Four months since the World Health Organization declared COVID-19 a worldwide pandemic, the world is slowly reopening after an unprecedented lockdown.

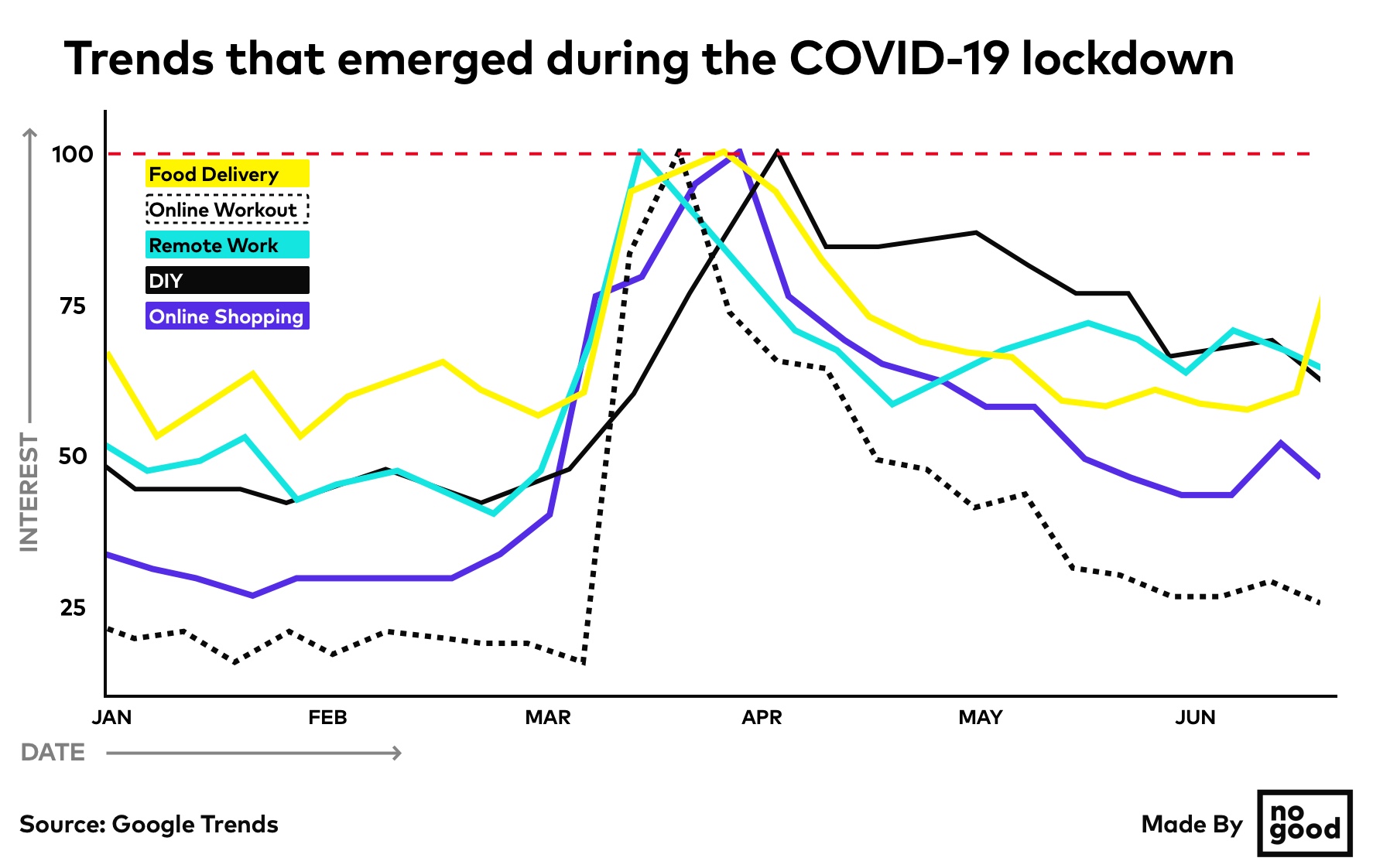

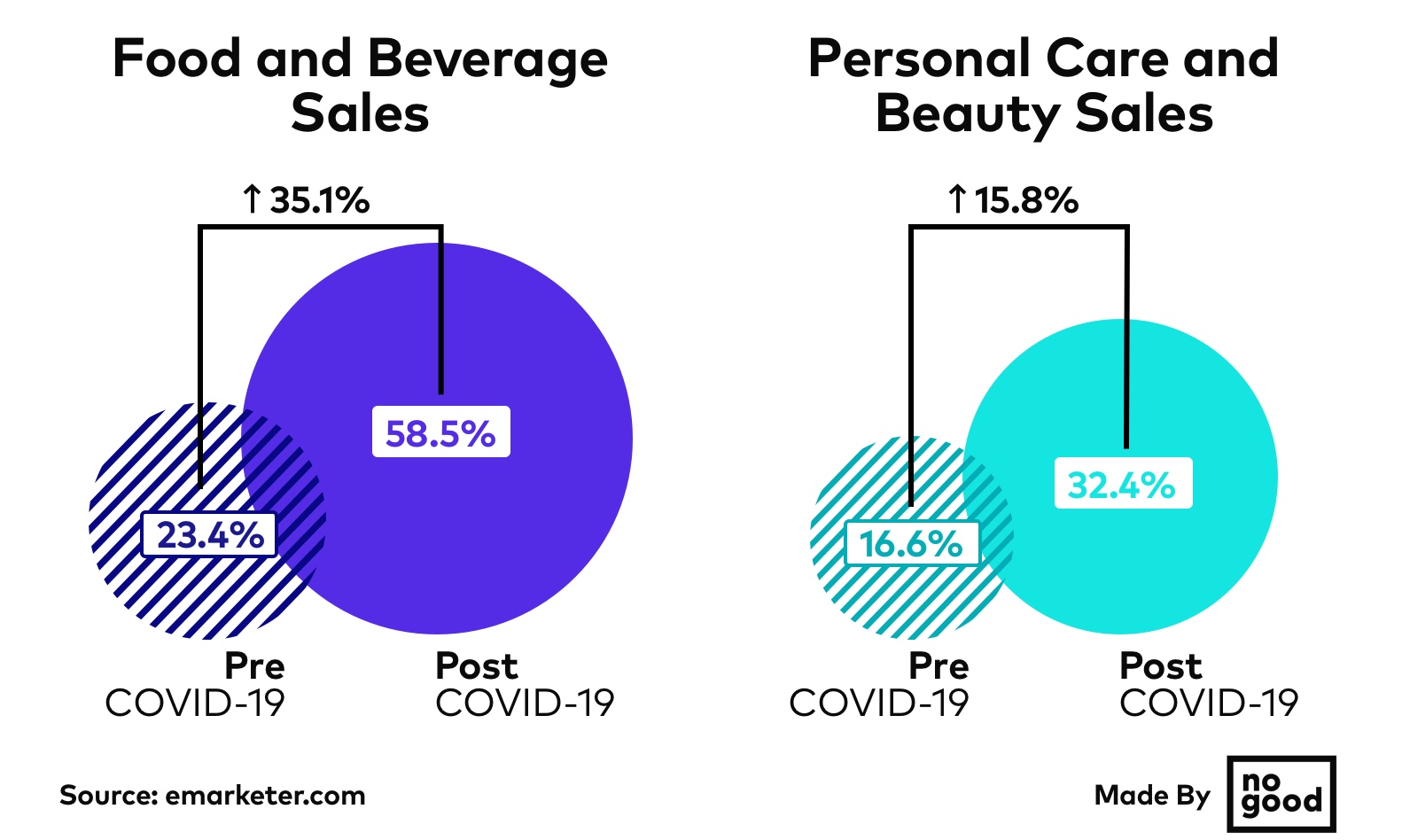

The consumer market is changing, with declines in some traditionally strong markets and drastic increases in others. A survey run by Statista highlights that 43% of people are likely to spend more than before on health and hygiene, followed by 40% in