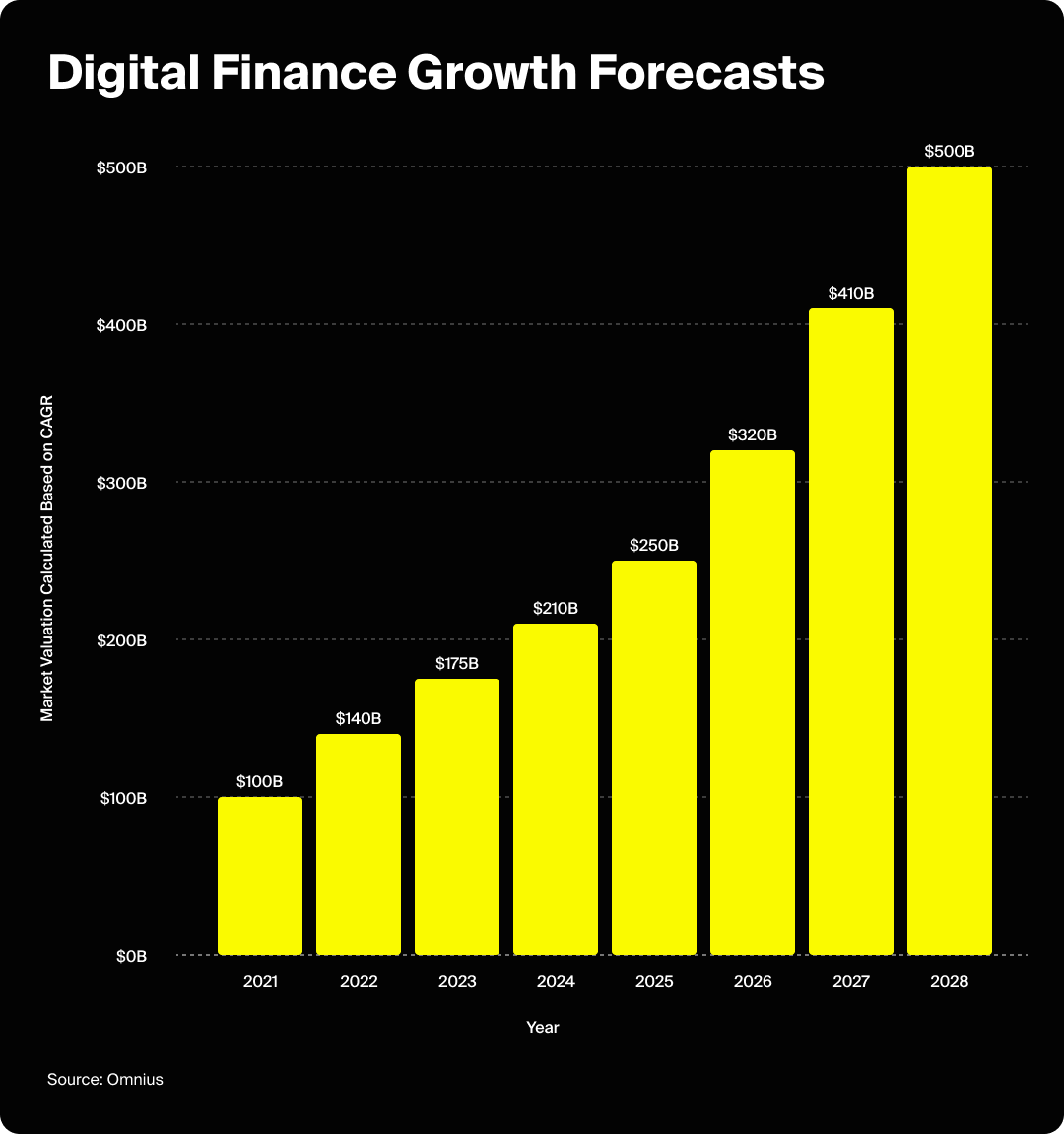

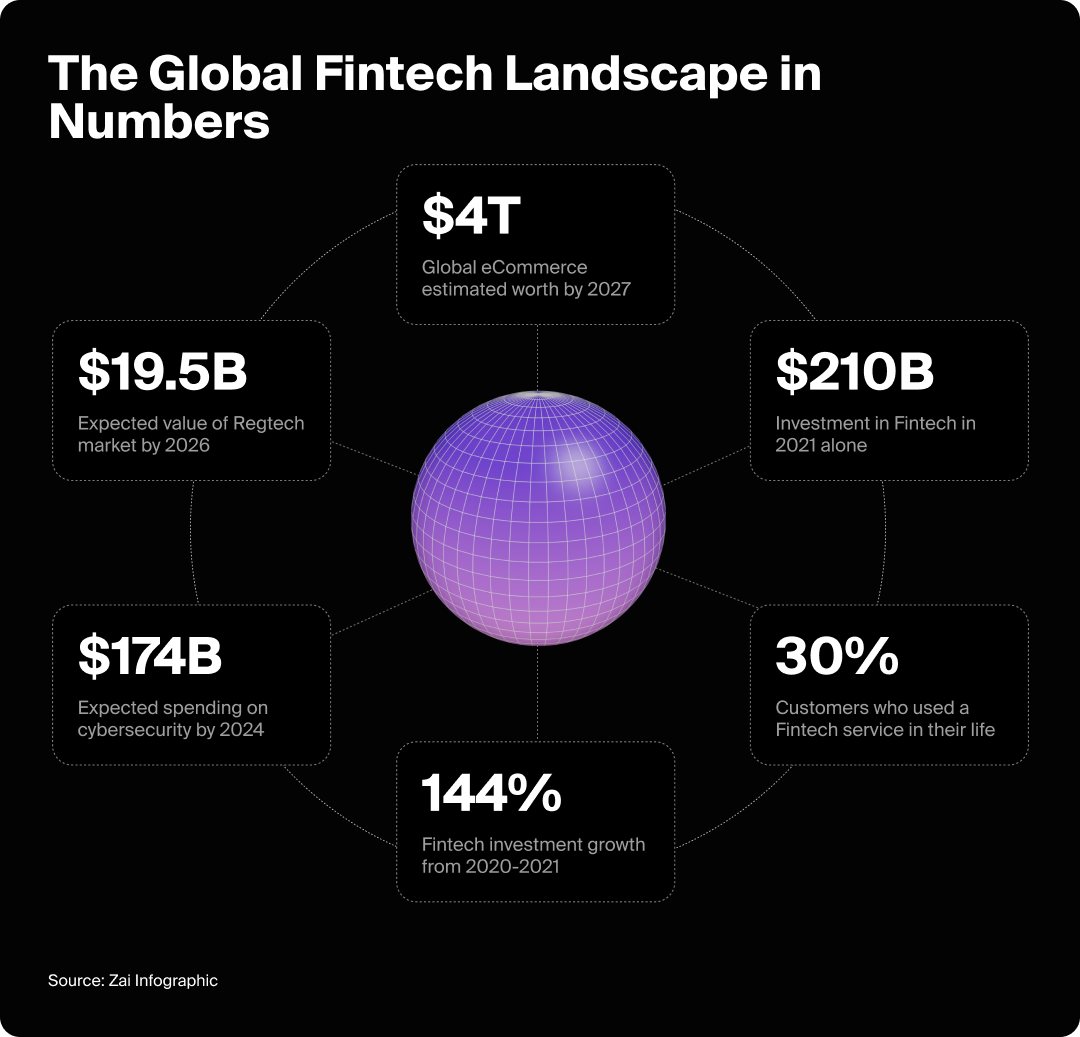

Fintech remains one of the fastest-growing tech sectors, spanning embedded payments, alternative lending, digital banks, and investment platforms. Market expansion is projected to surpass $514.9 billion by 2028, fueled by digital wallets, AI, and financial inclusion initiatives.

But the industry’s environment has shifted. From 2018 to 2021, Fintech rode a venture-backed wave of “growth at all costs.”

In 2026, capital is harder to secure, customer acquisition costs are higher, and regulators demand stricter compliance. At the same time, users expect greater transparency and trust.

In this new era, performance marketing is no longer about chasing rapid acquisition. It’s about balancing precision with compliance, improving unit economics, and building resilience. This guide explores the challenges and opportunities fintech founders face today, and how performance marketing can still power sustainable growth.

Core Challenges Facing Fintech Performance Marketers in 2025

The fintech industry is currently defined by rising ad costs, stricter regulations, and shifting consumer expectations. Businesses must navigate these pressures while still driving sustainable growth, making it critical to understand the core challenges shaping performance marketing.

