The U.S. beer segment has lost share due to the rise of hard seltzer. The hard seltzer market is growing at a spectacular rate, drawing consumers away from other alcoholic beverages. Hard Seltzer and other seltzer-like products combined are expected to drive the ready-to-drink beverage category, making it the fastest growing alcoholic beverage in the U.S. over the next five years.

Market Trends

Hard seltzer is a highball drink that contains carbonated water, alcohol and often fruit flavoring. The popularity of this drink has skyrocketed in recent years. The reason is that it has entered the market at just the right time, while the product itself has attracted a wide range of consumers. According to Nielsen, hard seltzer is most popular among Caucasians between the ages of 21 and 44 from affluent neighborhoods, and it appeals equally to both genders. In addition, the development of an immense wellness market reflects that consumers are placing more value than ever on their lifestyles and taking control of their own well-being. Low in calories, refreshing and with a ABV comparable to most light beers, it’s undeniable why the hard seltzer market is experiencing its finest hour.

Moreover, ready-to-drink beverages or RTDs like hard seltzer are packaged for immediate consumption at the time of purchase. According to ForMarkets, the global market for RTDs is expected to reach $17.67 billion by 2025. The market is growing at a CAGR of 7.2% from 2018 to 2025. That’s why companies like White Claw, Truly, Bon & Viv and others are seizing this opportunity. This trend also appeals to beer drinkers who are looking for something different, spirits lovers who want something lighter, and casual drinkers who do not like strong alcohol and prefer drinks with a lower ABV.