household cleaning products and 31% in online shopping for food and drinks. These changes extend into industries including travel, healthcare, fashion, and retail among others.

eCommerce vs Traditional Retail Trends

eCommerce vs Traditional Retail Trends

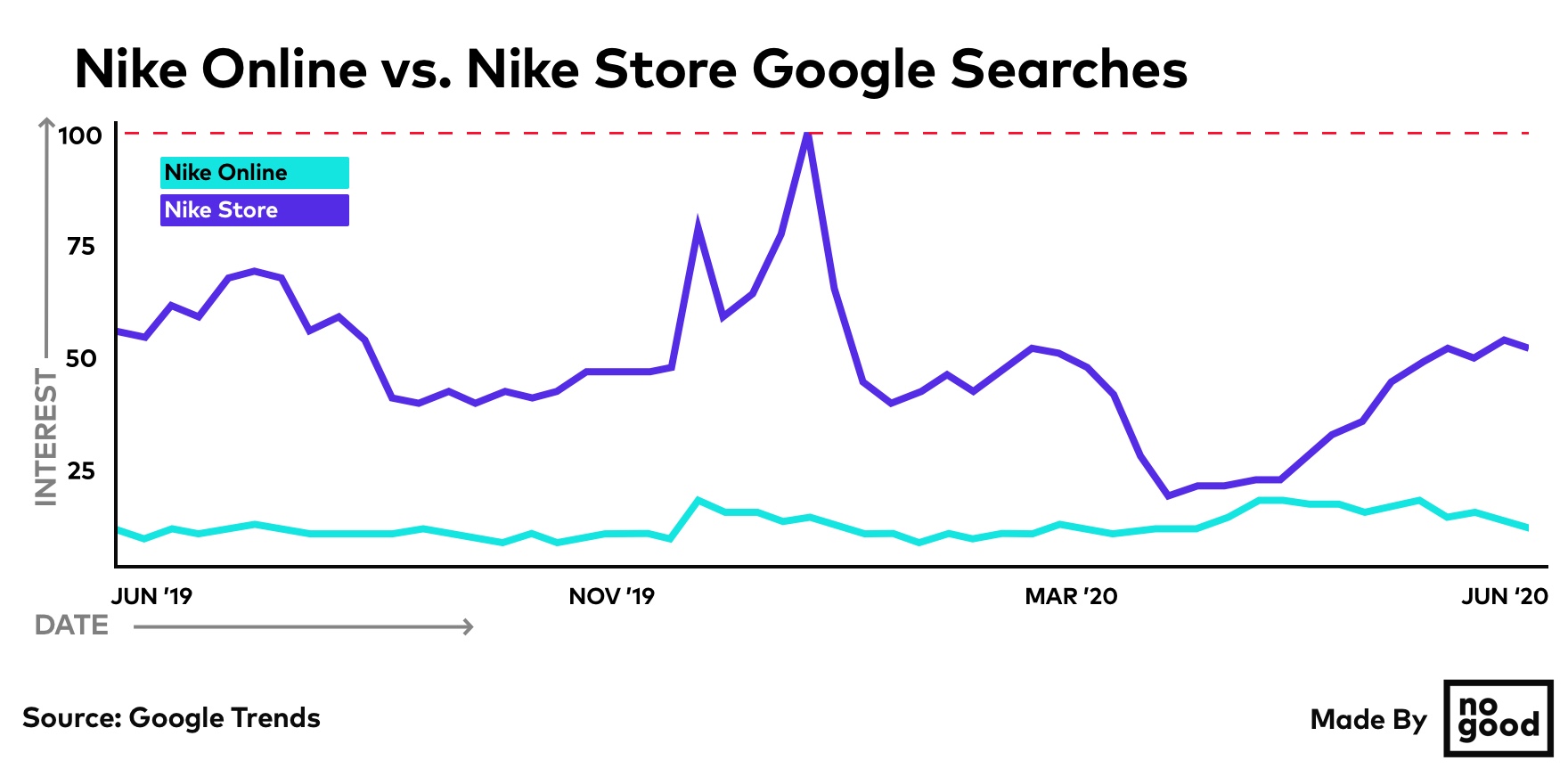

Strong consumer brands (like Nike), that stayed emotionally connected with their fan-base during the pandemic, have witnessed a lift in online sales. That trend isn’t expected to fade away.