1. Trust in Algorithms, Not Just Brands

Consumers expect transparency; not only from Fintech brands, but also from the algorithms behind them. In lending and investing, explainable AI is no longer optional. Marketers must go beyond testing value propositions and targeting audiences. They need to clearly communicate how decisions are made, not just what the product offers.

For “Your Money or Your Life” (YMYL) topics, authority hinges on E-E-A-T principles and third-party validation through reviews, press, and accreditations. Reddit reviews, being present on social media (i.e., TikTok or YouTube), and performing AEO (Answer Engine Optimization) to be visible in AI search engines are more important than ever.

2. Ad Cost Inflation

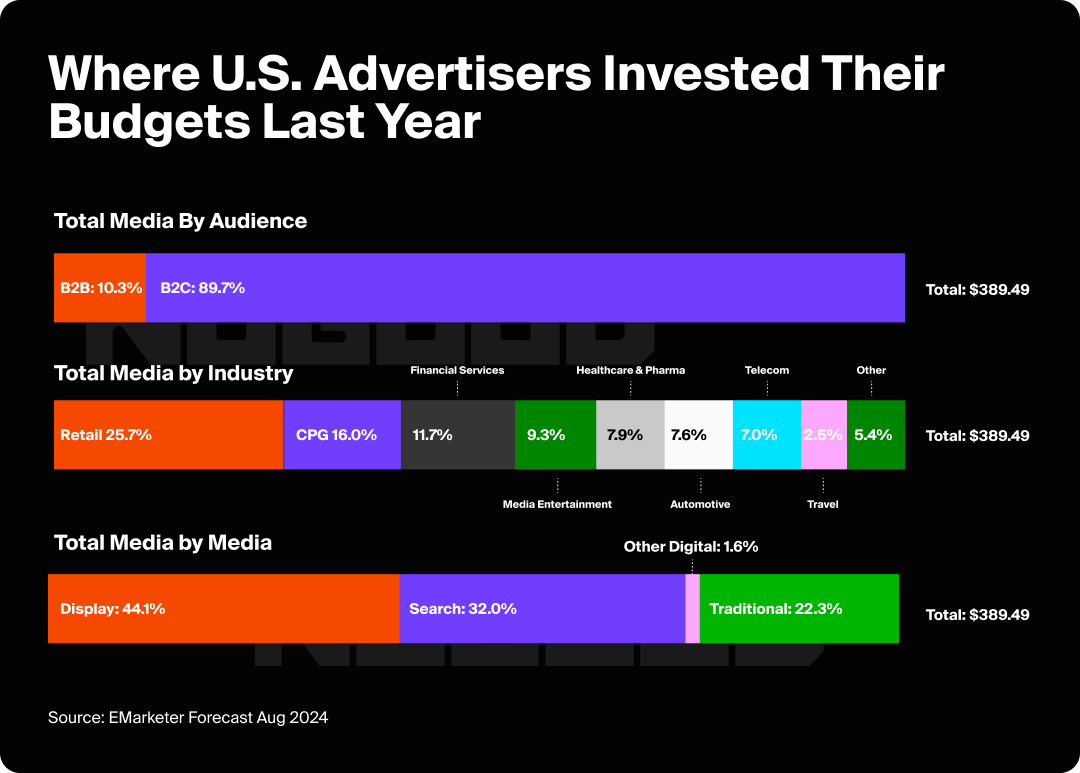

Customer acquisition costs (CAC) in Fintech have skyrocketed, reaching up to 40% YoY growth in some B2C channels. Google Search CPCs for financial keywords often exceed $3.44, making them among the most expensive in digital marketing.

Without a hybrid acquisition strategy that blends organic (SEO, content, partnerships) with paid media, margins can quickly collapse.

3. Regulatory Tightening

Banking-as-a-Service (BaaS) and embedded finance have blurred the lines between software and banking, pushing regulators to enforce bank-level compliance on startups. As a result, RegTech solutions like Alloy or ComplyAdvantage have shifted from nice-to-have to mission-critical.

