While the blockchain gaming industry grew to $3Billion in 2021, it only amounts to drops in what is the $300Billion bucket that is the entirety of the gaming industry — drawing further attention from brands wishing to leverage NFTs in video games. With titles like Axie Infinity developing and maintaining healthy active-player rates, Web3 continues to prove itself as a viable platform in the gaming industry — however, the majority of the gaming community isn’t quite sold on the idea of blockchain games.

This may be shocking but, gamers want to play games first, and earn money second (or not at all). In a marketplace that is over-saturated with high-quality content ranging from AAA titles, to masterfully polished indie games, it’s a gamer’s world and brands are living in it. So as you’re planning your partnership with a Web3 or live service game ask yourself — are we having fun yet? Because gamers just want to have fun.

TL;DR:

- Communities dictate success

- Playerbases are loyal and valuable

- Digital assets shouldn’t be presumed to be a store of value

A Brief History of Brand Collaborations in Gaming

While the gaming industry was worth a fraction of what it is today, brands in the ’90s began taking notice of the potential value of the industry as a tool for connecting with their communities. In a pre-downloadable content (DLC) world, where toys came in cereal boxes and cartoons were elaborate ads in the form of children’s content, brands needed a more direct approach to bridging the gap between their products and the audiences they were seeking.

The result of these circumstances was full-on branded video games.

McDonald’s, Chex, 7-Up, Pizza Hut, California Raisins, and many other brands entered the space in the early ’90s with proprietary game experiences — to varied results.

Pizza Hut’s Yo! Noid was a release on the original Nintendo Entertainment System (NES) that was a fully realized 2-D platformer that was well regarded and fairly successful in its release. The game was created as a companion piece to their existing “Avoid the Noid” campaign of that era, which was already proven as a successful piece of media to leverage, and the release of the game validated their hypothesis that the crossover between pizza lovers and gamers was substantial.

Other brands, however, were less successful and broke the cardinal rule of putting fun first with the release of what came to be known as “shovelware” which was often served in the form of free CD-ROMs in boxes of cereal, or direct-mail campaigns.

Chex’s infamous Chex Quest was a low-effort first-person shooter (FPS), similar to DOOM, which was released via cereal box and was as unremarkable as it was puzzling. Though it retains something of a cult following and spawned a few unofficial fan-made sequels, it left the gaming community scratching their head and was widely perceived as pandering.

As much as we focus on authenticity in today’s market, the same was still true for children in the ‘90s with their gaming experiences. As those children have grown up, they hold the same values as they did then, and new generations share the same demands for authenticity in sharing their sacred gaming culture.

TL;DR

- Authenticity matters when approaching the gaming community

- The gaming community has grown up and is raising a new generation

- Gaming has evolved, and so must brand partnerships in the space

Live Service SZN

When World of Warcraft (WoW) was released, it signaled a paradigm shift for the gaming industry, and by extension, the brands that were seeking to reach gamers with their products. WoW brought with it the advent of Games as a Service (GaaS), a subscription-based model, with the introduction of Downloadable Content (DLC) seasons. Rather than purchasing a game with a definitive end, new seasons of content were packaged and released adding new quests, new weapons, and armor, and rejuvenating the experience.

This significantly extended the shelf life of any game that had a gameplay loop that adequately fit this model by introducing new content to the existing game mechanics rather than having to create an entirely new game. Each season ran for a number of weeks, ranging from 10 weeks to almost 40, and the revenue source shifted from purchasing the game itself to a Free-to-Play model in which players were given the base game and could either purchase new seasons or pay for cosmetics (more on this later).

While this wasn’t necessarily leveraged by brands at the time, it set the foundation for a fertile testing ground for brands to leverage seasons for campaigns that tied their brand directly to games while simultaneously building the framework for digital economies built around digital assets. Players also had the opportunity to opt-in or opt-out of each season’s content depending on whether it suited their personal interest — giving publishers and brands new insights into their audiences.