Nike in-store sales will surpass the online ones though, as the country reopens. The Nike in-person shopping experience is hard to top, even with the best e-commerce site.

“Digital” is now a necessity and consumer brands are investing in improved e-commerce sites as well as stellar customer service and impeccable delivery.

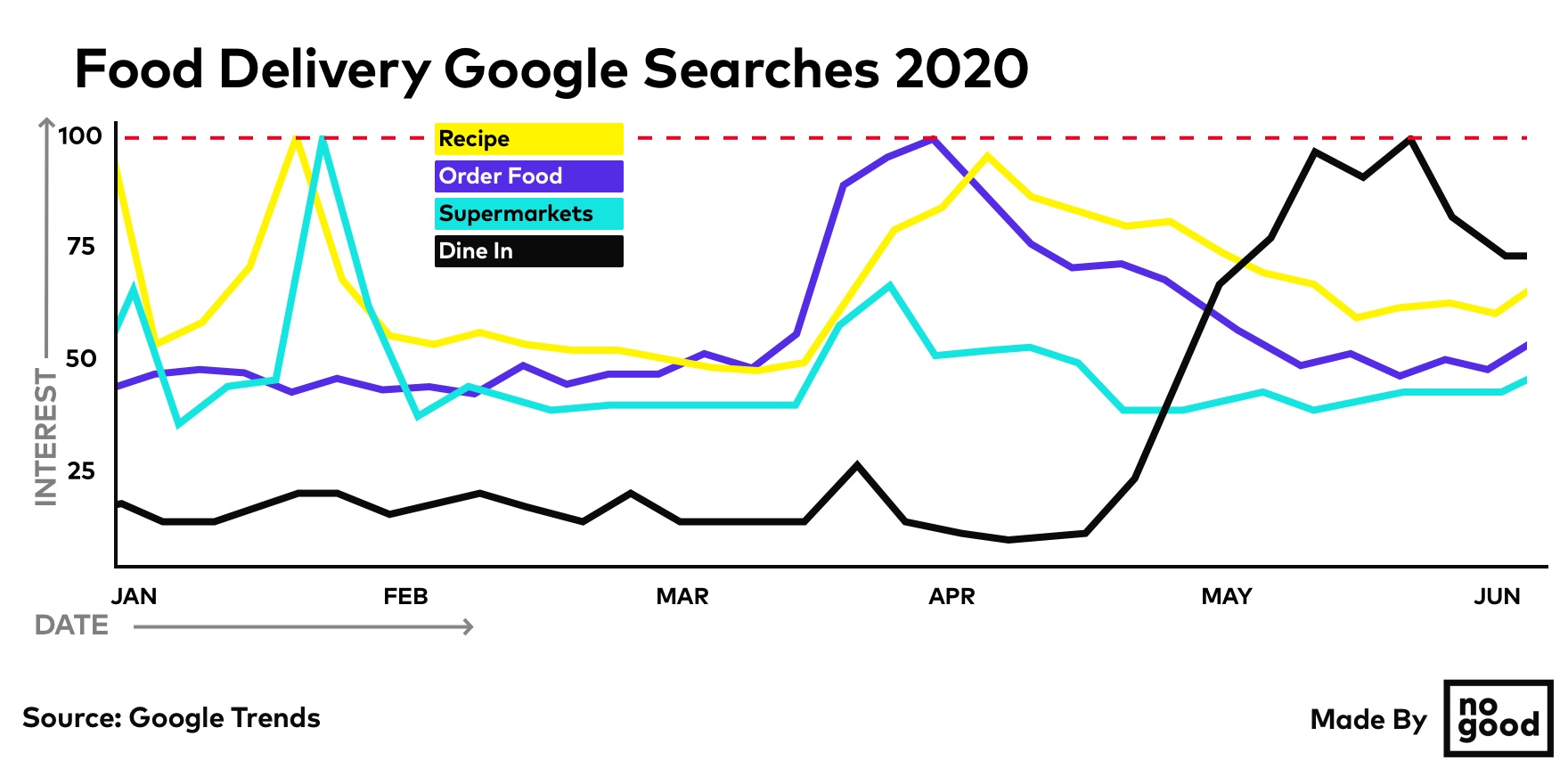

Delivery Services

According to Twitter data, there were 250.000 tweets about ordering delivery from March 9 to March 22 (there were 80,000 Tweets about pizza alone), almost a 300% increase from the previous month.

People showed their support for their favorite restaurants by ordering from them, and platforms like Instagram rolled out interactive “food order” and “gift card” story stickers with their own unique content aimed at driving awareness of the new ways in which people can support their favorite local restaurants.