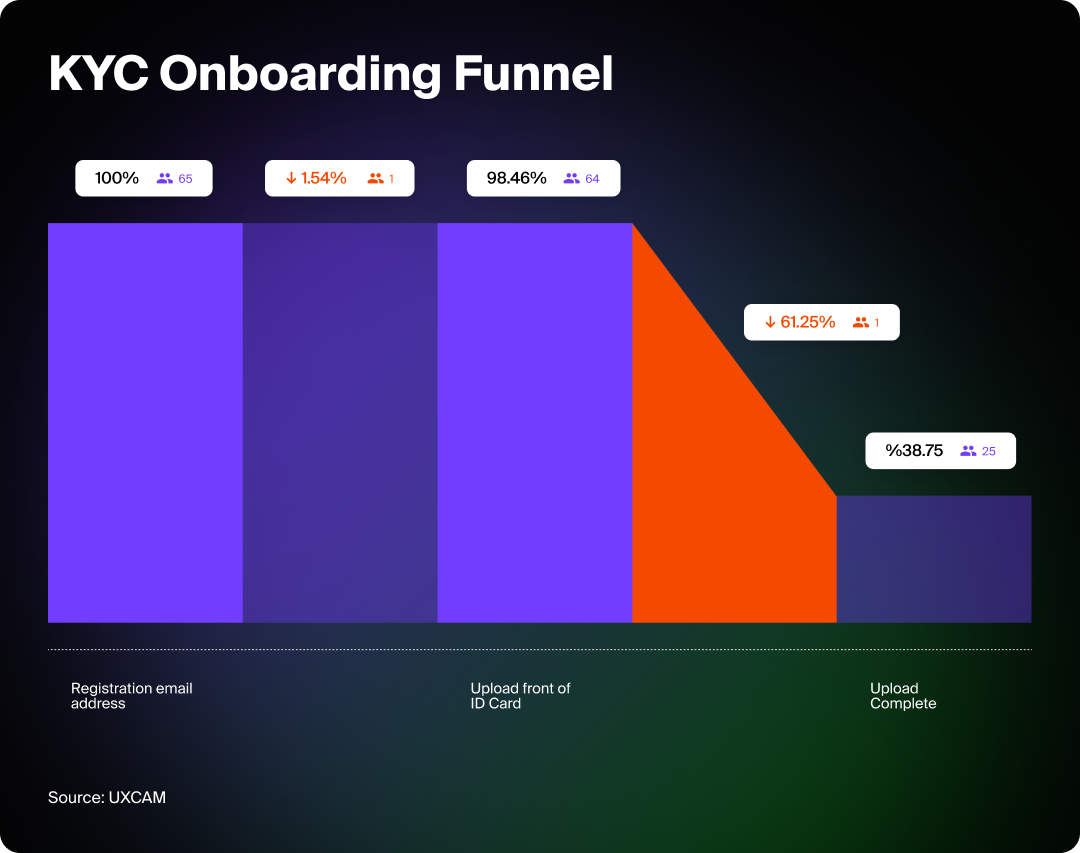

For marketers, this means compliance is no longer an operational afterthought, but a growth lever. Frictionless KYC and onboarding processes can directly improve conversion rates, while tools like consent mode and advanced verification protocols maintain security and build user trust.

4. Globalization & Localization

Fintech growth increasingly depends on cross-border payments and localized solutions. But scaling globally requires hyper-localized marketing strategies that adapt to regional compliance frameworks; GDPR in the EU, RBI regulations in India, CFPB oversight in the U.S. Balancing global ambitions with local compliance and cultural nuance is now a core marketing challenge.

Case Study: Wise

Wise scales globally by localizing both its product and marketing for each market. In Europe, the focus is on low-cost SEPA transfers; in India, campaigns emphasize compliance with RBI regulations and UPI integrations; in the U.S., Wise highlights speed and transparency of cross-border payments. This hyper-local approach enables Wise to operate compliantly across 160+ countries while maintaining a consistent global brand identity.

Growth Opportunities for Fintech Performance Marketing in 2025

While challenges are significant, they also open the door to smarter, more efficient strategies. From diversifying acquisition channels to leveraging AI and focusing on retention, fintech startups can unlock new opportunities to scale sustainably and stand out in a crowded market.

