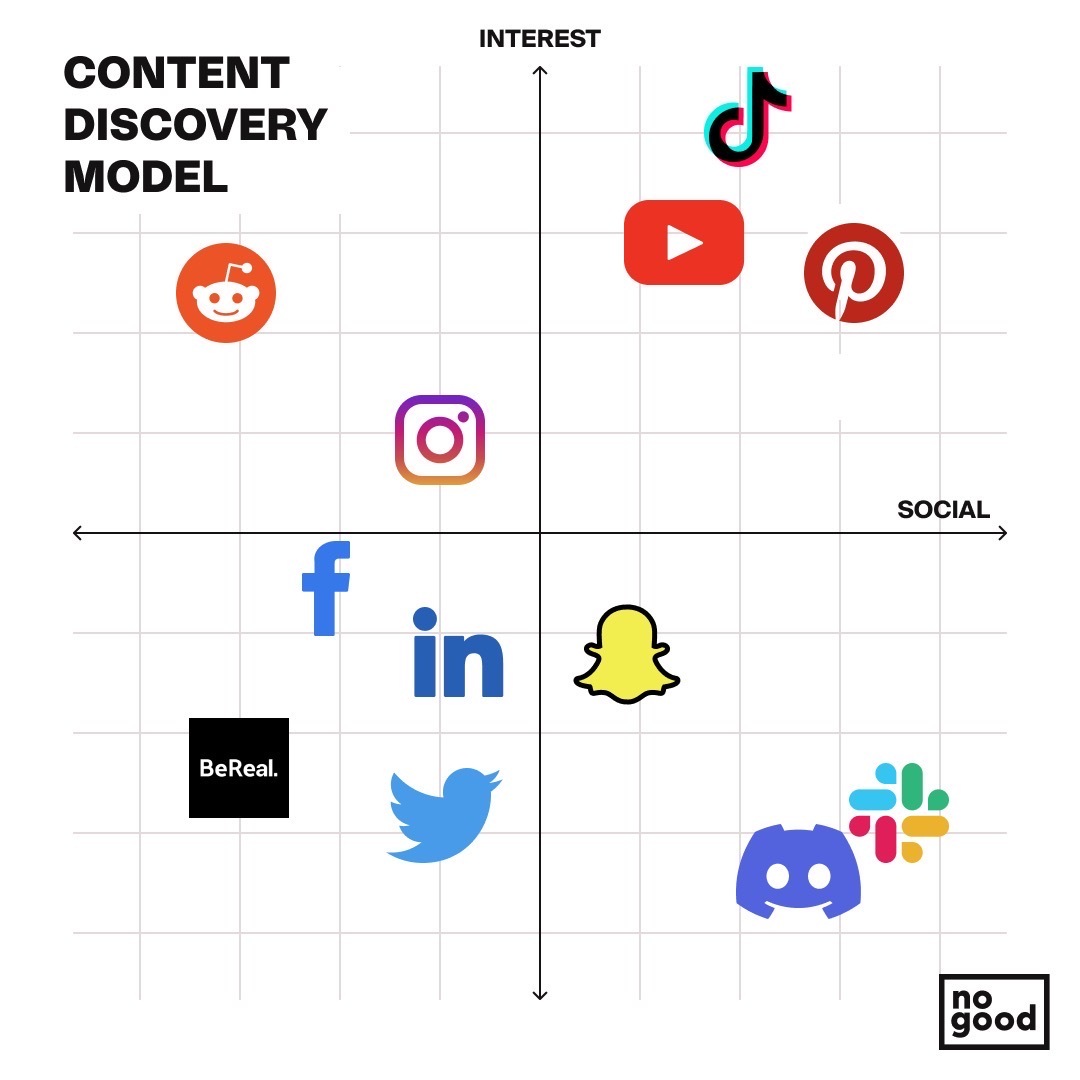

As they adjust their algorithm and interface to give preference to short-form videos served up by content creators, Instagram and Facebook will no longer be a place to connect with friends and family or follow your favorite celebrity. They are moving to a content discovery algorithm model that is primarily interest-based rather than connection or social-based.

In a social-based content model, you see mostly content from those you follow + of course a ton of ads. In an interest-based model, you see content based on your interest, that you are more likely to view until the end, that keeps you longer on the app, and you guessed it — view more ads.

To put it simply the future is consumption > connection, a further drift from Facebook’s core mission.

As Facebook, Instagram and TikTok shift to become entertainment platforms over social platforms, their goals become keeping you on the app as long as possible — people you know will rarely factor into that goal.

The social piece of the puzzle will be effectively moved to our DMs; it’s moving to our Messenger, Discord, Slack, Whatsapp, or iMessages where communities are being built today. The new definition of social media is a highly addictive AI-powered content discovery engine — and that model is here to stay.