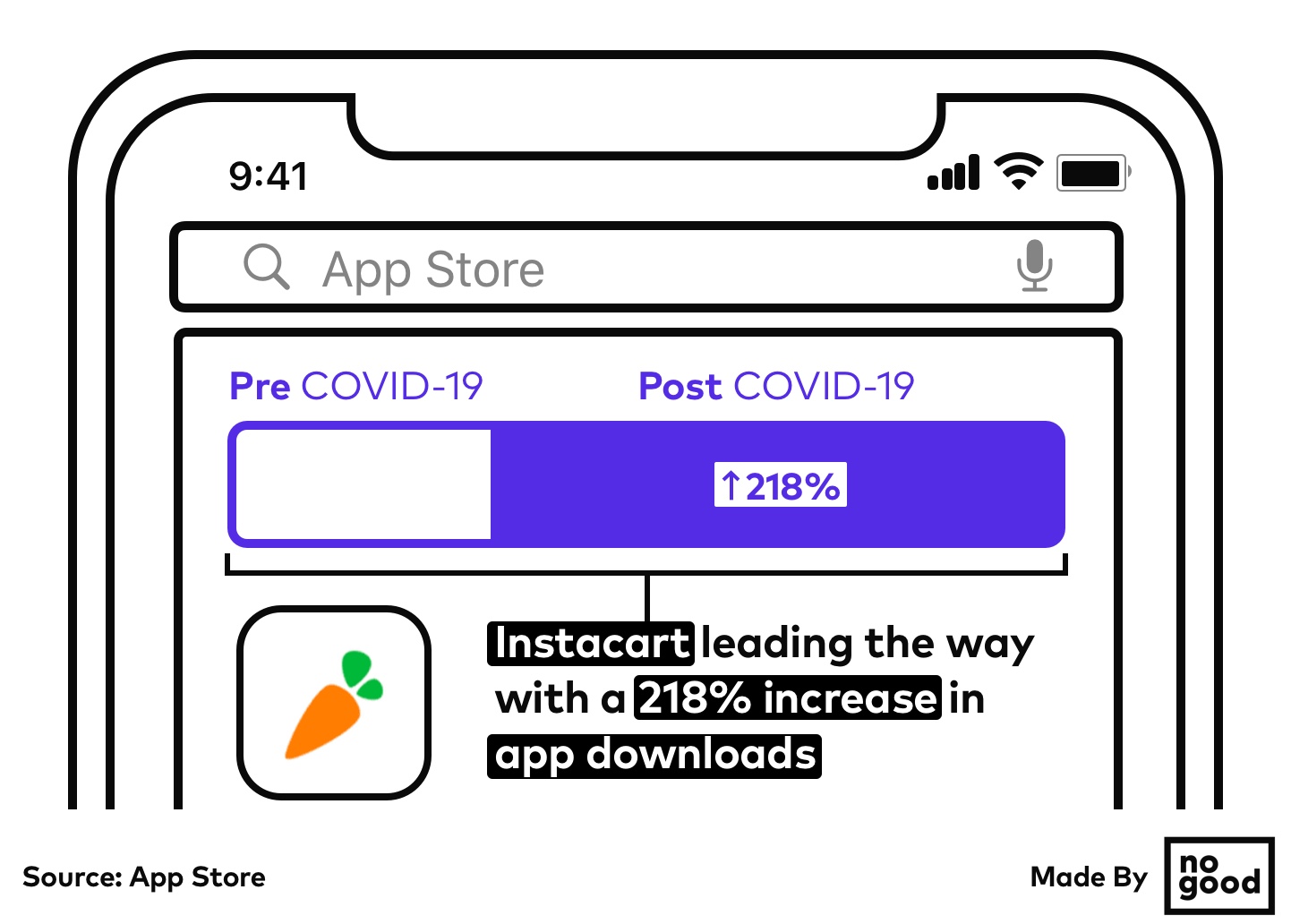

Grocery shopping apps experienced an increase in downloads with Instacart leading the way with a 218% increase in app downloads.

The company reportedly added over 300,000 people to their workforce to face the increase in demand of March and April.

Only about 3% or 4% of grocery spending in the U.S. was online before the pandemic. That market share has surged to 10% to 15%, according to research by consulting firm Bain & Company.

Experts say that will likely remain at a higher level because many customers have downloaded apps, tried new services and discovered their convenience.

Searches for recipes reached a peak two weeks from the lockdown as people tried to normalize their stay-at-home routines. The lift is comparable to the ones normally seen at Thanksgiving and Christmas.

Food Retail

The grocery store experience has been slow to evolve over the last century. While many companies have attempted to automate and digitize their processes, the industry as a whole has been stagnant in that regard. After the large scale shutdowns during the pandemic, online grocery shopping rose in demand dramatically.

Instacart, a grocery delivery service, reports its orders increased by 150% since the shutdowns. Instacart app downloads increased by 218%. The increase in demand has caught many companies by surprise, with companies like Amazon and Instacart going on hiring sprees in order to fill the gap. Amazon hired 175,000 operations and delivery specialists, but simultaneously limited online grocery shopping signups until they can keep up with sudden demand. Kroger even turned one of its physical stores into a fulfillment center for online orders.

While initial demand for groceries overall increased, it is hard to tell whether this will sustain itself as the pandemic settles, however the move to digital in the grocery industry is more permanent, with many companies opting to restructure their businesses around online delivery. Bain & Company reports that online grocery spending has increased by up to 4-fold since the beginning of the pandemic and the trend seems to only be getting stronger.