1. Smarter Acquisition Mix

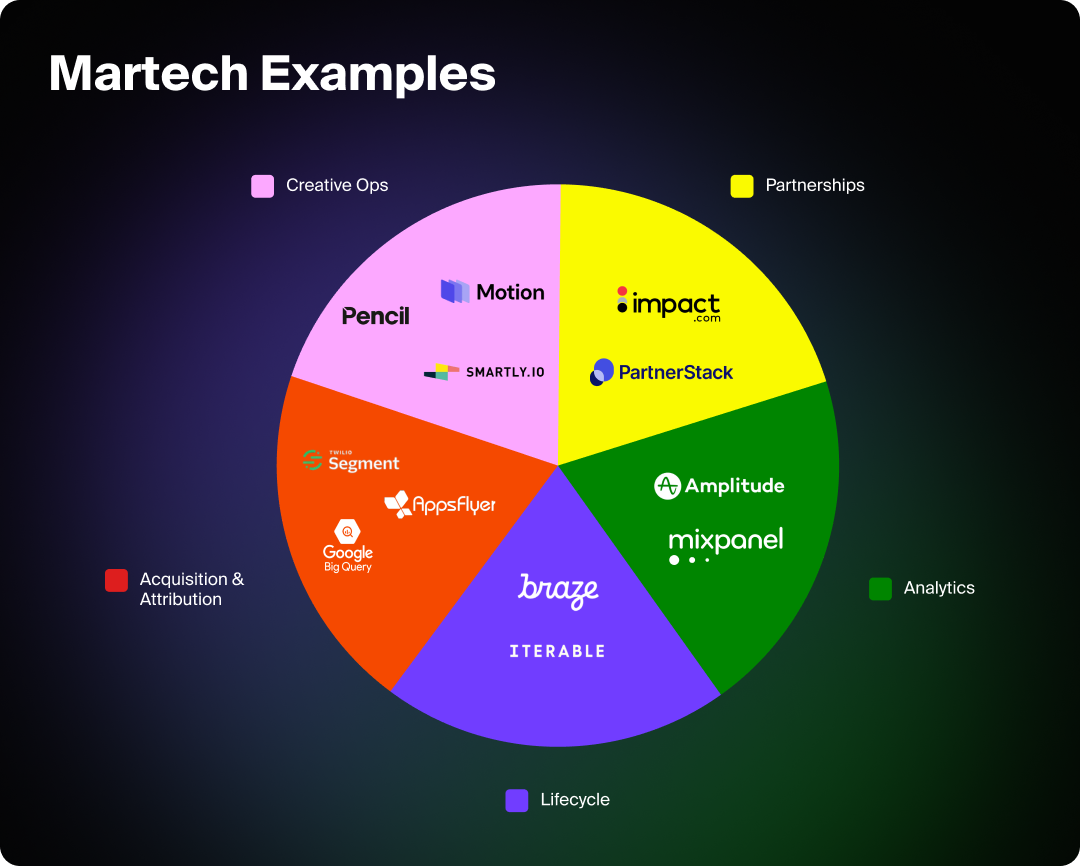

Fintech marketers are diversifying beyond paid search and social by layering in partnerships, affiliate programs, and embedded distribution. Embedding products into payroll apps, ride-sharing platforms, or digital wallets creates organic exposure at scale. Tools like Impact.com and PartnerStack streamline partner management, while strong SEO and AEO ensure visibility in AI search.

2. Creative & Messaging Experimentation

The most effective campaigns lean into trust-driven creative. Marketers are using stat-led messaging, verified testimonials, and UGC to establish credibility. Short-form video on TikTok or YouTube Shorts drives top-of-funnel discovery, while long-form content builds depth. Platforms like Smartly.io or Motion help analyze and scale creative variations efficiently.

Case Study: Wise on TikTok

Wise leverages UGC and short-form video on TikTok to humanize cross-border payments. By encouraging creators to showcase real-life money transfers and travel scenarios, Wise lowers CAC compared to traditional paid search while strengthening brand trust among younger audiences.

3. AI & Automation in Marketing Ops

AI is being applied across the funnel to enhance efficiency and personalization. Braze and Iterable power personalized onboarding and lifecycle messaging, while Amplitude and Mixpanel provide predictive churn insights.

Conversational AI through Intercom or Salesloft reduces friction in KYC flows. Pairing AI bidding with offline conversion tracking ensures campaigns optimize for high-value users, not just cheap CPCs.