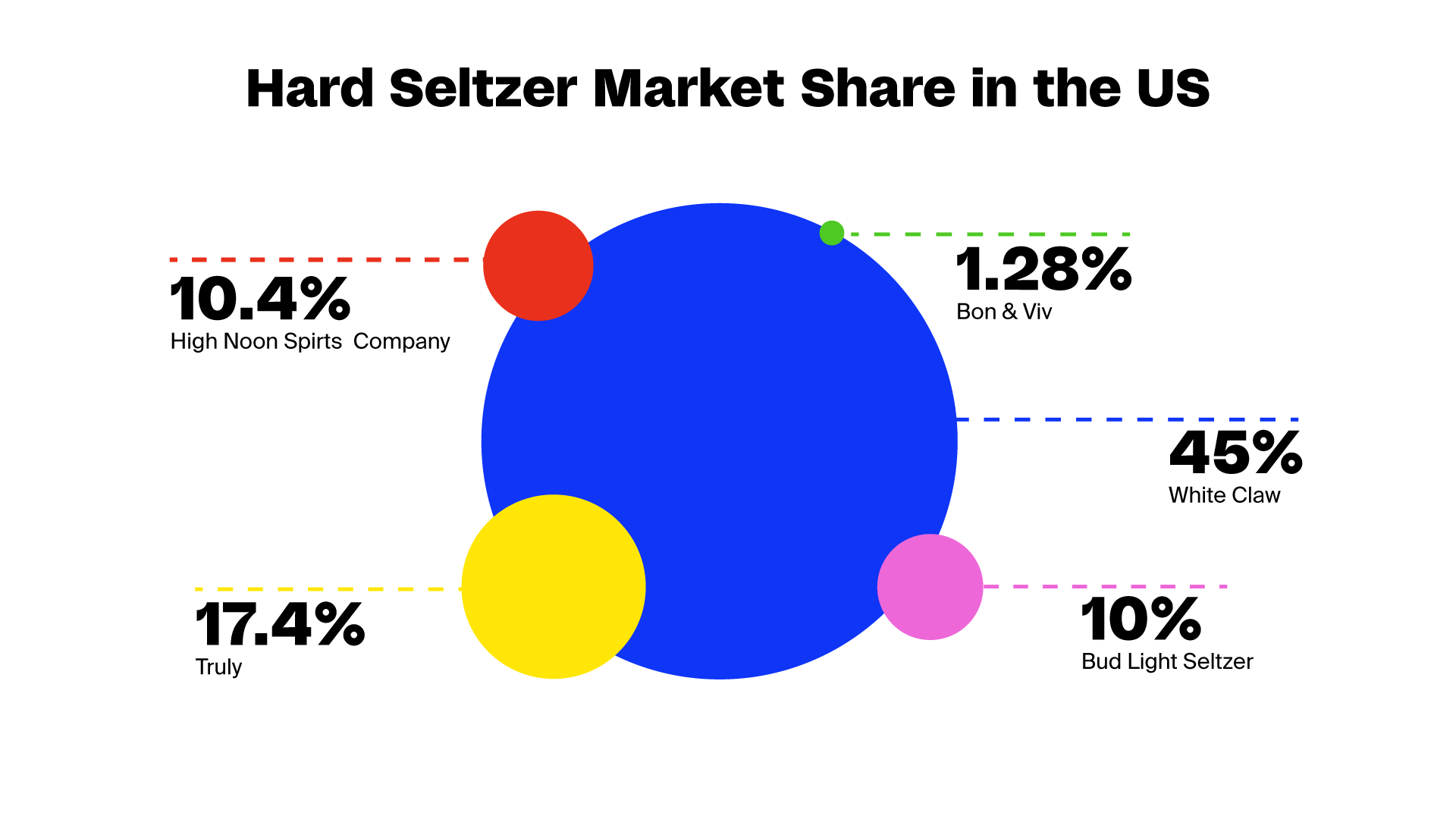

According to a report by Grand View Research, the hard seltzer category, currently worth about $13.47 billion, could grow to $57.34 billion by 2030. Key manufacturers are promoting their products in innovative ways. White Claw leads with a 45% share, followed by Truly (17.4%), High Noon Spirits Company (10.4%), Bud Light Seltzer (10%), Bon & Viv (1.28%) and other brands (15.92%).

The Strategy Behind the Brand

Since its launch in May 2016, White Claw has been the most popular hard seltzer. Its popularity has made its founder, Anthony von Mandl, a rock star in the spirits world. Before launching White Claw, he made a fortune with Mike’s Hard Lemonade, and built some of the best wineries in the world. His wineries were also visited by Prince William and Kate Middleton in British Columbia in 2016. Von Mandl has been dubbed “Tony Baloney” by many media outlets. The reason is his knack for telling compelling stories to sell his products.

White Claw hard seltzer has been so popular since its launch that the company faced a shortage in September 2019 after the “Summer of White Claw” when Trevor Wallace posted a YouTube video that has since had 6 million views. The drink, about which many memes have since been made, “struck a chord with the zeitgeist of American drinkers as it sits at the intersection of health, wellness and convenience”. In 2021, White Claw sales topped about $2 billion. The company still holds the title of “best hard seltzer.”

The drinks combine the simplicity of seltzer water with a gluten-free alcohol base and a hint of fruit flavor. The alcohol comes from fermented sugar derived from malted, gluten-free grains. The company’s marketing goals have long focused on building consumer awareness, engagement and excitement through a 360-degree approach that extends its influence beyond the brand’s digital channels into traditional media and retail. Hard seltzer is an entire category created for Millennial sensibilities. White Claw is undeniably a major pop culture force and the best-selling hard seltzer brand in the world.

Trends Driving White Claw’s Growth

1. Wellness

In recent years, wellness has become a term that means much more than physical health, exercise and nutrition. It is a multidimensional term that encompasses physical, emotional and social health. For consumers, the rise of wellness culture means embracing a personal sense of holistic well-being, while brands are reinventing their values to match this trend. Brands are advertising “aspirational lifestyles” on social media, and Millennials are the first to grasp and adopt the wellness mindset. Millennials are moving the health and wellness market in new ways, driving three of the biggest trends in the category.

The Natural Marketing Institute (NMI) found that 77% of them view a healthy, balanced lifestyle as “very” or “extremely important”. David Henkes, senior principal at Technomic said that “Consumers are looking for refreshing alternatives that are ‘better for me,’ though what ‘better for me’ means is open to interpretation”. White Claw has capitalized on this trend by developing products that are only 70-100 calories, 3.7% alcohol and 0 grams of carbohydrates, are naturally gluten-free. The products come in a standard 12-ounce can and feature amazing fruit flavors. Flavors include black cherry, mango, watermelon, natural lime, ruby red grapefruit, raspberry, lemon, tangerine, strawberry, blackberry, pineapple and passion fruit.

2. Appealing to its fans’ tastes

Listening is important, very important in fact. The company tapped into its Internet fans and selected these flavors based on 70,000 social media requests. Paying attention to the preferences of your fans who reach out to you can go a long way. Positive word-of-mouth has been the strongest marketing advantage for White Claw. There are a total of twelve flavors of White Claw, packaged in various forms such as cans, jars, and others. In addition to the individual drinks, White Claw offers six 12-can packs so customers can try all of the brand’s flavors. Last year, the brand launched two new innovations, White Claw hard seltzer Variety Pack Flavor Collection No.3, featuring three new flavors, and White Claw hard seltzer Surge, a stronger refreshing wave with 8% alcohol. According to Danelle Kosmal, Vice President of Nielsen’s beverage alcohol practice, variety packs play an important role for hard seltzer. They are the best-selling flavor packs for nearly every brand and account for 63% of Hard Seltzer’s total sales.