Travel Industry

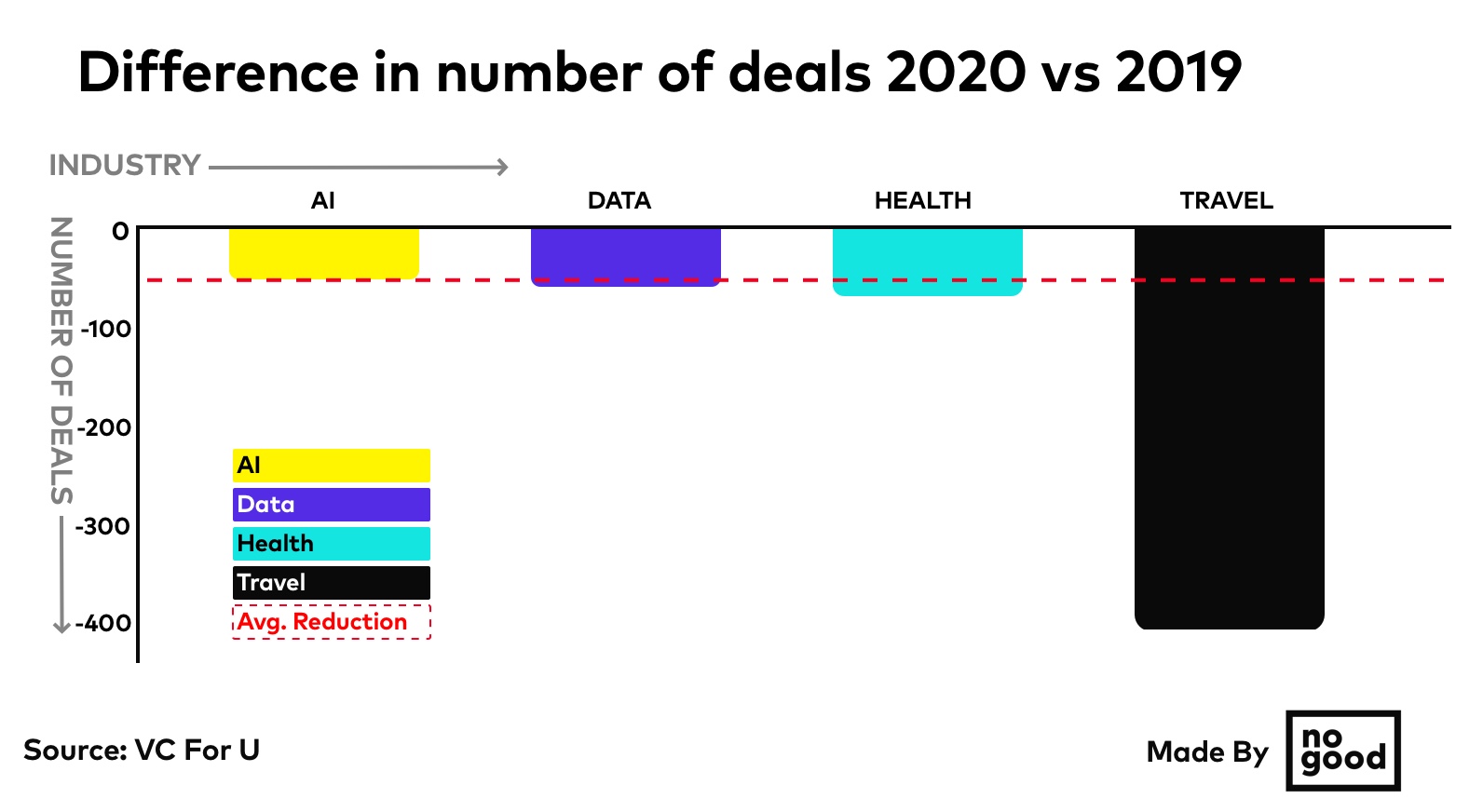

Travel was not only one of the hardest sectors hit by COVID-19, with the biggest hospitality companies cutting up to 40% of their workforce, but one of the industries hit the most by venture capital disinvestments. VC-backed deals in travel tech have declined by 400% compared to the same time period last year due to the pandemic.