4. Retention as a Growth Engine

With CAC rising, LTV is the metric that matters. Fintech companies are investing in loyalty programs, referral incentives, and personalized cross-sell offers. Tools like Tremendous automate referral rewards, while Klaviyo and Braze enable lifecycle campaigns tied to user behavior.

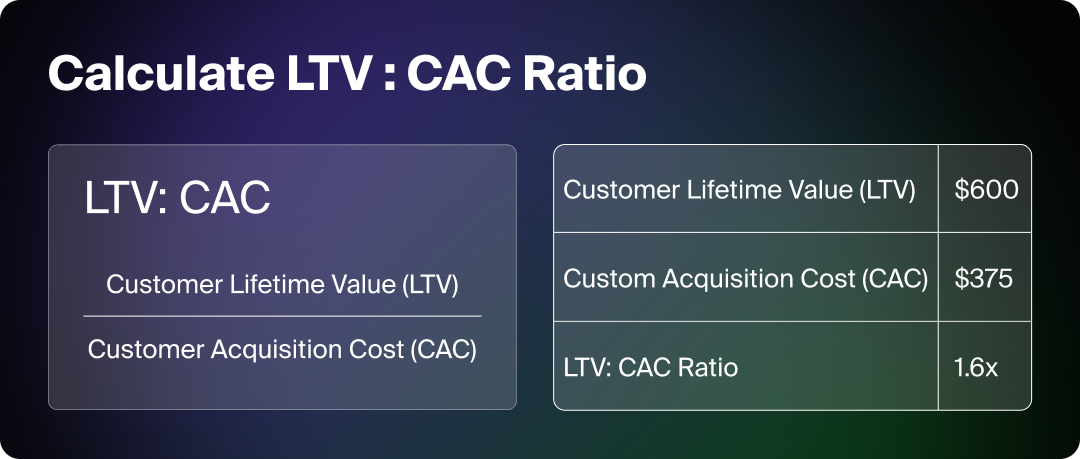

Tracking LTV:CAC by cohort (aiming for ≥3:1 within 12–18 months) keeps retention tied directly to profitability.

Case Study: Revolut

Revolut drives retention by building an ecosystem of sticky features that keep users engaged beyond core banking. Daily transaction notifications, budgeting tools, cashback offers, and premium tier upgrades encourage consistent use.

By layering in lifestyle features like travel insurance and crypto trading, Revolut increases LTV while reducing churn, turning retention into its most powerful growth lever.

5. Data-Driven Experimentation

Leading Fintech companies run continuous test-and-learn cycles. Multivariate landing page testing with Optimizely or VWO, rapid creative iteration with Pencil, and privacy-safe tracking via server-side GTM or Segment + BigQuery pipelines make experimentation scalable.

Dedicating 10–15% of media spend as a test budget ensures constant innovation while managing risk.

Case Study: Ramp

Ramp scales efficiently by using experimentation to optimize every stage of the funnel. From A/B testing landing page flows to tracking feature adoption in real time, Ramp treats growth as a series of measurable experiments.

By integrating product analytics with marketing spend, Ramp proves ROI on each channel before scaling, ensuring campaigns improve unit economics rather than just driving volume.

Metrics That Matter in 2026

Growth without measurement is guesswork. To scale effectively, fintech companies need to track the right performance metrics, those that capture acquisition efficiency, retention, and profitability, to ensure every campaign improves unit economics and long-term growth.