This is not how the Instagram algorithm was originally built and it’s a major shift away from the original purpose and DNA of the platform that is likely to have a ripple effect in the marketing and media world.

Here are some major industry implications of this:

The term “influencer” started (and now ends) with the old version of Instagram. The marketing industry is now zooming in on the concept of content creators, where creators only get engagement if they’re creating interesting, engaging, and niche-relevant content that people with similar interests might find valuable.

As Instagram moves to favor interest over connection, users will start seeing more content curated to their specific interests, and less content from accounts they follow. Creators and influencers will start seeing a further decline in engagement from their followers and more engagement from strangers particularly on widely relevant content that has gone viral on the app or is specific to their niche interests.

Vanity metrics like followers and posting lifestyle-driven content like your meals, or travel accommodations, just because you are “famous” or an “influencer” will no longer cut it. You are feeding the algorithm now, not just your followers.

Impact on the influencers and celebrity partnership space:

The influencer marketing world as we know it is coming to an end. It started with Instagram and will die with it.

The value of follower count will become irrelevant as pay-per-post models begin to decline. It’s now about the content that will be produced. This is why most mega-celebrities are worried about the revenue stream they get from Instagram. The days of being paid per post are likely over as the market shifts to better reflect performance-based models seen elsewhere in the marketing landscape. Reach or followers will no longer be enough to satisfy brands looking to leverage social accounts, and will soon be replaced by conversions, engagement, and niche communities.

The partnership deals that Instagram influencers once won based on follower count will need to be re-evaluated. This will hurt mega-influencers that rely more on their follower count than micro-influencers who are building their brand by creating on-trend interesting content that feeds the algorithm, speaks directly to their communities, and competes for virality.

More ad revenue slowdown for Meta:

Meta is being pummeled on all fronts with the aftermath of iOS 14, a tough exchange rate, being consistently out-paced by TikTok, while being hampered by an unmotivated employee base (which Zuckerberg just called out), and impacted by the war in Ukraine. Even if they were able to quickly fix a few of these factors, it’s still an uphill and arduous climb back to the top. It will have to get worse before it gets better.

Impacts on Advertising:

Abandoning the social network model and moving to a content recommendation engine model, the advertising mechanisms of Instagram (and now also Facebook to follow) will likely change. There is frankly not as much real estate for ads anymore and users seeing ads every other post will significantly impact the quality of the experience — particularly if the ad content is not optimized to follow the best UGC standards and the authenticity needs of the modern consumer.

This will likely result in a significant loss of ad dollars at least in the immediate terms.

This is why Instagram launched its creator marketplace last month — another major change inspired by TikTok.

If the content engine changes, the ad model will have to change as well.

Ads will become native to feeds moving forward and will be served directly through creators as organic content — a proven sustainable way for brands and creators to monetize without impacting the users’ experiences. TikTok has proven the model by striking the right balance between a good experience and monetizable ad space, it’s now up to Meta’s (and other) platforms to take note and keep pace.

Impact on Creative:

The “Instagram Aesthetic” and curated, carefully manicured branded images will no longer have a place in your ad creative as culture has moved away from the millennial, minimalist branding and aspirational creative era.

As we have been witnessing the push toward UGC and a decline in static ads for more than a year now. Today’s creative is all about community building through relatable authentic storytelling and partnership. The job of ad platforms will be to amplify that.

Why Meta Made this Change:

To illustrate the contrast, TikTok’s reported daily time spent on the app is almost double that of Instagram. 52 vs 28 minutes — a troubling sign despite Facebook’s significantly larger user base.

Having launched 2 years ago, Instagram’s biggest ‘experiment’ in years, Reels, was heavily ‘inspired by’ TikTok. With this change, Reels has become the place where users spend most of their time on the app, representing about 1/5th of engagement — with the algorithm heavily favoring content being pushed through as Reels. Presented with this type of data coupled with TikTok’s meteoric growth, the decision to lean into Reels’ discovery engine and reconsider the parts that are not driving engagement makes total sense. This was expected and Instagram is unlikely to be influenced by any backlash from its user base as they continue to incorporate changes to the platform to better cater to Reels.

This may have been their only way to potentially save a declining social monopoly and they arrived at it a little late. The speed at which Instagram cloned Snapchat stories did not match their response to TikTok with the creation of Reels — possibly explaining Zuckerburg’s recent frustration with some employees and the level of talent Meta has today as compared to 4 years back.

But I guess it’s the nature of being too big and tackling too many things at once. While TikTok had just over 500 million global active users by the end of 2019; in September 2021, TikTok said it had more than 1 billion. Instagram was late, and Facebook lacked focus during the period where TikTok was capitalizing on the Covid acceleration moment — bringing us to a post-pandemic world where TikTok is leading the push away from social media and the new era of consumption-driven platforms.