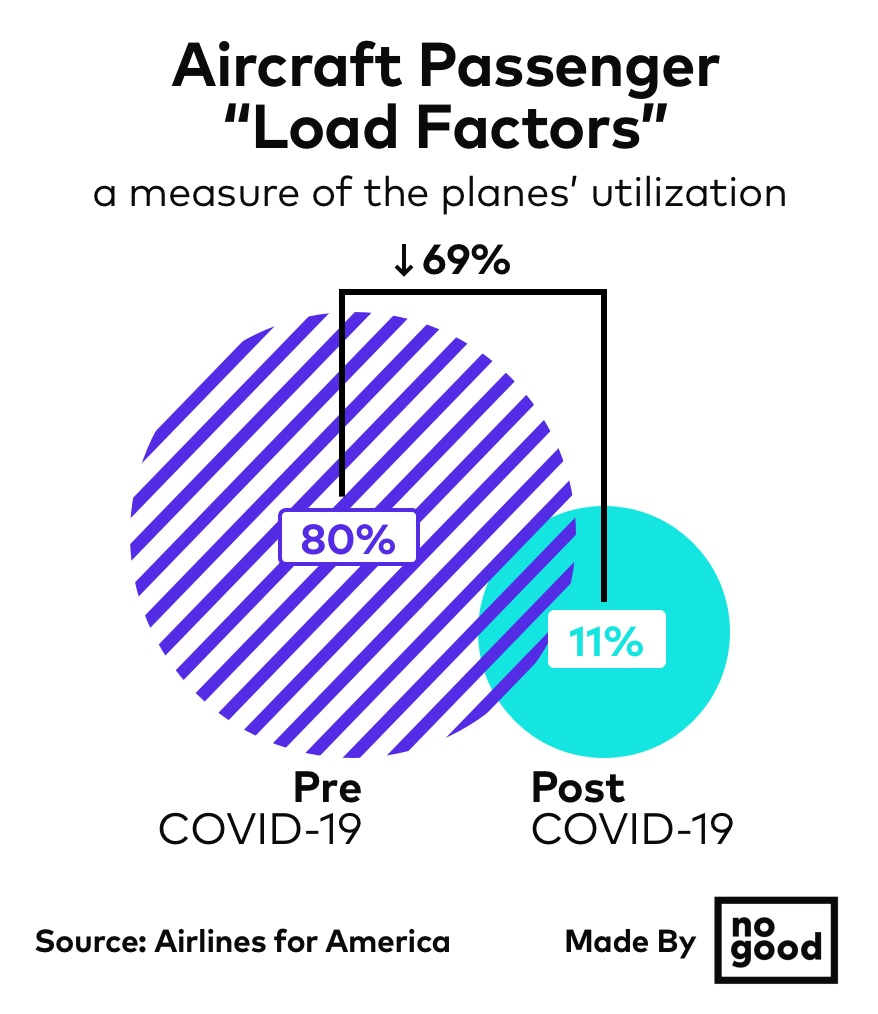

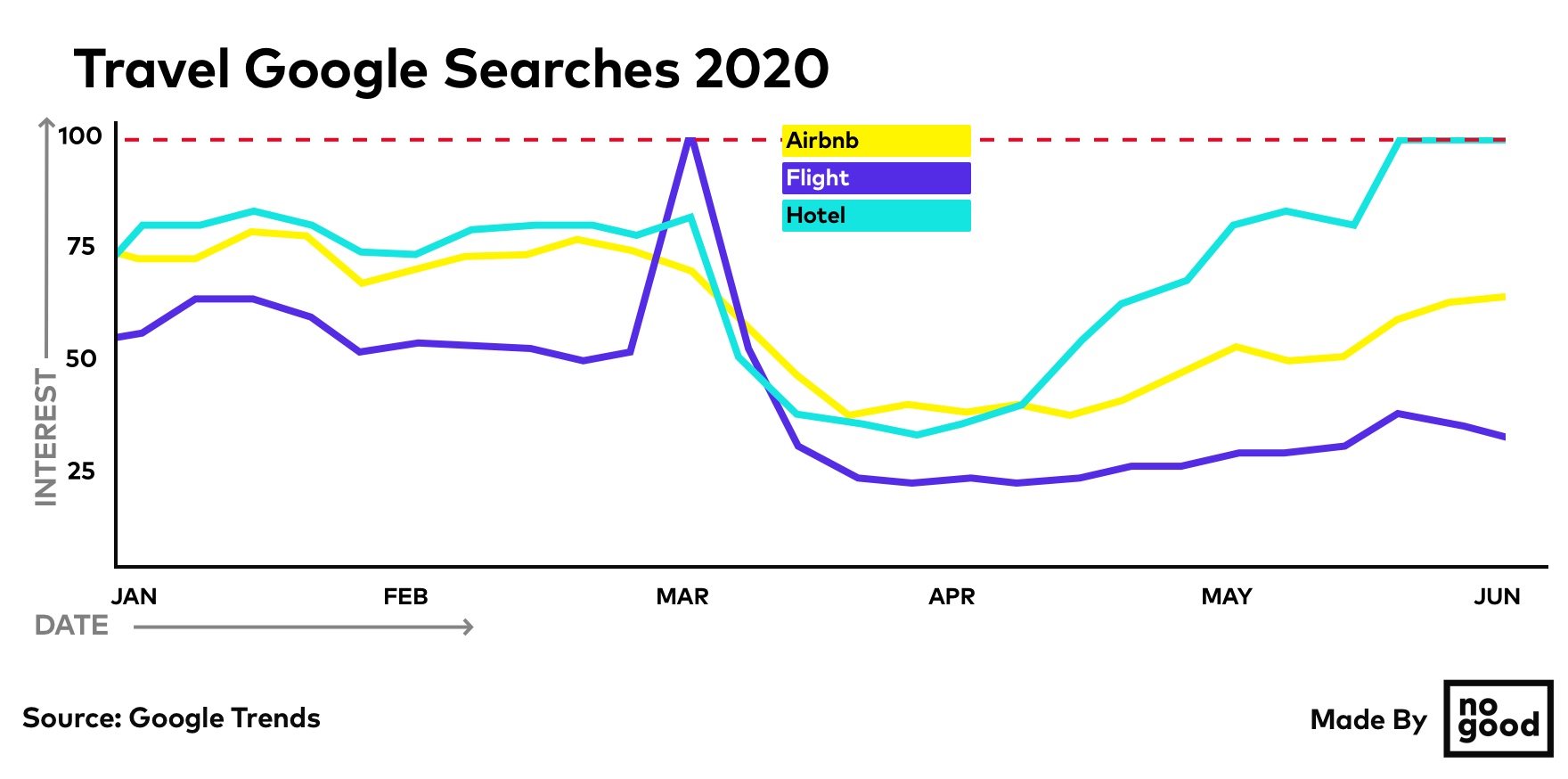

85% of international flights were cancelled and airlines are still flying semi-empty planes but while flight searches have not yet returned to pre-covid numbers, people are starting to look for holidays, hotels and vacation rentals again.

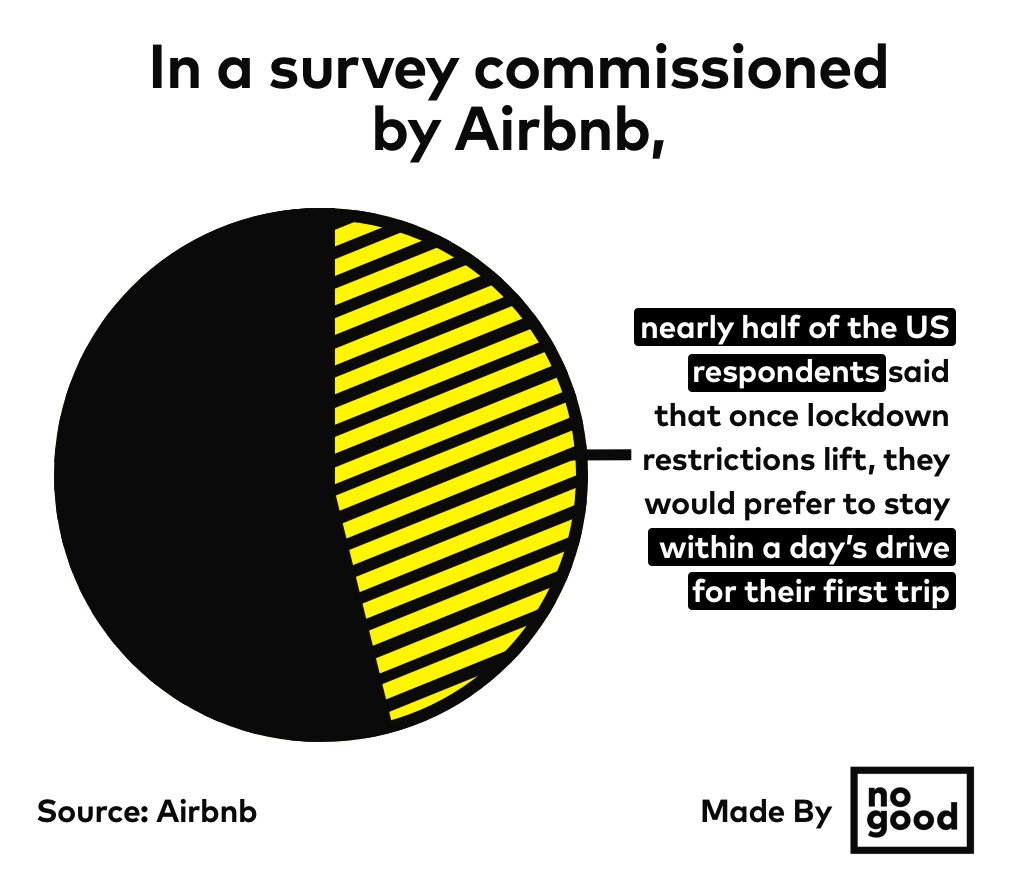

Since February, the number of Airbnb trips made within 200 miles from home, a distance most travellers could drive in a day, has increased from 30% to over 50% of total bookings.

According to the search trends for local accommodation, travel in the United States seems to be In recovery.

During that period, 55% of the nights booked for travel to listings in the US were with Superhosts, compared to just 45% during the same time period in 2019.