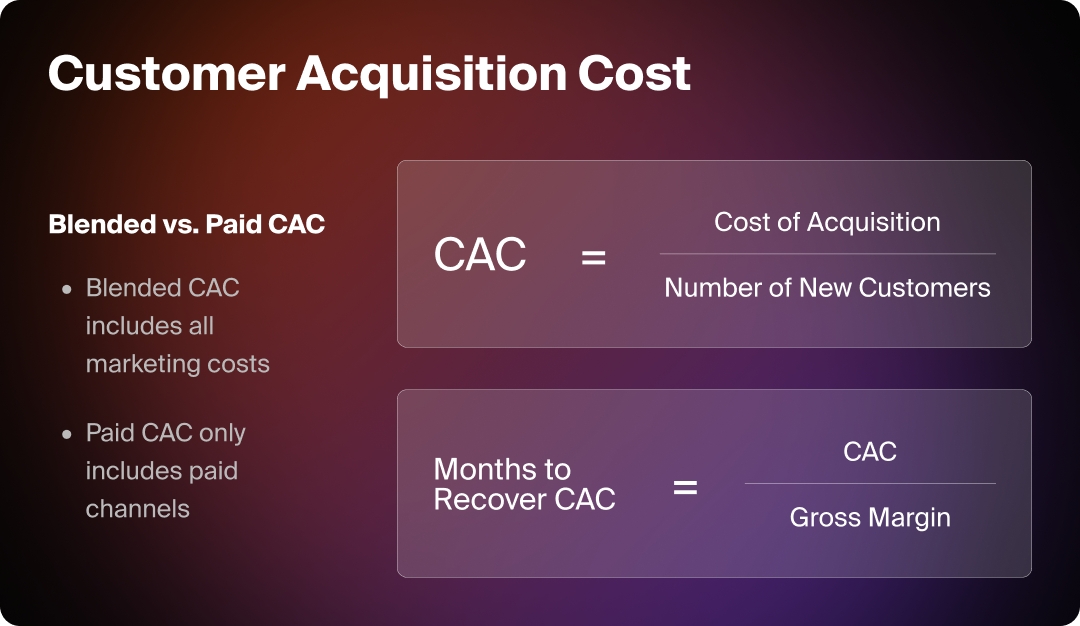

1. Blended CAC

Paid-only CAC is misleading in a world of multi-touch journeys. Track blended CAC (paid + organic + partner channels) to understand true acquisition efficiency. Benchmarks vary, but Fintechs should aim for CAC payback within 12 months.

2. LTV:CAC Ratio

Lifetime Value relative to CAC is the north star for Fintech economics. A healthy ≥3:1 ratio signals scalable growth, while anything below 2:1 suggests acquisition is outpacing retention or monetization.

3. Payback Period

How quickly you recover CAC through customer revenue. Shorter cycles (≤12 months) create more runway to reinvest in growth; longer cycles can choke cash flow when capital is tight.

4. KYC Drop-Off Rate

KYC drop-off rate is one of Fintech’s most overlooked metrics. Complex verification processes can kill conversion rates. Track where users abandon onboarding and invest in smoother KYC with RegTech integrations to improve funnel efficiency.

5. Compliance Approval Cycle Time

Regulatory reviews for ads and campaigns often delay launches. Monitoring approval timelines helps marketing teams forecast go-to-market more accurately and push for process improvements with compliance teams.

6. Engagement & Retention Metrics

Acquisition only matters if users stick. Monitor:

- DAU/MAU ratio (daily to monthly active users) for stickiness

- Churn by cohort to see if specific segments are dropping faster

- Feature adoption rates (e.g., % of users activating auto-pay, savings, or investment features) to identify upsell opportunities

Strategies for Fintech Companies to Scale Marketing Fast

With limited budgets and rising competition, fintech startups need proven tactics to grow quickly without burning their runway. By setting compliance guardrails early, testing continuously, and leveraging the right martech stack, teams can speed up acquisition while staying compliant and efficient.

Here are battle-tested shortcuts that help Fintech startups accelerate growth without burning runway.

1. Set Compliance Guardrails Early

Don’t wait for Legal to slow you down; build pre-approved creative templates (claims, disclaimers, disclosures) so campaigns can launch in days, not weeks.

Pre-Approved Creative Template [Example]

|

Category |

Template |

Disclaimer / Notes |

Status |

|---|---|---|---|

|

Headline |

“Get [Product Name] in just X minutes; secure, fast, and trusted.” |

Replace X minutes with actual approved time (e.g., 5–10 minutes). |

✅ Approved |

|

Headline |

“Join [#] customers already using [Product Name] to manage their money smarter.” |

The number must be sourced and verified. |

✅ Approved |

|

Value Prop |

“No hidden fees. Transparent pricing from day one.” |

Must link to pricing page/terms. |

✅ Approved |

|

Value Prop |

“Your data, protected by [Encryption Standard/PCI-DSS/FDIC].” |

Use only verified certifications. |

✅ Approved |

|

Benefit |

“Access funds in as little as 24 hours.*” |

*Approval times vary based on verification and eligibility. |

✅ Approved |

|

Benefit |

“Earn up to X% APY on your savings.†” |

†Rates subject to change; see terms for details. |

✅ Approved |

|

CTA |

“Start your application today — no commitment required.” |

None |

✅ Approved |

|

CTA |

“See your personalized offer in minutes.” |

Only if the system guarantees real-time results. |

✅ Approved |

|

Visual |

Product UI screenshot with overlay: “Bank-level security” |

Must display actual approved security badge. |

✅ Approved |

|

Visual |

Badge overlay: “FDIC Insured” |

Only if accounts are truly FDIC-insured via a partner bank. |

⚠️ Conditional |

2. Define Unit Economics Before Scaling

Know your CAC, LTV, and payback targets before turning up the spend. If a channel doesn’t hit your LTV:CAC threshold, cut it fast, because time is your scarcest resource.

