This week, Zuckerburg announced that Meta will be charging a subscription for a blue check mark and premium version of its services — a move not unlike what Twitter is already doing. Meta is the second biggest digital ad platform in the world with a 28% market share. They are certainly not the first social platform to tap into subscriptions as a secondary revenue stream, but this change marks a mainstream shift in the way social media platforms think about revenue diversification, and highlights the challenges ad platforms are facing with their existing ad monetization models.

We all know it. Users hate intrusive and interruptive ads. Users don’t want to be tracked — and they certainly don’t enjoy being served with targeted ads. Ads have become such a ubiquitous part of social media consumption that users have simply learned to tolerate them; but if the business model of subscription journalism like The New York Times or The Economist suggests anything, it’s that profitability and scale are reachable if the product is worthy of subscription.

The attraction of social media is that it’s “free”, or is it? The truth is, most users know deep down that their use of social media has never really been completely free. The exchange that hides behind a facade of “free” use revolves around user data and increased ad consumption. Users are “paying” with their time and attention, which are quickly becoming the hottest commodities in an attention-deficit economy. Indeed, users are spending a record number of hours on social media, but the challenge of late is that platforms are beginning to face difficulties in profiting off of people’s time and attention.

The ad business is slowing down

In 2022, most social media and ad platforms reported a slowdown in their ad revenue compared to prior years. Digital ads seem to be slowing in growth as the hype and common practice of online businesses are cooling down. On top of that, the recession has been pressuring social media platforms to squeeze more cash out of their users to make up for the decline.

The online ad business model has historically been the predominant way social media companies made money, but that boom has slowed down this year. We are very familiar with some of the catalysts of this slowdown: a weakening economy and Apple’s ad tracking changes limited the influx of data from user devices to ad platforms, and have effectively made it more difficult to demonstrate worthwhile return on advertisers’ investments.

Google is on a similar path as Apple. For years, brands have been relying on these tech giants to track website visitors, improve the user experience, and collect data that helps target ads to the right audiences. We also lean on them to learn about what our visitors are checking out online when they aren’t on our websites; but the way we use cookies and Google ad-tracking tools could change dramatically with Google’s efforts to launch a privacy sandbox (which is in beta at the moment) and phase out third-party cookies by 2023.

Meta platforms have seen a year-over-year revenue growth decline over the past 18-plus months, down from over 45% as of the first quarter of last year to a drop of 4% as of last week’s Q3 report. Snapchat’s growth fell off a similar cliff, declining by 60% over the same period. Shares of major social media companies, including Meta, Snapchat and Pinterest are down an average of 60% this year as investors have broadly lost faith in their first act. All of a sudden, subscriptions have gone from a theoretical secondary revenue stream option to a must-have.