Globally, over the first weekend of June, Airbnb saw year-over-year growth in gross booking value for all reservations made around the world for the first time since February.

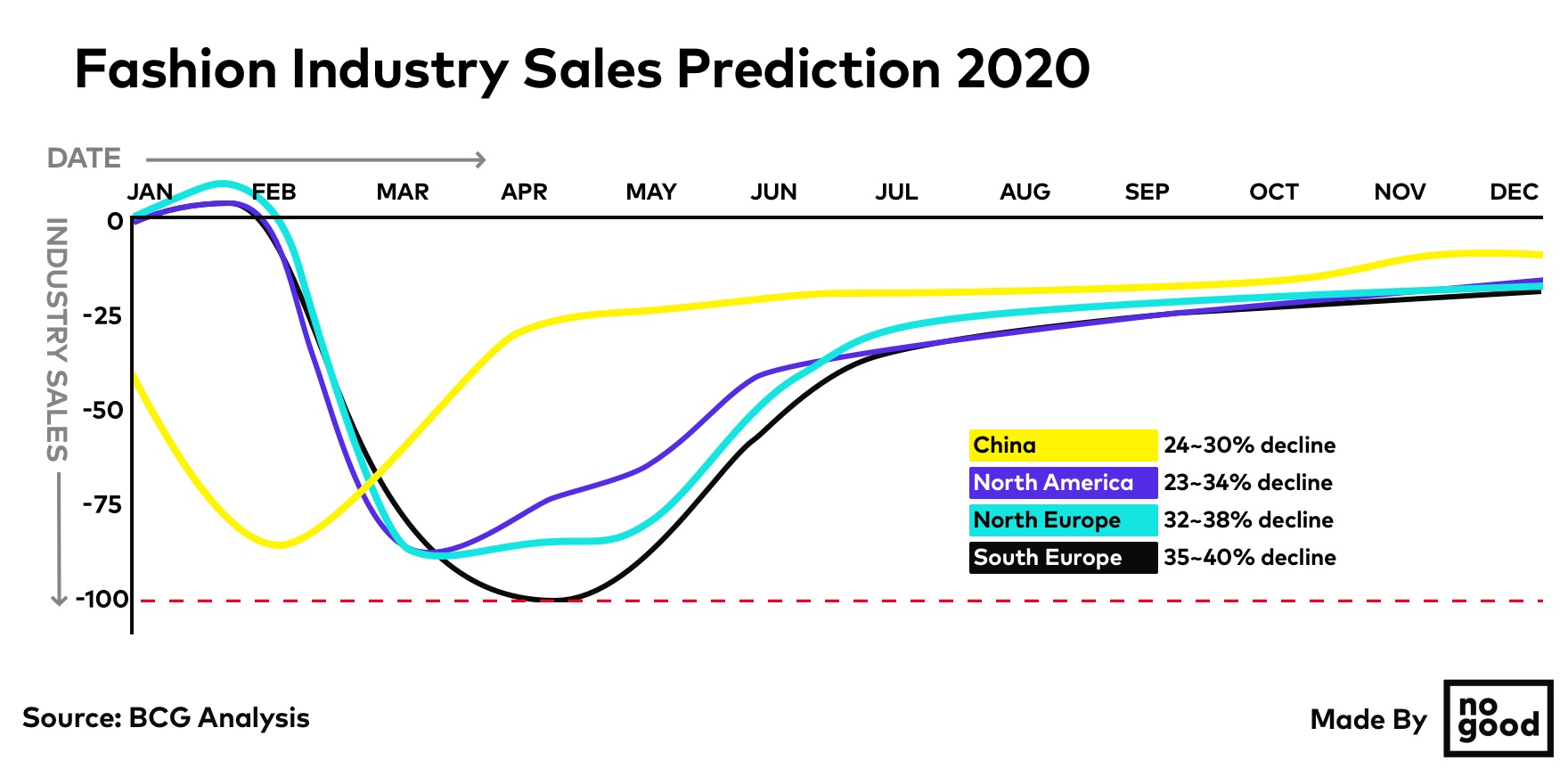

Fashion

This is not without precedent. During the Great Depression, the 1918 flu outbreak and the Second World War, fashion shifted from luxury to practicality and then recovered as each crisis subsided in a relatively consistent fashion. Most experts expect the same drop and recovery to happen once again.