3. Build a Test-and-Learn Roadmap

Allocate 10–15% of your budget to experiments every month. Fail fast, but document everything so that the learnings compound. A shared testing hub across teams turns small wins into scalable strategies.

4. Choose the Right MarTech Stack

Your stack should work as a growth engine, not a patchwork.

5. Automate Early Wins

- Sync CRM and ad platforms with offline conversion tracking to train algorithms on profitable users.

- Use dynamic creative optimization (DCO) to generate and test hundreds of ad variants at once.

- Automate referral payouts to keep viral loops frictionless.

6. Go “Embedded” Where Your Users Already Are

Partnership distribution (integrating into payroll apps, eCommerce checkouts, or mobility platforms) compounds faster than trying to win every user 1:1 through ads.

7. Treat Retention Like Acquisition

Shift part of your ad budget into lifecycle campaigns. Push personalized upsells, reminders, and rewards through lifecycle marketing tools because every retained user is a cheaper, faster path to growth than chasing a new one.

Conclusion

Fintech startups in 2025 are operating in one of the most challenging, but also most rewarding, environments yet. Rising CAC, stricter regulations, and user demands for transparency have raised the bar. But these same pressures are forcing smarter strategies, stronger creative, and more disciplined growth systems.

Performance marketing is no longer just about acquiring users fast; it’s about building trust, resilience, and efficiency into every campaign. The Fintechs that win will be the ones that:

- Diversify acquisition beyond ads alone.

- Embed compliance and transparency into their funnels.

- Leverage AI and automation to scale intelligently.

- Treat retention as a growth engine, not an afterthought.

- Continuously test, learn, and optimize with data.

The playbook has changed, but the opportunity is massive. For Fintech founders, performance marketing remains the growth engine; it’s just tuned for a smarter, more sustainable era.

Fintech Marketing FAQS

What is Fintech in marketing?

Fintech in marketing refers to how financial technology companies promote their products and services through digital and performance-driven channels.

Because Fintech deals with “Your Money or Your Life” (YMYL) topics, strategies focus on trust, compliance, and measurable ROI, using tools like SEO, paid search, partnerships, and lifecycle marketing.

What are the four types of marketing strategies?

The four core marketing strategies for Fintech companies are:

- Acquisition marketing (SEO, paid search, affiliates, partnerships)

- Creative and messaging strategy (UGC, testimonials, authority content)

- Retention marketing (email, push, loyalty, referrals)

- Experimentation & optimization (A/B testing, funnel analytics, creative iteration)

Who is the target market for Fintech?

The target market for Fintech companies varies by product but often includes:

- Consumers seeking easier, cheaper, or faster financial solutions (e.g., digital banking, investing apps).

- SMBs and freelancers needing payments, lending, or payroll tools.

- Underbanked or global audiences who need access to cross-border payments and financial inclusion products.

How do Fintech and digital marketing work together?

Digital marketing is the engine that powers Fintech growth. Because Fintech is digital-first, acquisition and retention rely on online channels such as Google Ads, TikTok, SEO, influencer partnerships, and lifecycle tools like Braze.

Performance marketing ensures Fintechs can measure CAC, optimize funnels, and scale compliantly, all while building user trust.

What is performance marketing?

Performance marketing is a data-driven growth strategy where every dollar is tied to measurable outcomes such as approved accounts, funded apps, or retained users, rather than vanity metrics. In fintech, it means defining unit economics (CAC, LTV:CAC, ROI), using measurable channels, and tracking the funnel end-to-end with privacy-safe methods.

Success comes from continuous testing, feeding high-value conversions back into bidding algorithms, and optimizing for profitability and retention, not just acquisition, making it the engine for sustainable growth.