The rise of social subscriptions

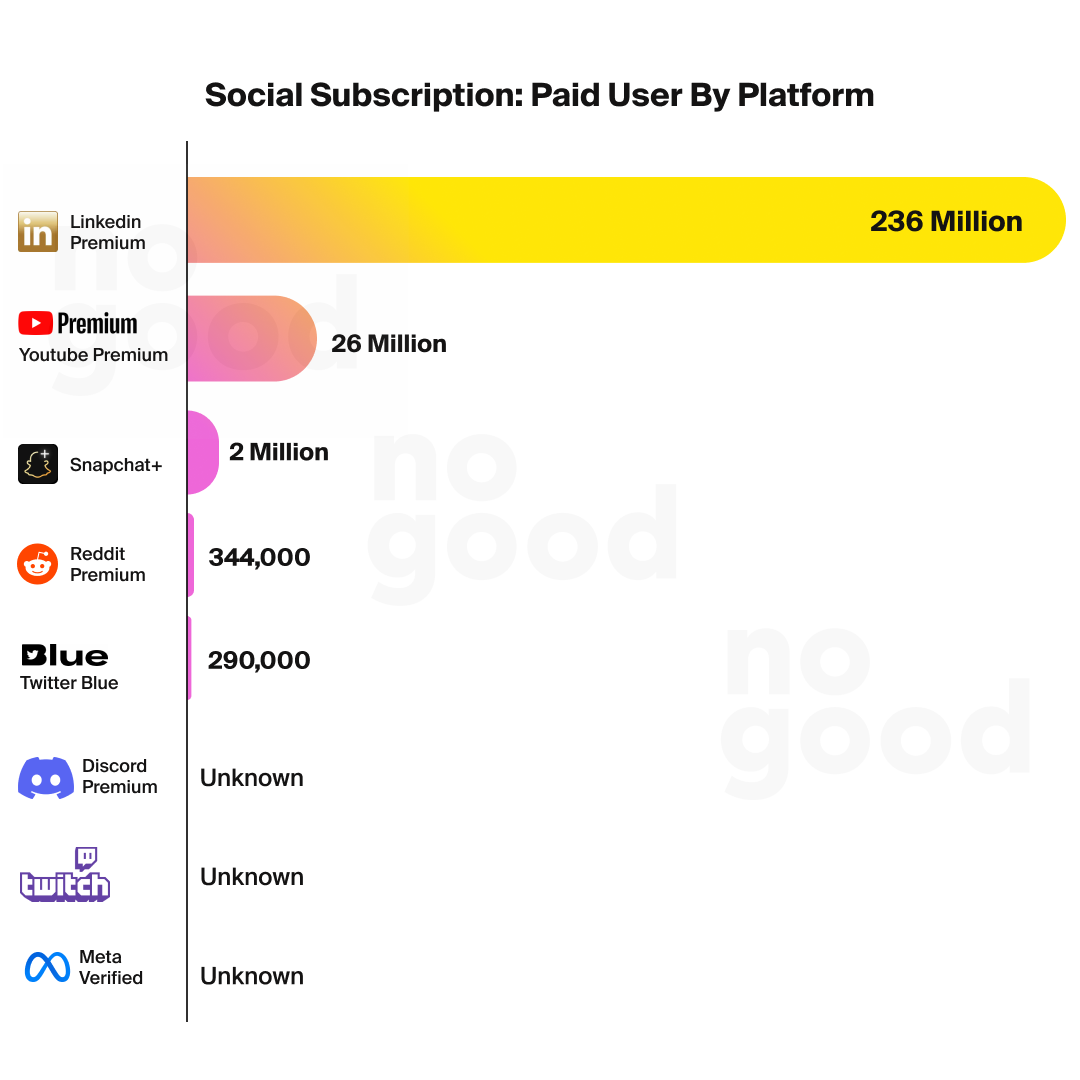

The subscription philosophy in social media isn’t new. Subscriptions have been the key to driving the success behind Youtube Premium, an ad-free viewing experience that allows people to switch between apps without shutting off their video. Platforms like LinkedIn, Youtube and Twitch have built sustainable revenue streams from their subscription businesses for years now. It’s estimated that LinkedIn generates around 4.45 billion U.S. dollars from their premium subscriptions alone. On Twitch, people are paying up to $24.99 a month to watch others play video games with digital pieces of “flair.” On the contrary, other platforms, such as Meta and ByteDance, have only explored subscriptions as a theoretical secondary option.

Snapchat’s move into subscriptions has also been gaining traction. Though the social app reported a disappointing second quarter with an earnings miss, its new subscription-based offering, Snapchat+, has already helped the app rake in over $5 million in revenue in its first month. The Snapchat+ subscription launched on June of 2022, offering users access to various premium features such as ghost trails on maps, story rewatch indicators, and custom app themes. Snapchat+ gives the company a means of diversifying its revenue streams beyond advertising — which is something many other social platforms are beginning to explore as well.

Why do people pay for subscriptions for social platforms? The reason lies in the sheer amount of time that people are spending on these social media platforms, be it through streaming, gaming, messaging or dating. People are perfectly willing to pay for a premium car or a license plate; yet on average, consumers today are spending less than an hour a day in their cars and nearly 7 hours across their favorite social media apps. With that said, why wouldn’t consumers want to invest in improving their experience on the social media platforms they spend so much of their time on?

One challenge for social media platforms is that subscriptions and ads are often mutually exclusive — but that hasn’t stopped platforms from selling an ad-free experience. One big perk of Twitter’s Twitter Blue subscription, for which the company is reportedly looking to begin charging subscribers nearly $20 a month, is the ability to read select articles from major news outlets free of solicitations.

Will the social platform with the most users (Meta) be the best at the subscription game? Or the one that enjoys the most time spent (TikTok)? If the online dating industry or the streaming subscription services have taught us anything, consumers will probably continue to dabble in many but opt to pay for the one or two that they care about most at any given time. This prioritization of a select number of apps would suggest that the number of total users on an app might be less relevant than its engagement rates. Sensor Tower data shows that while time spent across top social media apps has increased over the past few years, some apps are more addictive than others. Time spent on TikTok has increased 26% from the first quarter of 2020 through the third quarter of this year; while Meta’s Facebook and Instagram have also logged double-digit percentage increases. Over the same period, time spent on Snapchat and Twitter declined 26% and 6%, respectively.

If social media platforms, which have historically been free, want to attract paying subscribers, they’ll need to highlight one main tool or feature to entice users, and slowly tack on more perks. Platforms have gone years without asking people to pay, so the key premium feature will have to extremely valuable to justify the cost to the user.

Subscribers might never be as lucrative to social media platforms as their advertisers, but the landscape of social media is changing, and the sector will struggle to grow without tapping into the opportunities of subscription-based models.

Where social goes from here

Today’s social media apps are mostly AI-powered content recommendation and discovery engines with the primary goal to keep the user hooked on to the platform for as long as possible. Today’s Tiktok or Instagram is not vastly different from entertainment platforms like Netflix or Youtube. In other words, the “social” aspect of social media has effectively moved to our DMs — the WhatsApps, the Discords, the Close Friends stories.

We have seen the rise of community-led growth strategies where brands are connecting with their consumers on a much deeper and more value-focused level. As a result of this shift towards value-driven initiatives, brands should invest in zero and first party data collection, to collect emails and phone numbers so that they can communicate with their consumers without relying on social platforms. Today’s CEOs and brand founders need to think like a creator and a community builder, and focus on building a loyal community that will outlast the rapidly changing monetization models of modern social platforms.