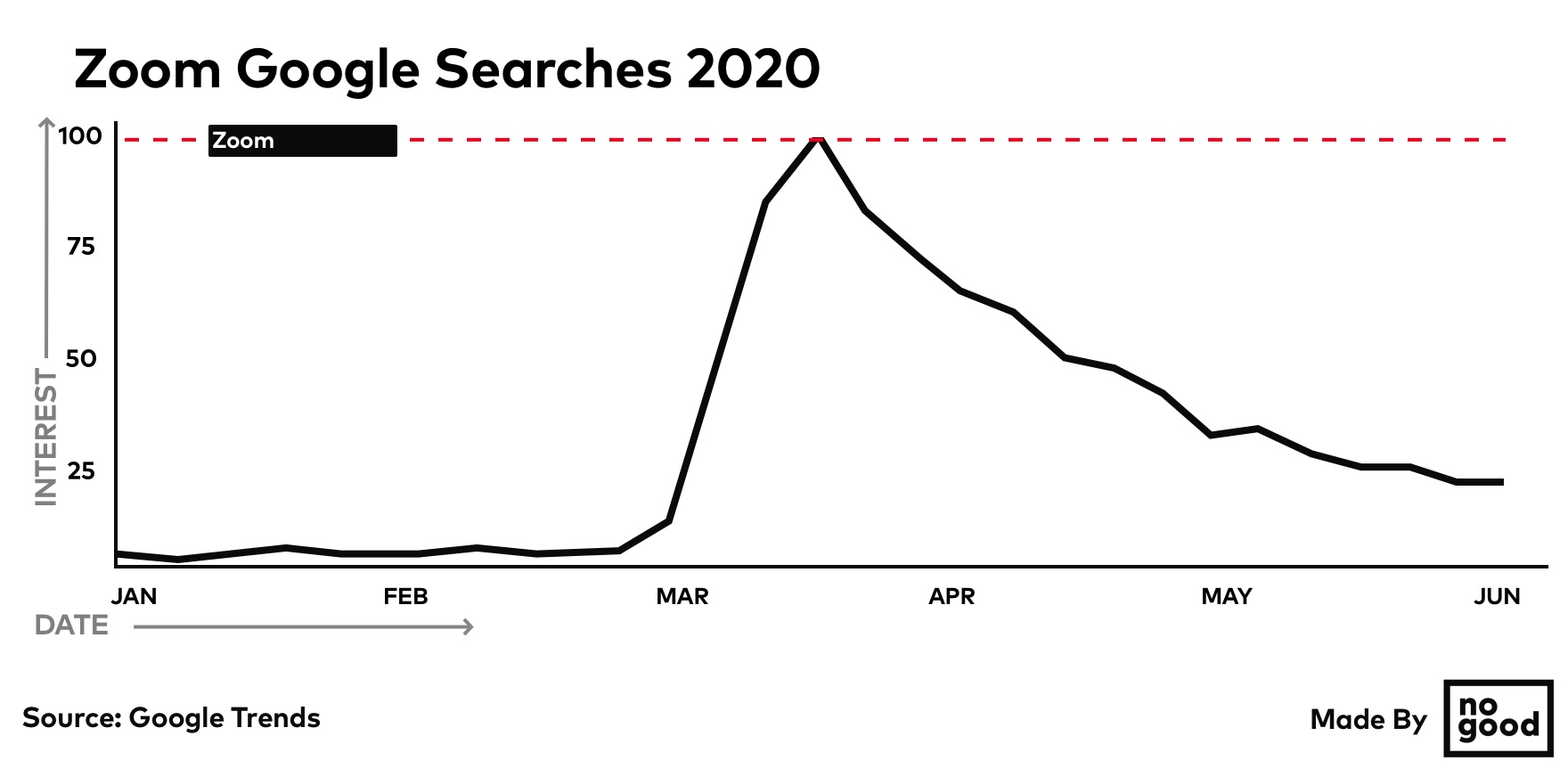

Collaboration and Video Conferencing Software

Consulting firm Global Workplace Analytics, estimates that around 30 percent of the workforce will continue to work from home at least part time after the pandemic is over, compared to the low single digits before the pandemic.

As we shift to a new workplace setting, we see technology play a more important role now that knowledge workers have familiarized themselves with collaboration tools and understand the value they pose. Platforms Zoom and Slack will likely carry into day-to-day activities long after the pandemic is over.

- Slack added 9,000 new subscriptions between February and March, and 80% increase over the preceding 6 months

- Microsoft teams grew its active users by 70% in a single month

- Google Meets exceeded 100 million users in April

- Zoom announced 300 million users, up 100 million users in a single month.

The growth in the number of users and the movement towards more permanent work from home policies indicate that collaboration softwares and tools will continue to grow after the pandemic.

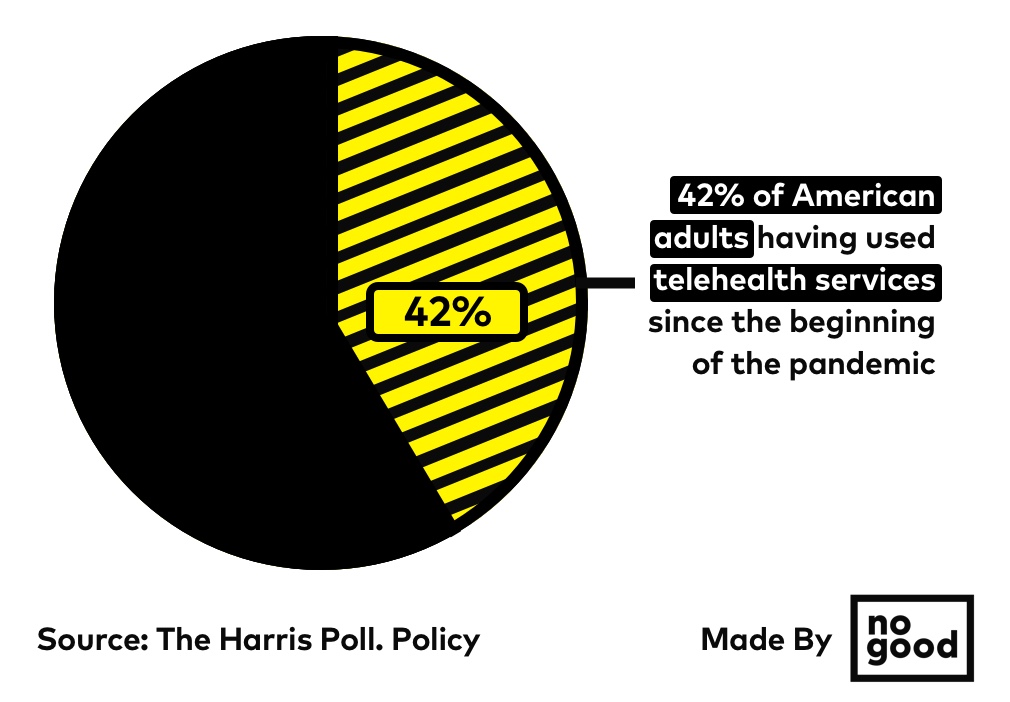

Healthcare

Policy makers are now pushing to reform the healthcare industry to allow for more telehealth accommodations after the pandemic is over. Telehealth will serve as the new doctor’s office with physical visits being reserved only for procedures and hospitals for more urgent or invasive matters, such as responding to a pandemic or surgeries. Additionally, as the pandemic has hit manufacturing centers such as China hard, there has been a move to diversify drug manufacturing supply chains to avoid shortages caused by border closings or other global trade complications according to officials at the Food and Drug administration. This also means a return to local drug manufacturing, with many pharmaceutical companies looking to establish local factories to be able to quickly replenish supplies as the pandemic continues.

Authors:

Floriana Frigenti, Ahmed Ouda

Hey, Great post! COVID hit many businesses and they had to move towards digitalization. This post is very informative for market understanding. Thanks a lot.