3. Increase in market demand

It was just two years ago that sales of hard seltzer giant White Claw boomed to the point that panic broke out among young adults eager to buy the trendy drink when a shortage began in the United States. While many speculated that hard seltzer was just a summer drink and therefore subject to the ups and downs of seasonal products, the category has proven resilient. Still, hard seltzer’s popularity presents both opportunities and new challenges.

There are many theories as to why hard seltzer is so popular. Seltzer is perceived as healthier than other alcoholic beverages. All of these reasons for consumer preferences contribute to a market that is attracting market participants from all walks of life and disciplines. The growing acceptance of low-alcohol beverages among millennials and the younger generation is driving product demand. In addition, consumers are trying to reduce their alcohol consumption or get sober, which has led to a further increase in demand for low-alcohol beverages.

4. Embracing the future of gender norms

Gender norms are changing and companies are realizing that this change cannot be ignored. What has made White Claw so successful in all of its marketing campaigns is that they do not make assumptions about what their customers are looking for based on their gender, but take a gender-neutral approach. Their product is aimed at everyone, male and female consumers. Millenials and Gen Z, more than any other generation before, do not see gender as a barrier or guardrail to their socialization. They want to spend time together and do the same things.

White Claw, with the tagline “Made Pure,” is named after the term for a breaking wave and is marketed more like a premium sparkling water than a beer. Zara Flynn, marketing partner at creative agency Rothco, explains, “It was not about going with what the beer industry is doing right now. It was about breaking all those norms and creating something really fresh and unique.” White Claw was able to succeed because it was meant for everyone and no one. It’s an inclusive way to spend quality time with friends (the experience).

5. Income inequality

White Claw and other brands in the industry have become up-and-coming brands while having an affordable price. They have become a “lifestyle brand” by creating experiences around the product itself and prioritizing shared moments with friends instead of materialistic goods. Millennials, hard seltzer’s target audience, are experiencing rising costs and lower wages, leading them to prioritize experiences over status symbols. Hard seltzer has embraced this idea by combining affluent experiences like windsurfing, boating, hiking, etc. with the product itself without spending too much money.

6. Standing apart

In a market full of choices, White Claw has been relegated. White Claw has a search volume of 1,330,000,000 in Google, 42 times the search volume of “spiked seltzer” (2,530,000 results) and “hard seltzer” (28,900,000 results) combined. The brand’s greatest strength is its ability to read the market well and its willingness to devote resources to the best of what they do. Its success lies on creating a beverage that consumers crave and give them reasons to share that craving.