Seasons for live service games have since been adopted by titles like Fortnite, CSGO, Overwatch, League of Legends, Valorant, Apex Legends, Halo Infinite, GTA Online, and numerous others — attracting active player rates of 1-10M per month.

This creates a unique testing ground for brands because each season creates a new opportunity for experimentation — allowing for low-risk entry with fairly substantial potential for brands to gain high levels of visibility.

TL;DR

- Subscriptions have infiltrated the gaming industry

- Seasons allow for rapid testing for brands in digital spaces

- Digital economies can be built around digital assets

Fortnite and Two-Week Testing

There’s a lot that brands can learn about partnerships from observing Fortnite and their approach to seasonal content and assets. On the short-list of previous partnerships, you’ll see such names as Moncler, Marvel, The NFL, Rocket League (another great example, maybe we’ll cover them later), The NFL again, Star Wars, Halo, LeBron James, Ferrari, Balenciaga, Air Jordan…you get the picture.

Epic Games has been a proponent of blockchain technology and has leveraged a number of metaverse experiences as part of its Fortnite strategy. While they continue raising money and refining their plans for rolling out NFTs in video games on their platform, their previous and existing practices yield a great deal of knowledge on holistic and sustainable approaches for brand partnerships involving digital assets and meta experiences.

The biggest note that brands should take is of their pricing model — with each season only costing users roughly $10USD, with additional cosmetic purchases being given a similarly accessible ~$15USD.

This stands in stark contrast to the many brands’ perceptions of the implementation of NFTs in video games in that the value of digital assets in games is tied to ownership, and that retained value is the crux of the digital asset economy — historically this has not been the case.

The digital asset economy for NFTs in video games tends to be far more transient than has been perceived publicly since cosmetic assets tend to serve the same purpose as their physical counterparts — and as we know, clothes go out of style all the time.

It’s these transient trends that heavily imply that the successful implementation of NFTs in video games requires a value adjustment — creating assets that are accessible with high-value potential, rather than high barriers to purchase. Currently, we see the NFTs and digital asset marketplaces heavily correcting downwards for previously over-valued assets, which has been the opposite of the trend the gaming industry has historically seen — with static valued assets appreciating in value due to scarcity — a great opportunity for brands and fans alike with the resale tracking capabilities that NFTs offer.

Dunks and Digital Scarcity

With each passing season, new items are dropped, and users will want to both fit in and stand out with their digital SWAG — this should be top of mind as you develop a strategy for your season. Creating a balance between high-rarity items that will potentially seek high dollar amounts in secondary markets, while also providing everyone an opportunity to participate, will avoid feelings of exclusion while still capitalizing on FOMO without demoralizing the audience.

This is a practice that most brands should already be familiar with from physical product partnerships. Stemming from the economy of experiences, brands have previously clamored over pop-up shops where brand mash-ups took place, and limited products were released. The result of which was insanely long lines, with extremely long wait times, for a chance to get a grailed piece of merch.

In 2018, Arizona Ice Tea launched their ‘Great Buy 99’ pop-up experience, a branded bodega with lots of branded merchandise ranging from bandanas to fanny packs, and of course a pair of highly sought-after Nike Dunks.

It goes without saying that the majority of those waiting in line were wanting those Dunks, though obviously there were a limited number of them produced — so there was a decent amount of luck involved in having the opportunity to buy them.

Ultimately, if you showed up and got in early enough, you at least left with SOMETHING. This is the essence of live service seasons and random item drops, and something to keep in mind as you develop your digital asset strategy.

With each digital offering, the intention is not to exclude anyone, but to have certain items be limited and sought after to create hype. This will drive audiences to engage with that season, in the hopes that they’ll get lucky and receive the high-value item drop.

Though simultaneously, all users can feel included since they receive a variety of cosmetic items to customize their characters so they can be a part of the experience that season.

The Black Market

The value of digital assets for brands is rooted in visibility and brand recognition. Read that a few more times and let it sink in. The returns that most brands can expect to see as a result of a partnership with a game, whether on Web3 or in the traditional space, are from future affiliated sales — not the sales of the digital assets, or their resale.