7. Viral marketing

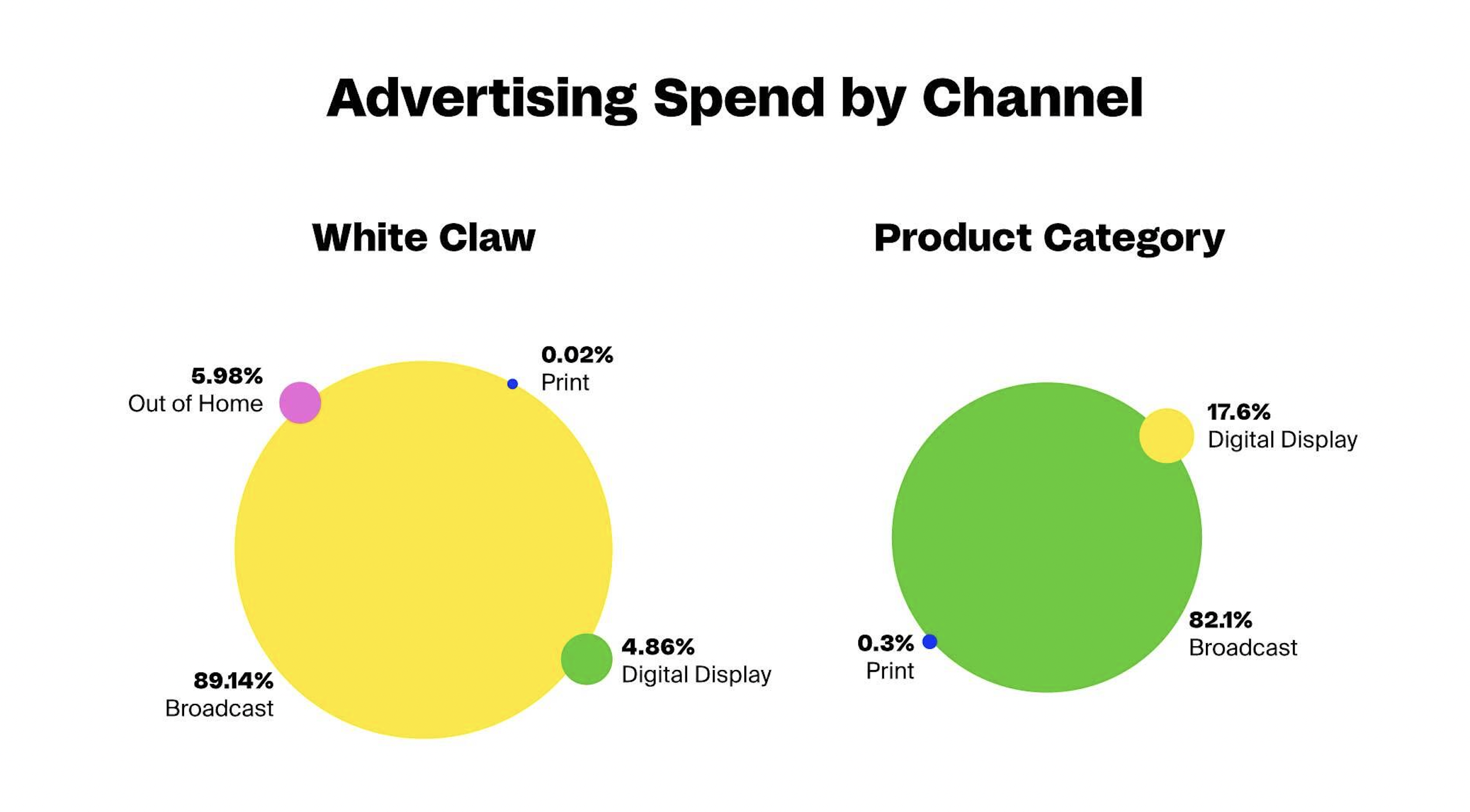

Overall, spend in the hard drinks category increased 39% year-over-year. The largest increase is in digital spend, which is up 63%. Hard seltzer brands spent $41.8 million on digital advertising between January and October 2021. Although shoppers have shifted to digital advertising more than any other category, TV is still by far the largest channel for this category. Brands spent nearly $194.5 million through TV, up 35% from the previous year. Print media spending also increased. Investments increased 20% from $541 thousand to $649 thousand.

From the beginning, White Claw has been very selective about ad placement. According to Kantar Media, the brand’s media spend was approximately $20,397,502, with 89.14% of the media budget tracked spent on broadcast advertising, 5.98% on out-of-home advertising, 4.86% on digital display advertising and 0.02% on print advertising. Kantar does not count social media spending, where White Claw spends much of its advertising on Instagram, Facebook and Twitter.

The brand has long benefited from earned media, much of it coming from fans who run social media accounts like “whiteclawmeme” and “whiteclawchronicles.” After all, word of mouth is the best marketing strategy. One of PR ‘s biggest breakthroughs came in the summer of 2019. Trevor Wallace released the video that popularized the phrase “There are no laws when you drink Claws.” After that, the brand became the unofficial party drink of Americans, and created a huge online buzz around the brand. Even police departments felt the need to remind citizens that laws do indeed apply when you drink White Claw. The company’s policy was mainly to educate consumers about the brand and define it.

All Things Considered

These are some of the lessons to take from the success of White Claw such as:

- Brands need to be transparent and aware of changing norms in society. A marketing strategy for a specific gender audience does not exist for many brands.

- Being first gives you an edge over the competition, but it does not eliminate the competition that comes next.

- Brands need to be clear about their vision and constantly communicate it with their audience without forgetting their fear.

- Be innovative. Technology is always letting us find new ways for our brands to reach consumers, which directly impacts product design. Embrace this change and find ways to use technology in your favor instead of viewing it as an obstacle.

Will the new entrants take market share away from White Claw? Although being first to market and in the minds of consumers is a very effective marketing strategy, competition from new entrants is becoming increasingly fierce. This year, the market continues to see triple-digit growth driven by increasing consumer demand, expanded availability of established brands and new product launches. It remains to be seen, but we are confident that White Claw will remain one of the leading players in the hard seltzer market.