While NFTs and smart contracts are laying the groundwork for tracking future resale on goods and assets that are sold in the after-market, these mechanisms for tracking and attribution are still very much a work in progress, and while brands would love to see a cut of a $1.4M sale of a digital knife from CSGO — there is no precedence for this in the market yet.

There is historic precedence for the after-market value of goods as set by Nike. The previously mentioned pair of Dunks from the Arizona Ice Tea pop-up have a current resale value of ~$700 — which is great publicity for the brand despite them not seeing returns for those sales.

Creating an economy driven by collection will provide brands higher returns and more notoriety than attempts to take a cut of the resale market, with those who do being perceived as greedy — Ticketmaster has entered the chat.

Aftermarket value, however, is absolutely a metric for success and is being mentioned here as it’s something that should be baked into the collaborative process of building your partnership.

The $1.4M knife is only worth that because of the scarcity that was created for that particular item drop, and the communal desire for that particular piece.

Similar to the Arizona Dunks, items can and SHOULD be designed with the intention of becoming collectible and scarce, but this should be done with the express knowledge that the brand may not receive any monetary returns for this success — or at least not directly.

Competitive Spaces

Content creators and competitions in eSports get an honorable mention for those seeking to infiltrate and collaborate with the gaming community. Similar to your favorite podcast, many content creators on YouTube and Twitch will be happy to plug your product if it’s an audience fit and there’s an organic synergy between their content and your product.

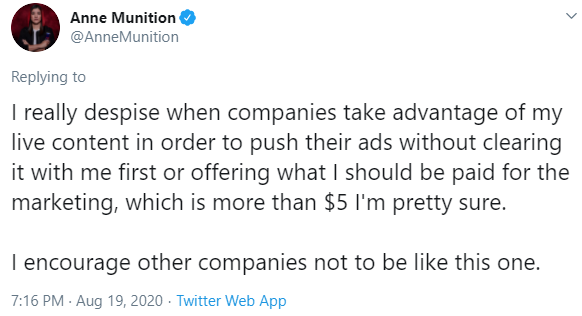

This unsurprisingly ties back to the foundation of authenticity, and respect for the space, which some brands have made missteps in the past for us to learn from.

Burger King found itself suffering from a faux pas in 2020 when they cleverly subverted the process of seeking brand partners on Twitch. The streaming platform, owned by Amazon, has a feature where users can send monetary tips to creators with a message attached that will appear on-screen during an individual stream.

Burger King’s agency at the time, rather than taking traditional channels and seeking a proper partnership with the streamers themselves, opted to use this feature to plug their products — essentially co-opting the process to advertise to thousands of users for what was likely a few dollars.

This did not sit well with the Twitch community, and ultimately triggered an apology from the royal burger brand.

There is ample opportunity, however, for brand collaborations both on and off stream, with the competitive eSports space, and Twitch landscape, offering numerous opportunities for highly curated audiences to interface with your brand.

The Future of NFTs in Video Games

If I can speak on behalf of all gamers, I can say that there’s no issue with the monetization of digital assets in games — if they are supplemental to the gaming experience itself.

What troubles the community at large, and has been the largest hindrance to mass adoption of NFTs in video games and bridging the gap between Web3 and traditional game media is the perception that the play-to-earn model is one that audiences want — but haven’t properly realized yet.

Steam, a digital game library app, has had a digital marketplace for years where users can buy, sell, and trade collectible digital assets for both real and digital currencies — this concept is nothing new.

What is new is the attempt to put those assets in front of the gaming experience itself — it will never happen.

The greatest instances of success for brands partnering with those in the gaming industry have always been those who recognize, understand, and engage directly with the community they’re attempting to reach.

Ultimately, no one is going to turn their nose up at a cool Moncler jacket in Fortnite. Though, they may do so if the jacket costs $10k, or is somehow put behind boundaries that diminish the gameplay experience.